‘Buy the dip’ is sabotaging the stock market’s upside potential

Wall Street’s “buy the dip” mentality is sabotaging the stock market’s upside potential. That’s because this mindset keeps investor sentiment from ever becoming bearish enough to support more than a relatively anemic rally.

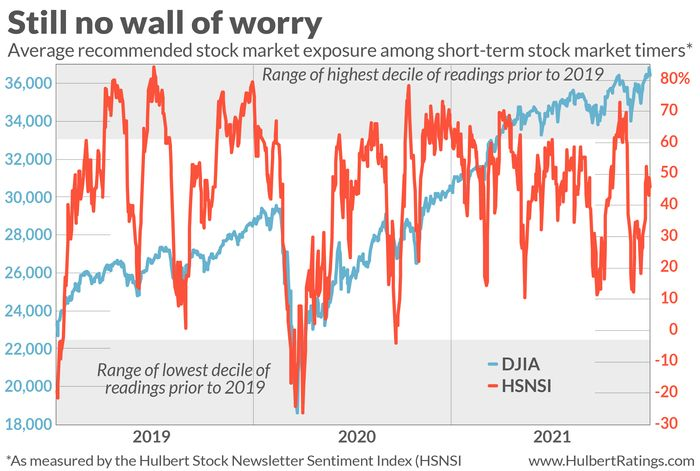

Investors’ buy-the-dip tendencies are illustrated in the chart below, which plots the average recommended equity exposure, using the Dow Jones Industrial Average as a benchmark, among a subset of short-term stock market timers tracked by my auditing firm. This average is what’s measured by the Hulbert Stock Newsletter Sentiment Index (HSNSI).

Notice the increasingly higher lows to which the HSNSI has dipped during periods of market weakness over the past two years. March 2020 was the last time the HSNSI dropped solidly into the zone of excessive bearishness, which I’ve defined in prior columns to be the lowest 10% of readings since 2000. The HSNSI dipped down to touch the upper edge of this decile in September 2020, and in subsequent periods of market weakness it hasn’t even fallen that far.

This trend of increasingly higher lows is worrisome because it means the market’s sentiment foundation is becoming progressively weaker. It means we’re that much closer to the bull market’s peak, which will be characterized by the last bear throwing in the towel and deciding that every dip is an aggressive buying opportunity.

The textbook illustration of such a top came in March 2000, when the internet bubble burst. Incredibly, market timers on balance became more bullish in the wake of the first 10% correction off that month’s highs.

Today’s buy-the-dip mentality hasn’t become that extreme, but we’re headed in that direction. Despite the market’s recent weakness, the HSNSI currently is higher than 61% of all daily readings since 2000.

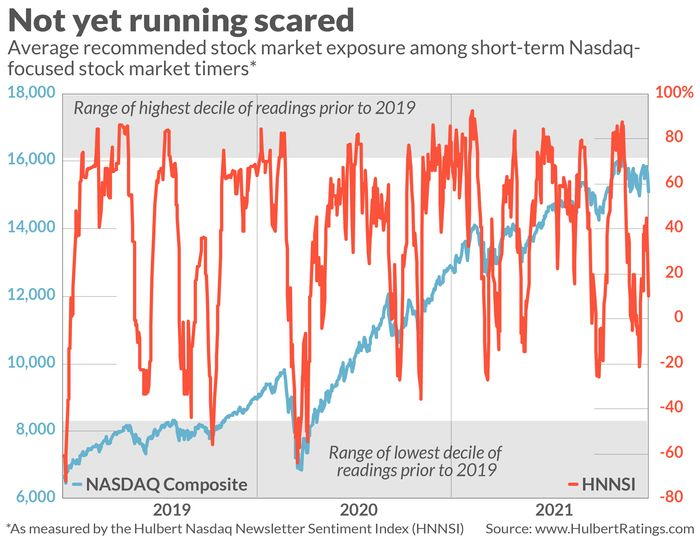

A similar story is being told by Nasdaq-focused market timers. That’s very revealing, since technology stocks have been among those hardest hit over the past several trading sessions. So we’d otherwise expect these timers to be especially quick to jump off the bullish bandwagon.

Consider another sentiment measure that my firm maintains, which reflects the average recommended equity exposure among short-term Nasdaq-focused stock market timers. This average is plotted in the accompanying chart of the Hulbert Nasdaq Newsletter Sentiment Index, or HNNSI.

Notice the same pattern of increasingly rising lows in the HNNSI. It currently is higher than 37% of all daily readings since 2000.

Contrarians typically avoid trying to predict how sentiment will unfold. But that doesn’t stop them from reflecting on what would support the bull market’s longer-term health. They would find it particularly encouraging if sentiment were to drop into the zone of excessive bearishness. If sentiment doesn’t drop that far, in contrast, contrarians will be expecting a less-impressive rally. Given recent experience, they are not holding their breath.

Comments