Summary

- UiPath reported F2Q22 results that were ahead of estimates on revenue, EPS, and ARR. The company also guided revenue and ARR ahead of estimates.

- For the second consecutive quarter, UiPath growth continues to slow. Both revenues from on-prem and the cloud slowed significantly. ARR, UiPath-favored metric, also continues to slow.

- While UiPath is not overly expensive, it is not cheap either. While the company beat results, The reported results are not good enough to sustain a high valuation.

- The company would need to invest aggressively in quota-carrying sales headcount to keep the growth going. UiPath guided a significant increase in its opex for F3Q, disappointing investors.

- Investors should sell UiPath shares now ahead of lockup expiration in October. We expect shares to remain under pressure due to slowing growth, increasing competition, and revenue volatility.

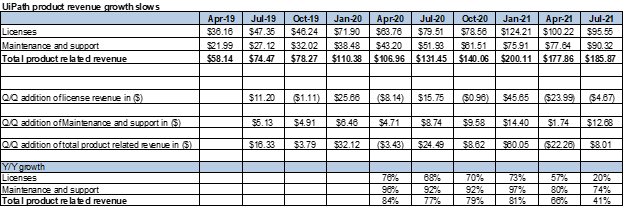

After UiPath's(NYSE:PATH)results last evening, we reiterate our SELL rating on the stock. While UiPath insists that ARR is the correct metric to use in evaluating the company, we believe ARR growth itself continues to slow. UiPath sells software that is deployable on-prem and in-cloud. Revenue is recognized differently on-prem and in the cloud due to ASC 606 revenue recognition standard. UiPath does not have visibility on how a customer intends to deploy the purchased software. This leads to variability in reported ARR, revenue, and EPS. Even before this problem manifests fully, we have already seen the company's revenue and ARR growth slow. Product license revenue continues to be a problem for the company and continues to slow. License revenue growth slowed from 73% at the time of IPO to about 20% at the end of the July quarter.

Similarly, maintenance and support revenue declined from 97% at the IPO to about 74% at the end of the July quarter. Total revenue growth fell to 40% from 81% at the time of the IPO. We believe this decline will only accelerate as the competition continues to heat up. For more details on UiPath and its outlook, please refer to our last note on SA. Therefore, we urge investors to take profits now and await a better entry point post lockup.

Good results but not good enough for a highly valued stock

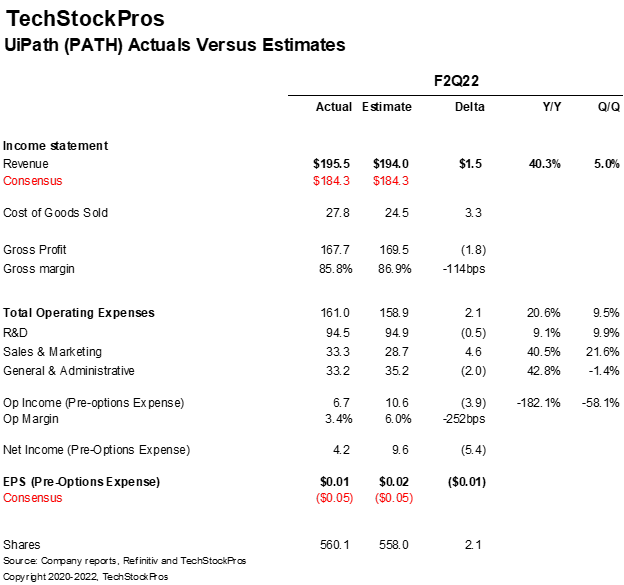

UiPath reported results ahead of estimates and provided revenue and ARR guidance that was ahead of estimates. UiPath reported revenue of $195.5 million versus a consensus of $184.3 million. Revenue grew 40% Y/Y, down from 65% in the prior quarter and down from 81% at the time of its IPO two quarters ago. EPS was $0.01 versus a consensus of -$0.05. Better than expected EPS was driven by higher than expected revenue, offset slightly by higher than expected opex. The company added 600 customers during the quarter for a total of 9,100+. The company also noted that it now has 1,247 customers whose ARR is greater than $100K. The Dollar Based Net Retention Rate (DBNRR) was 144%, which is impressive by any standard. However, it could be that many customers are starting with a small purchase and then buying more over time, unlike other companies that have lower DBNRR but higher initial ASPs. The following chart illustrates UiPath results versus consensus estimates.

Revenue continues to slow

What worries us is that product (on-prem and cloud) revenue continues to slow pretty consistently. License revenue growth declined to 20% Y/Y and has fallen from 73% at the IPO just two quarters ago. Similarly, revenue from the cloud, classified as the maintenance and support revenue, continues to slow. Revenue from the cloud slowed from about 97% at IPO to about 74% at the end of the F2Q. Total revenue (cloud + on-prem) declined from 81% at IPO to about 41% for the F2Q. This slowing revenue is a worrisome trend for investors holding the stock. The following chart illustrates revenue trends for the company.

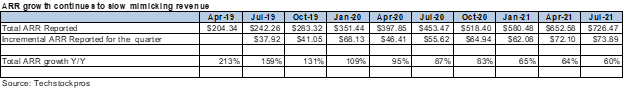

ARR also continues to slow

UiPath continues to insist ARR is the correct metric to evaluate the company. Alas, even ARR continues to slow. UiPath reported a total ARR of $726.5 million. ARR grew 60% Y/Y and is down from 65% the company reported before the IPO. During the quarter, the company added $73.9 million in new ARR. Q2 quarterly ARR was essentially flat Q/Q. This slowing of ARR growth is likely caused by increased competition. We expect the deal cycles continue to elongate. The vetting process will take longer as enterprises evaluate competing offerings from Microsoft(NASDAQ:MSFT), Salesforce(NYSE:CRM), SAP(NYSE:SAP), and other pure-play RPA products. The following chart illustrates the ARR slowing growth.

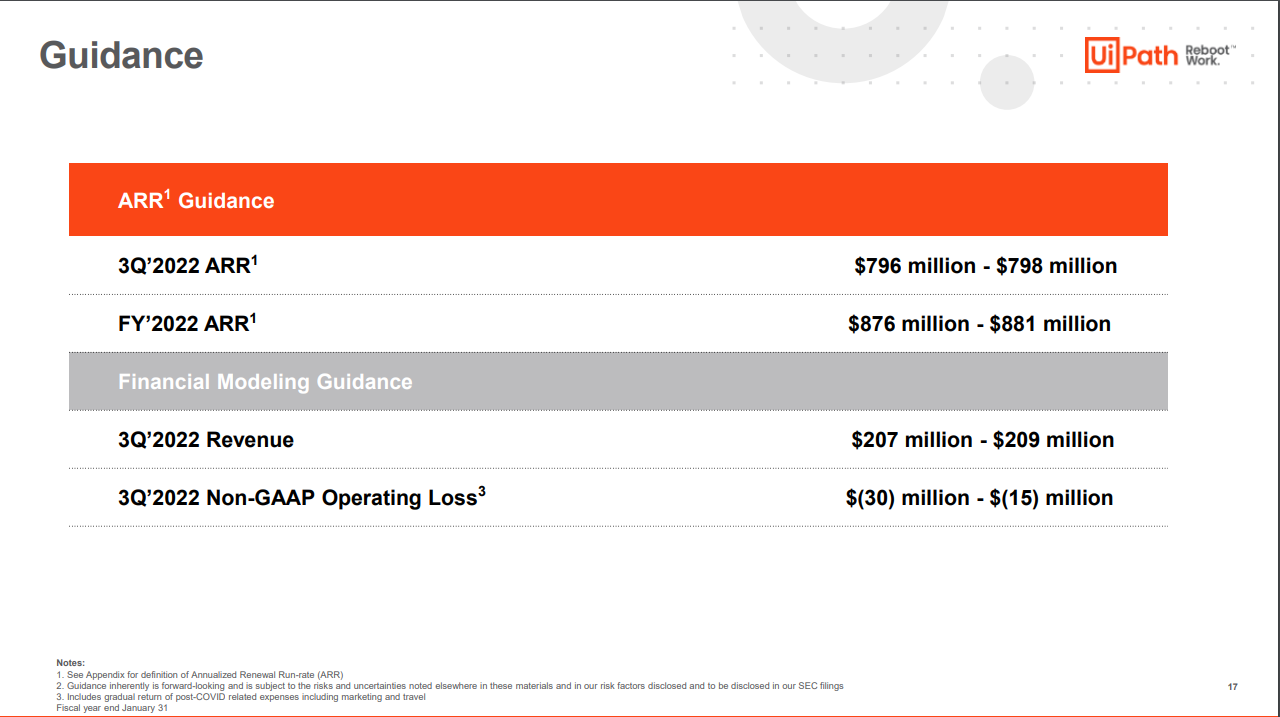

Guidance

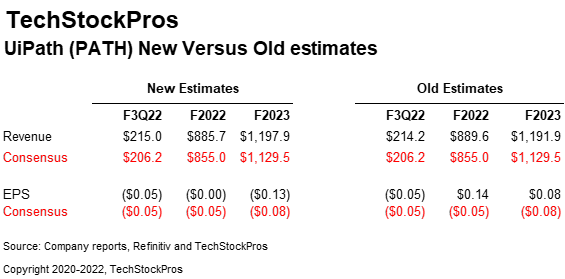

UiPath provided revenue guidance above consensus estimates. Revenue is expected to be in the $207-209 million range, versus the prior consensus of $206.2 million. The company is guiding operating loss in the range of 15-to-30 million. The company noted that travel and upcoming user conference would cause a spike in opex during F3Q22. The company guided 3Q ARR in the range of $796-798 million, or up 54% Y/Y. The company also guided FY2022 ARR in the range of $876-881million or up about 51% Y/Y. The following chart illustrates UiPath's guidance.

We believe these Revenue and ARR estimates are conservative. We expect the company to beat them handily as it had just done. The question is, can the growth accelerate from the current levels? Unless the growth can accelerate from the current levels, we expect UiPath stock to be under pressure. The following chart illustrates our estimates.

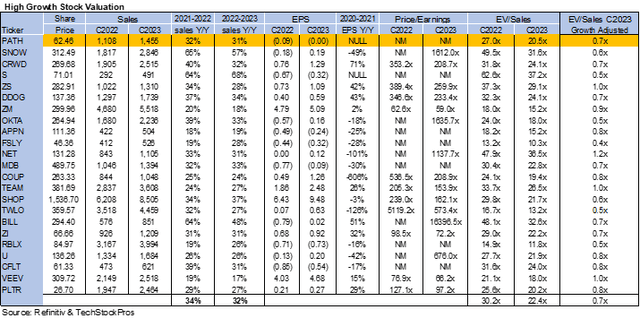

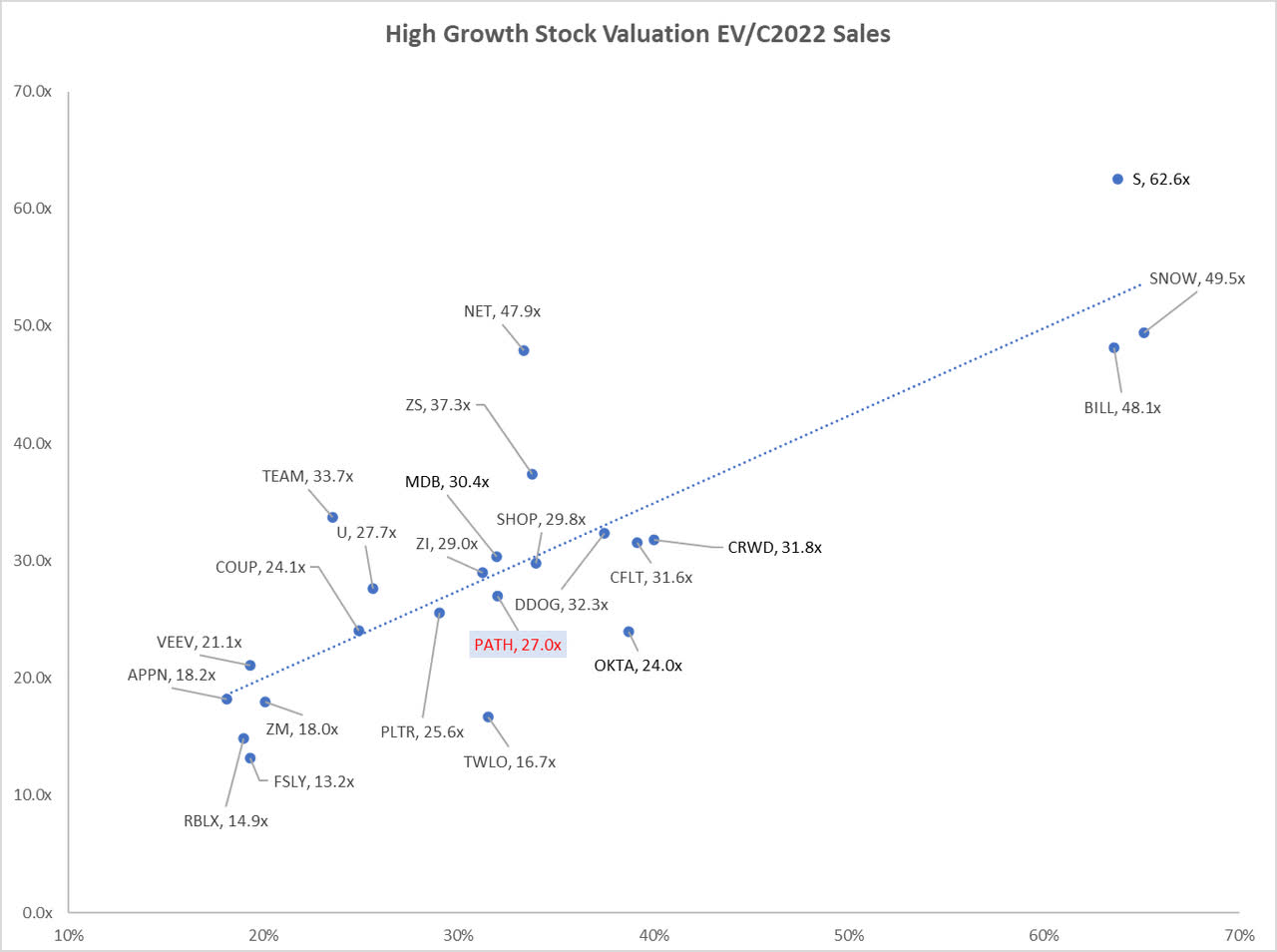

Valuation

We value UiPath using EV/Sales multiple. UiPath is trading at 27x EV/C2022 sales versus the high-growth peer group average of 30.2x. While UiPath is not overly expensive compared to high-growth software peer group, UiPath is facing intense competition. UiPath faces competition from pure-play automation players such as Blue Prism(OTCPK:BPRMF), Automation Anywhere, and large software companies like Microsoft, SAP, and Salesforce. We expect UiPath valuation to compress from the current levels as the growth continues to slow. The following charts illustrate the valuation for our high-growth peer group.

What to do with the stock

While we believe UiPath will likely retain its market leadership for the next few years, we believe the competition is intense. We expect Robotic Process Automation (RPA) market to remain fragmented with UiPath, Automation Anywhere, Blue Prism, and Microsoft battling it out for market share. We expect Microsoft to take share from all vendors, including UiPath. We also expect Salesforce to siphon off some share via its RPA APIs. We expect UiPath growth continue to slow, and we expect the company to invest in Sales & Marketing to keep revenue growth going. We do not expect UiPath to reach its long-term operating margin target of 20%+ until the end of C2025. However, in the near term, we expect shares of UiPath to contract from the current levels. With lockup set to expire in October, we expect additional shares to become eligible for sale. We expect many insiders to take profits, pressuring the stock in the next few weeks.

We expect UiPath shares to hit the $30-35 levels over the next 12 months. Therefore, investors who own the stock should sell their shares now before the lockup expires. Investors looking to buy shares of UiPath should wait till November of this year until all eligible for sale shares have the opportunity to be traded.

Comments