- Netflix shares have accumulated losses of about 60% YTD. Much of that drop can be blamed on abysmal Q1 earnings.

- Even with sizable challenges ahead, NFLX is now trading at more modest multiples and still has solid fundamentals and a good long-term outlook.

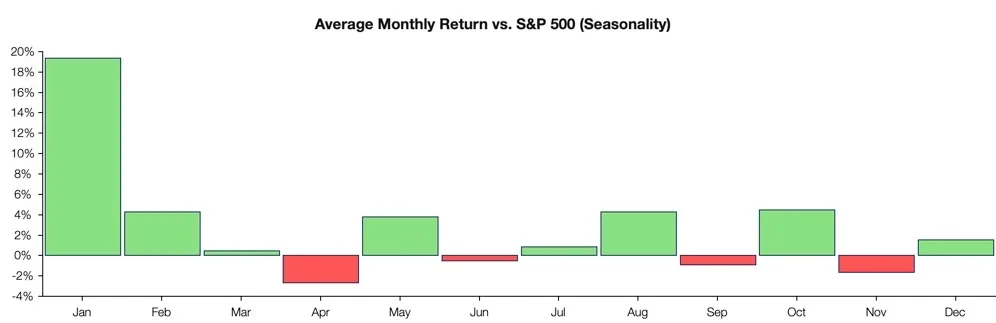

- When comparing the performance of Netflix shares against the S&P 500, September has tended to be a poor month for the streaming giant.

A Long-Term Projection First

When considering Netflix (NFLX) stock, I believe it makes more sense to take a long-term view rather than looking for short-term trade opportunities. With that in mind, I continue to think that Netflix remains a good long-term stock to own. That’s thanks to the company’s solid business fundamentals and its relatively cheap pricing. NFLX is currently trading at 21x next year's earnings - that's 85% below the stock’s historical average (going back to 2009).

Why have Netflix shares sunk so deeply? In Q1, the streaming giant dropped about 40% after releasing terrible earnings. It reported a sequential net loss of 200,000 paid subscribers, while market expectations were for a net addition of 2.5 million subscribers.

In Q2, though, analysts overcorrected in the bearish direction. The Wall Street consensus had the streaming giant losing 2 million subscribers. And even though Netflix did report the biggest user loss in history – about 970,000 users – the subscriber loss wasn't as bad as the market had predicted.

The last two earnings reports have showed that it is no longer so easy for Netflix to attract new users to its platform. So, the company's short-term focus has shifted to re-accelerating revenue growth (rather than user growth) by improving the monetization of its existing user base.

This is why Netflix is exploring paid sharing options. It’s also why Netflix plans to roll out a lower-priced advertising-supported plan, through which it hopes to draw additional revenue streams from tens of millions of households.

September Tends To Be Seasonally Weak

In the short term, September has tended to beseasonallyweak for Netflix. I use the chart below to show how Netflix stock usually behaves throughout the year. This chart illustrates the outperformance and underperformance of Netflix stock vs. the S&P 500, by month, over the past decade (otherwise known as “seasonality”).

Netflix has jumped almost 500% since 2016. And since that year, January has by far produced the best returns – while April has produced the worst. An explanation for this pattern could be related to the holiday season.

In recent years, disregarding 2021 and 2022, Netflix typically beat December quarter expectations and, consequently, saw its shares soar. In 2017, 2018, and 2019, for example, shares skyrocketed 13%, 40%, and 26%, respectively, after NFLX reported successive record Q4 growth.

Note also that in July and August, Netflix shares also tend to trend upward, probably in anticipation of key fall season catalysts, such as new content releases.

In September and November, Netflix shares tend to perform worse, probably due to sell-the-news forces acting after earnings reports. There is also atheorythat stocks generally fall before the holiday season as traders offload their holdings to avoid significant risk while markets are closed.

The Bottom Line

Netflix stock managed to drum up bullish sentiment after its Q2 earnings. Many investors saw an attractive opportunity to buy Netflix shares at a considerable discount.

Even though I continue to believe that Netflix is the kind of stock to own for the long term, the current challenges regarding the resumption of growth in the near term should put some pressure on Netflix shares, especially with the macro backdrop still being unstable.

The “market perform” consensus among Wall Street analysts evinces skepticism of a sharp turnaround for the company.

Among the many skeptics, I pick Oppenheimer analyst Jed Kelly to sum up the experts' caution. He says there is a near-term upside concern for Netflix stock, which may be adversely affected by increased churn due. That churn may be due both to high competition among streaming platforms and general inflationary pressures, which cause consumers to slow discretionary spending.

Comments