Summary

- Tesla reported robust revenue and EPS beats for Q1. It demonstrated the company's remarkable resilience and pricing leadership in a harsh environment.

- Tesla aims to attain 1.5M production units by the end of FY22. It's looking to resume Shanghai's ramp quickly.

- However, we discuss why TSLA stock remains a Hold.

Investment Thesis

Tesla, Inc. (NASDAQ:TSLA) reported a highly robust FQ1 card yesterday. The market has been tentative about Tesla's performance going into yesterday's earnings. However, given TSLA stock's relative outperformance against its auto peers, the market remains optimistic.

Therefore, we believe Tesla's FQ1 performance has been largely priced in. Still, the extent of Tesla's earnings beats, even when stripping out regulatory credits was highly impressive. In addition, the company's ability to mitigate its costs of sales while raising prices demonstrated its remarkable production efficiencies and pricing leadership.

Tesla CEO Elon Musk also emphasized that the company faces supply challenges and has no immediate concerns about demand problems. Therefore, it should also assuage some investors' concerns regarding a more competitive environment. We are also convinced that the company remains well-positioned to succeed in a rapidly growing EV market that will thrive despite a higher inflation environment.

Nonetheless, we believe the production recovery challenges relating to Q2 should be investors' focus. However, Musk remains confident of Giga Shanghai's resumption. He also reaffirmed Tesla's 50% production growth rate and even suggested that 60% growth could be possible by the end of FY22.

We remain confident of Tesla meeting its guidance for the year. However, we maintain our Hold rating as we think its optimism has been priced in.

Tesla Achieved 30% Automotive Gross Margin

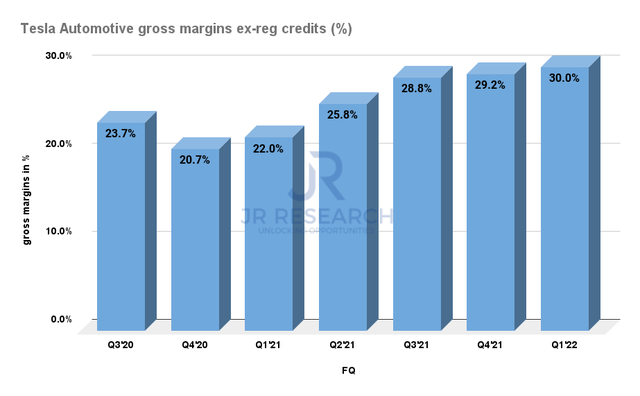

Tesla auto gross margins ex-credits %(Company filings)

Tesla delivered several beats in what was a highly remarkable quarter. It indeed demonstrated the prowess of its production efficiency and market leadership as demand continues to outstrip supply. The company reported revenue of $18.8B, up 80.5% YoY (Vs. Street consensus of $18B). It also delivered an adjusted EPS of $3.22, which easily surpassed the consensus estimates of $2.26. Notably, analysts were concerned about the recent supply chain challenges and raw material costs inflation on Tesla's bottom line. However, Tesla's robust adjusted EPS performance assured investors of the company's impressive ability to drive profits in a highly challenging macro climate.

The company reported regulatory credits of $679M, which was way ahead of consensus estimates of $312M. However, even after stripping out the credits, Tesla still delivered an adjusted EPS of $2.90, significantly higher than the Street's $2.26 estimate.

Notably, automotive gross margins ex-credits reached 30% for the first time. In addition, Tesla emphasized it embarked on a series of price increases in anticipation of rising costs moving ahead. While these challenges have not been reflected fully in its P&L, we believe reaching the 30% threshold again in Q2 could be challenging.

Why Q2 Margins Could Be At Risk?

Recent commentary from China had discussed its key LFP battery supplier CATL facing significant raw material costs challenges as it is also slated to report its Q1 card. Notably, these challenges are expected to impact its profitability markedly for Q1. In addition, CATL has discussed with its customers to increase prices as their contracts are due for renewal. Therefore, sources in China have suggested that CATL will likely implement marked increases in its prices from Q2. Shanghai Securities News reported (edited):

One thing is for sure, the surge in upstream battery raw material prices has transmitted the pressure to mainstream battery makers like CATL, according to sources.

The rise in raw material prices will be further transmitted to electric vehicle companies in the future, and consumers will likely face another wave of new energy vehicle price increases. CATL's price increase for customers will be implemented in the second quarter. Tesla is still negotiating with CATL and the current discussions are focused on whether to raise prices by 10 percent or 15 percent. -CnEVPost

Tesla also alluded to such contract renewals in its earnings call. CFO Zachary Kirkhorn accentuated (edited):

We estimate around 10% to 15% of our cost structure is exposed to raw materials. But, it doesn't impact us immediately or directly. In some cases, we have contracts with suppliers. But then, as those contracts expire, we have to renegotiate them so that there can be a lag. In some cases, our contracts do directly reflect movement in commodity prices or raw material prices. But the timing in which that Tesla pays for that has a lag associated with it as well based on the contract. (Tesla's FQ1'22 earnings call)

Hence, we believe that investors need to watch for the dynamics of these pricing uncertainties that could impact Tesla's gross margins in FQ2. Furthermore, Tesla's gross margins in Texas and Berlin are likely to face ramp impact and should be dilutive to margins in the near term. However, Musk remains confident that Tesla could scale rapidly over the next six to nine months in achieving its 1.5M production target. He articulated (edited):

The production in Q3 and Q4 will be substantially higher. So it seems likely that we'll be able to produce over 1.5M cars this year. From the point in which you have a factory complete and you're making a small number of units to the point where it's producing high-quality vehicles in volume is sort of nine to twelve months from the start of production. But to get to sort of the 5K-a-week level has typically taken us around 12 months from the start of production. (Tesla's earnings call)

It Highly Dependent On The Ramp Of Giga Texas and Berlin

We believe Musk's optimism is notable. Tesla is estimated to have lost about 50K production from Giga Shanghai's shutdown. However, the company is committed to recovering the lost output and still aims to produce 1.5M vehicles by the end of FY22. Therefore, it represents a 61.2% YoY growth in production, ahead of the 1.4M consensus estimates. Furthermore, it's also markedly above its 50% CAGR targeted growth cadence.

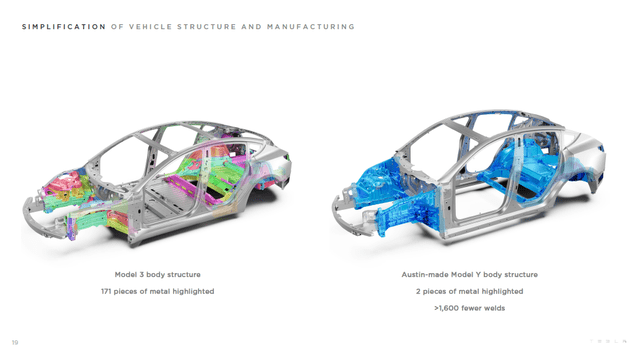

Simplification of Model Y structure and manufacturing(Tesla FQ1'22 update)

But, is it possible? Tesla certainly thinks so. In the earnings call, we gleaned several aspects of management's optimism from its key learnings from Shanghai's ramp. Furthermore, it believes that the significant improvements in its highly innovative manufacturing process would be pivotal.

Readers can refer to the chart above and observe the simplification of Model Y's structure based on the manufacturing process in its new Giga Texas. Tesla has eliminated more than 1,600 welds and simplified the Model Y's structure significantly compared to the current Model 3 structure.

Tesla also elucidated the improvements in the call, as management highlighted (edited):

Hopefully, we should be able to ramp production faster than Shanghai because we have learned a lot. We don't want to get complacent or entitled, but this should be a faster ramp because we have learned more, and we have done a lot to simplify the production process of Model Y which should lead us to a faster ramp in Texas and Berlin.

So we expect to almost double the capacity for the body, for example, reducing the number of robots but doubling our capacity in a lot of areas. Also, there are actually between 10% and 15% fewer stations in the general assembly. (Tesla's earnings call)

Is TSLA Stock A Buy, Sell, Or Hold?

TSLA stock consensus price targets Vs. stock performance(TIKR)

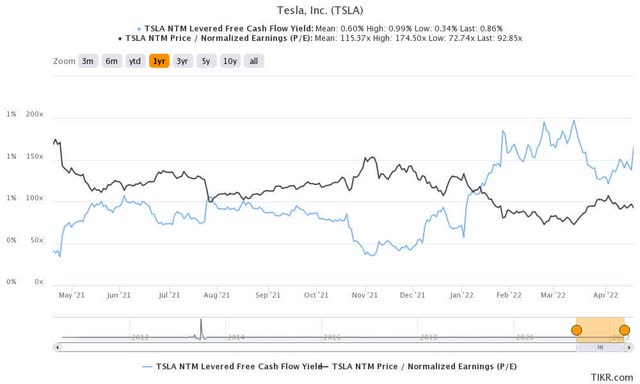

TSLA stock NTM FCF yields % and NTM normalized P/E(TIKR)

TSLA stock is currently up 7% in pre-market trading as the market applauded the remarkable quarter by Musk & Team. We concur that Tesla has demonstrated to its auto and tech peers how to execute in a highly challenging macro environment. Instead of putting out excuses, the Tesla team has continued to thrive in most environments, no matter how harsh they seem.

However, TSLA stock remains a Hold. We believe that the stock was fairly valued pre-earnings. Furthermore, it has also trended above the average consensus price targets ((PTs)).

Furthermore, for highly volatile stocks like TSLA, we expect a higher margin of safety to add exposure. As seen above, it's crucial for investors to demand such a buffer, given its highly aggressive FCF yields and P/E. So, we don't think TSLA stock looks attractive to enter at the current price levels, no matter the optimism.

We also don't think the Q2 margins and ramp headwinds have been adequately priced in and expect more volatility ahead. As a result, patient investors should have more opportunities to add moving forward.

Comments