ZINGER KEY POINTS

Tesla stock is down 25.9% since the end of March, reflecting investor concerns about tapering demand.

In the wake of recent vehicle price cuts, Jefferies analyst said It is hard to get comfortable with near-term earnings.

Tesla, Inc.(TSLA)$ shares haven't really recovered ever since the company reported its first-quarter deliveries data. Thestring of price cuts has apparently not produced the desired effect.One data point goes on to prove this deduction.

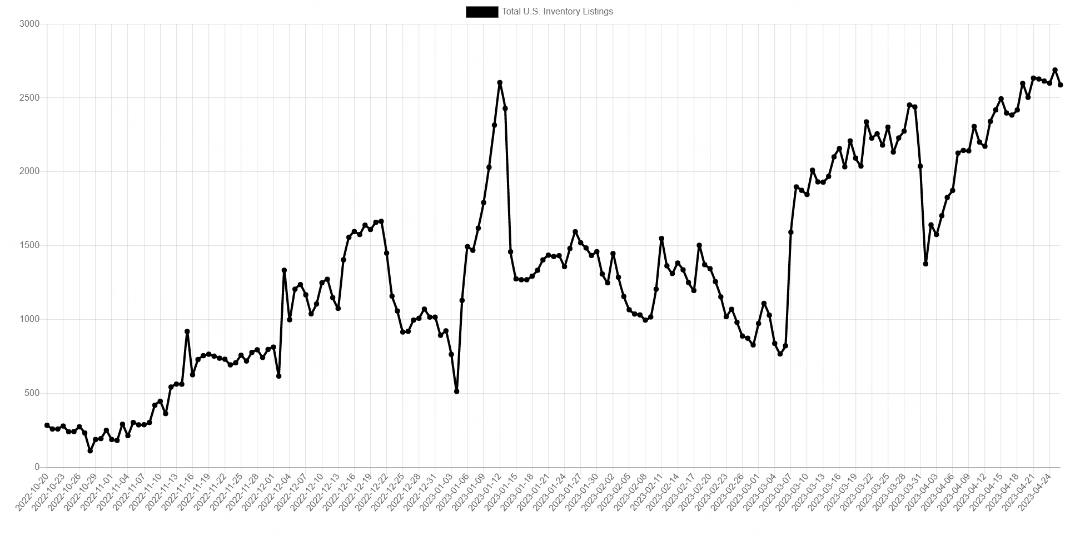

What Happened: Tesla's inventory levels in the U.S. was at an all-time high, said @TroyTeslike, a Twitter handle that provides key estimates for various metrics related to the electric vehicle maker.

The user noted inventory levels were higher than they were before the Jan. 12 price cuts, citing third-party data providers.

Tesla has been lowering vehicle prices in the U.S. since early January in a bid to boost volume. CEO Elon Musk has justified the moves by suggesting that the company is in a position of strength to implement those reductions.

Why It's Important: Wall Street, however, isn't impressed with the turn of events. Since the company reported its first-quarter deliveries, it has lost over one-fourth of its market capitalization.

As recently as Wednesday, Jefferies analyst Philippe Houchois, a longtime Tesla bull, downgraded the stock from Buy to Hold and reduced the price target from $230 to $185.

He contended that the first-quarter results did not validate demand elasticity offsetting lower prices. Cost progress may take longer to materialize, said, adding that “It is hard to get comfortable with near-term earnings."

Comments