DIS has traded lower in 2022, but the stock has outperformed its direct peers in the past three months. Here is why, and what could be in store for Disney stock in the foreseeable future.

The current year has definitely not been a good one for streaming stocks. Up to this point in 2022, Roundhill’s streaming ETF (SUBZ) returned painful losses of nearly 20%.

Among a pile of losers, one name stands out as having performed better than all its major peers and in line with the Nasdaq 100: Disney stock (DIS). Today, we look at why this may have been the case, and what lies ahead for shares of the Mickey Mouse company.

Why Disney has performed better

The chart below shows how DIS has not disappointed as badly as its media entertainment peers lately. A YTD loss of 10% is no laughing matter. But at least it has not been as bad as Netflix’s 37% decline or, worse yet, Roku’s 46% selloff in only three months.

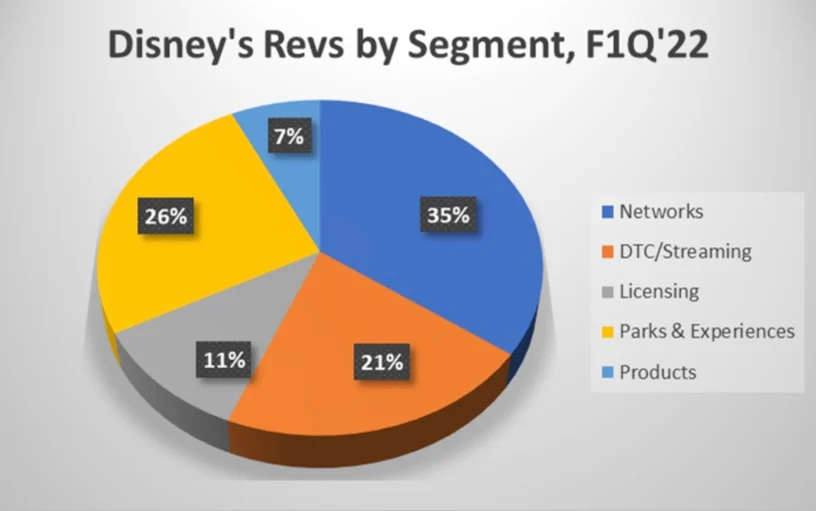

The first and obvious reason why Disney stock has been doing better is the diversification of the business model. Disney+ and other of the company’s streaming services, including Hulu, are arguably Disney’s crown jewel. But they are far from representing the bulk of total revenues.

The pie chart below shows that barely one-fifth of Disney’s sales in the most recent quarter came from DTC/streaming. Not displayed below is the fact that this subsegment is the only across the entire product and service portfolio that produces sizable operating losses.

If 2022 has not been the year of streaming services, it has been much better for the outside-the-home businesses. This is why, for example, Disney parks, experiences and products saw revenues more than double in the 2021 holiday quarter.

This is also most likely why Disney stock has been a winner among losers so far this year. While plenty of skepticism remains about the growth and profitability potential of Disney’s streaming offerings, some investors may be more excited by the recovery in other parts of the business.

The other main reason for DIS’s relative outperformance in 2022 may be the stock’s underperformance in 2021.

In the second half of last year, Disney stock dropped by an uncomfortable 13%. During the same period, the broad market S&P 500 (SPY) climbed 10%, and even streaming peer Netflix jumped 13%. Disney’s next-year P/E sank from 40 to 27 times in six months.

Faced with lower valuations and a battered share price, Disney stock probably appealed to bargain hunters in early 2022 — granted, still not enough to prevent the 10% YTD dip.

Can Disney stock climb from here?

Disney’s business fundamentals remain a mixed bag of good and bad. Parks, hotels and cruises are bound to recover quickly in this post-pandemic year. But DTC growth and margins remain a question mark, while networks continue to face secular pressures.

Wall Street does not seem too concerned. Of the 20 analyststrackedby TipRanks, 15 think that DIS is a buy. The consensus upside opportunity is an attractive 38% to a price target of $192.

I think that DIS is a good asset to own for the long term, but I would not count on the stock rebounding very quickly. While valuations seem attractive at last, there are plenty of risks associated with the business and the macroeconomic landscape that probably need to be sorted out before a rally begins to take shape.

Comments