July 26 (Reuters) - Lordstown Motors Corp(RIDE.O)said on Monday it received a $400 million equity investment from hedge fund YA II PN Ltd, at a time when the electric-truck maker is under regulatory scrutiny related to its SPAC merger and vehicle pre-orders.

According to a regulatoryfiling, Mountainside, New Jersey-based fund YA, managed by investment management services provider Yorkville Advisors Global LP, has agreed not to engage in any short sales or hedging transactions on Lordstown stock.

Yorkville Advisors Global did not immediately respond to a Reuters' request for comment.

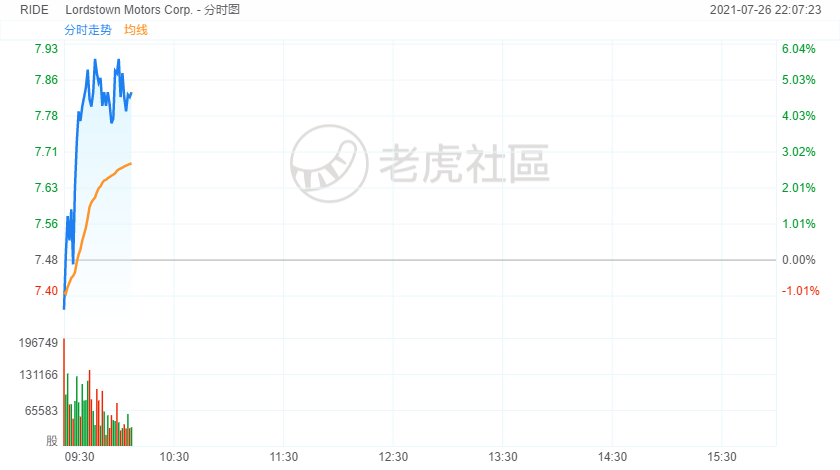

The company's shares were up 4.3% at $7.8, and are on track to snap a three-day streak of losses.

Lordstown said last week federal prosecutors in Manhattan were investigating its vehicle pre-orders and its merger with blank-check company DiamondPeak Holdings.

Comments