Stock futures rose ahead of the Federal Reserve’s decision on interest rates, while European markets advanced after the European Central Bank called a meeting to address bond-market disruption.

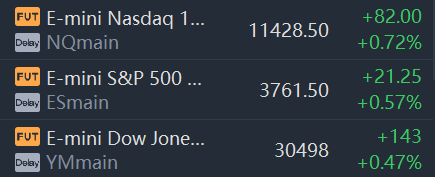

Futures for the S&P 500 added 0.57% Wednesday, pointing to gains for the broad index at the open. The S&P 500 fell into a bear market—a decline of more than 20% from its January peak—this week as mounting expectations that the Fed would raise rates faster than previously signaled sent a shudder through markets.

The Federal Reserve will lay out details of its latest effort to quell inflation through tighter monetary policy at 2 p.m. ET. Investors expect a0.75-percentage-point increaseto the Fed’s target rate, which would be the biggest since 1994. The central bank had previously guided for a 0.5-percentage-point increase, but rate expectations shifted higher after data showed inflation running at its fastest pace in more than four decades.

Technology stocks were poised to open higher. Futures for the Nasdaq-100 added 0.72% and contracts for the Dow Jones Industrial Average gained 0.47%.

U.S. government bonds steadied after sliding in recent weeks in a selloff that has pushed yields to their highest levels in more than a decade. The yield on 10-year Treasurys slipped to 3.398% from 3.482% Tuesday.

European stocks and peripheral government bonds in the eurozone rallied after the ECB said it would hold anad hoc meetingWednesday to discuss turbulence in theregion’s bond markets. Investors have dumped southern European government debt of late after the ECB set out plans to wind down its bond-buying program and raise rates to tame inflation.

The Stoxx Europe 600 rose 1.1%, led by shares of banks and insurers. Shares of Italian banks, which own a substantial chunk of government bonds, had suffered as the debt fell in price. Intesa Sanpaolo and UniCredit were among the best performers in the European market Wednesday.

The euro gained 0.7% to trade at $1.0483. The dollar, meanwhile, fell 0.6% against the WSJ Dollar Index, which tracks the currency against a basket of its peers.

“It’s a question of whether there’s something definitive today, or more an explanation of what to do in the future,” said Dorian Carrell, a funder manager at Schroders, of the ECB meeting. The ECB’s response to bond-market disruption is critical to global markets in part because it will influence the dollar, he said.

Cryptocurrencies kept tumbling. Bitcoin fell 8.4% to $20,155, putting the digital currency on track for a ninth straight daily loss. Ethereum slid 14%, extending arout in cryptocurrenciesthat has taken a toll on companies including Coinbase Global, which is laying off almost a fifth of its staff, and Celsius Network, a crypto lender now examining restructuring options. Coinbase shares skidded 6.8% in premarket trading.

Behind the selloff in crypto, and the recent turbulence in traditional financial markets, is the Fed’s likely change of gears in efforts to douse decadeshigh inflation. For years after the 2008-9 financial crisis, stocks, bonds and more speculative assets climbed as central banks pinned borrowing costs at low levels to goose inflation and economic growth.

The pandemic, whose economic effects central banks and governments combated with unprecedented financial stimulus, turbocharged that upward trend. Rampant inflation has prompted the Fed and many of its counterparts to unwind easy-money policies, and the assets that had benefited most from them are suffering.

Mr. Carrell said guidance the Fed gives about the direction of interest rates Wednesday is more important for markets than the size of the rate increase. Uncertainty about interest rates has been driving volatility in stock and credit markets, he said.

In commodities, Brent-crude futures fell 1.1% to $119.86 a barrel. The International Energy Agency said it expects global demand for oil to rise above prepandemic levels next year, driven by growth in China as it emerges from stop-start lockdowns.

Comments