- After stunning stock market volatility earlier this week, Goldman Sachs has this advice: Buy the dip.

- "Any further significant weakness at the index level should be seen as a buying opportunity," strategists said.

- The bank does not think the correction will deepen and turn into a bear market.

After a volatile start to the week that caused the benchmark index to swing more than 1,000 points in one session, Goldman Sachs has this advice: Buy the dip.

While the Federal Reserve is looking to raise rates in 2022 to tame surging inflation that's near a 40-year high, Goldman Sachs strategists said the central bank will likely hike rates to relatively low levels.

"Any further significant weakness at the index level should be seen as a buying opportunity, in our view, albeit with moderate upside through the year as a whole," strategists led by Peter Oppenheimer, said in a note Wednesday.

The whiplash in US equities began with jitters that a Fed determined to tame inflation will turn aggressively hawkish. That included investor concerns the central bank may start to shrink its nearly $9 trillion balance sheet — more commonly known as quantitative tightening.

What investors are most concerned about is the pace at which the central bank will hike rates. Last summer, the consensus was that there would be no interest rate rises in 2022 and only one at the end of 2023, the strategists pointed out. Now, four rate hikes are priced in.

That triggered a sell-off, and US equities are currently seeing a correction. But that's within a bull market cycle that should continue and remain in a growth phase, Goldman said.

Given this, the bank does not think the correction will deepen and turn into a bear market. The key is growth. Higher rates typically aren't negative for stocks as long as economic activity is still expanding, Goldman said. Rate hikes even during times of decelerating growth still sees positive, albeit weak, stock returns.

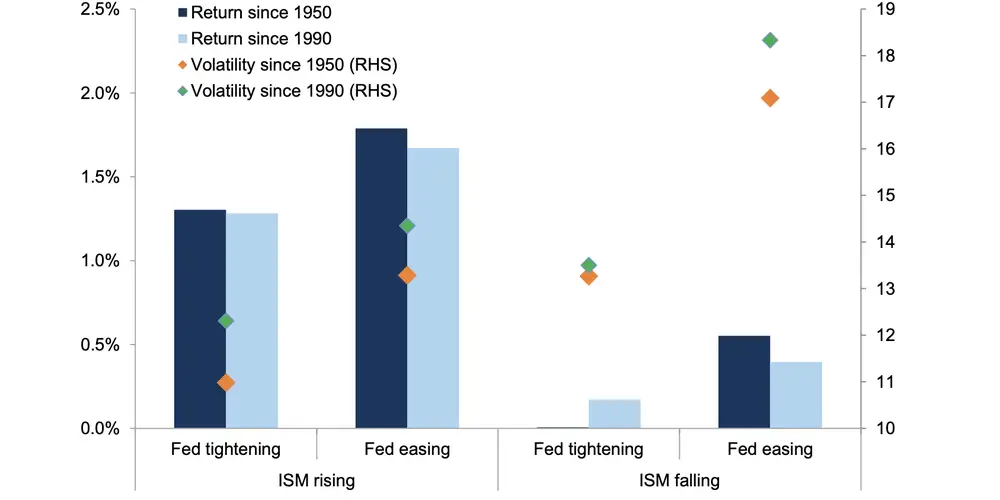

"Historically, a Fed tightening cycle that is accompanied by accelerating growth tends to be associated with strong returns and relatively low volatility," they said. "Meanwhile, a tightening cycle into slowing growth is associated with very low, but positive, equity returns alongside high volatility. It is this second combination that the markets seem to be pricing."

Comments