Dragged by profit taking and rising yields, Amazon stock had a dismal first quarter of 2021. The Apple Maven reviews the key drivers of underperformance in the shares of the e-commerce and cloud giant.

As the first quarter of 2021 reaches the end, Amazon investors lick their wounds. Shares of the e-commerce and cloud giant had a rough three-month period of performance, ending the quarter down 5% year-to-date while the S&P 500 marched higher.

Although the Apple Maven is mostly concerned with the Cupertino company and its investors, today we turn the focus of attention to the third most valuable company in the US: Amazon.

Not a great start to 2021

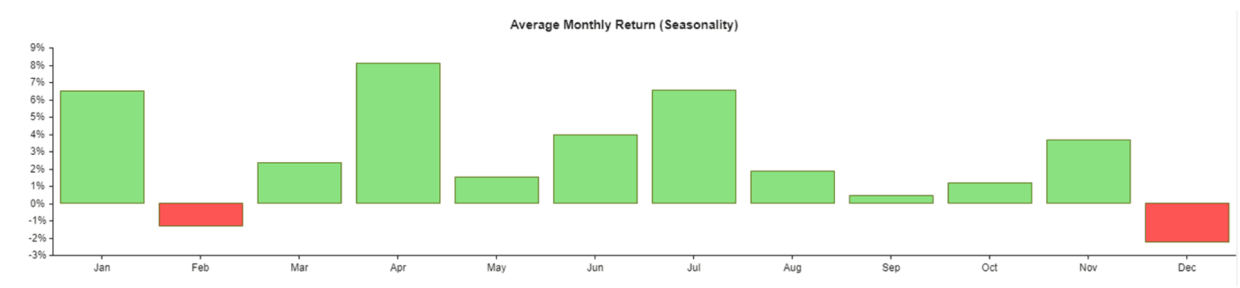

In the past decade, on average, Amazon stock produced a bit over 6% of returns in the first quarter – which is comparable to its peer Apple’s track record. By comparison, therefore, AMZN’s performance has been quite disappointing so far this year.

On the risk side, Amazon shares faced volatility of 27% in annualized terms, a number that was very much in line with the ten-year average. The maximum drawdown in the quarter was 13%, and it happened over a one-month period between early February and early March.

Compared to the broad market, Amazon stock trailed by just about 10 percentage points. Against the more relevant Nasdaq index, the underperformance was a bit less noticeable: 7 percentage points. Amazon failed to top the returns of any of its key peer and benchmarks, from the tech and consumer discretionary sectors to the FAAMG group of Big Tech stocks.

Compared to the broad market, Amazon stock trailed by just about 10 percentage points. Against the more relevant Nasdaq index, the underperformance was a bit less noticeable: 7 percentage points. Amazon failed to top the returns of any of its key peer and benchmarks, from the tech and consumer discretionary sectors to the FAAMG group of Big Tech stocks.

Ebbs and flows

Driving Amazon stock up and down since the start of the year were a few macro-level and company-specific factors. Below are Amazon’s best and worst days of performance that help to explain the stock’s journey through this challenging first quarter.

Going up:

- Amazon’s best days in the quarter happened late in January through the first of February,right around the company’s earnings day. January 20 topped the charts, with gains of 4.6%. It is hard to put a finger on what exactly caused Amazon and virtually all its direct peers to skyrocket ahead of Big Tech earnings week, other than enthusiasm for the upcoming results.

- The eve of Amazon’s earnings day, February 1, was the stock’s second best in the first quarter. A couple of Wall Street pre-earnings reports had come out, and most sounded bullish. Early February, however, also marked the peak for Amazon stock in 2021, and shares have been down 10% ever since.

Going down:

- The worst trading session for Amazon happened on March 18, when the stock lost 3.4%. The culprit seems to have been yet another leg higher in yields, supported by expectations for higher inflation and the reopening of the US economy. Other Big Tech stocks also took a hit that same day.

- The correction in Amazon stock from the early February peak picked up speed in late February and early March. During these couple of weeks, Amazon experienced four days of losses beyond 2%. To blame are likely the relentless rise in interest rates and some profit taking from a successful Big Tech earnings season.

Comments