U.S. equity-index futures fell amid concerns the nation’s inflation accelerated for a sixth successive month and that the Russian attack on Ukraine will continue. Bonds rallied as investors turned to the European Central Bank to gauge policy makers’ response to the war in Ukraine.

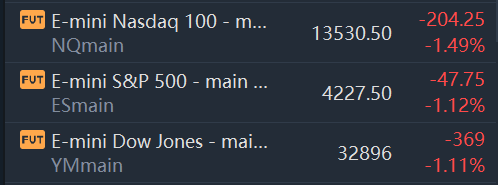

Market Snapshot

At 08:03 a.m. ET, Dow e-minis were down 369 points, or 1.11%, S&P 500 e-minis were down 47.75 points, or 1.12%, and Nasdaq 100 e-minis were down 204.25 points, or 1.49%.

Pre-Market Movers

Amazon.com (AMZN) – Amazon jumped 5.3% in the premarket after it announced a 20-for-1 stock split and a $10 billion share buyback program. The 20-for-1 split follows a similar move by Google parent Alphabet (GOOGL) earlier this year and is reviving discussion about whether Amazon or Alphabet might become members of the Dow Jones Industrial Average.

Boeing (BA) – The FAA has finalized safety directives aimed at fixing Pratt & Whitney engine issues on certain Boeing 777 jets. Boeing must now lay out the steps airlines will need to take to meet the FAA’s requirements. Boeing fell 1.5% in the premarket.

CrowdStrike (CRWD) – CrowdStrike surged 12.5% in premarket trading after reporting better-than-expected quarterly profit and revenue. The cybersecurity company also issued an upbeat 2022 forecast. CrowdStrike said it would strongly pursue market share as cybersecurity demand accelerates.

Asana (ASAN) – Asana shares tumbled 24.1% in the premarket after the collaboration software company forecast a wider-than-expected loss for the current quarter. Asana reported a narrower-than-expected loss for its most recent quarter, as well as revenue that exceeded analyst forecasts.

Marqeta (MQ) – Marqeta rallied 7.4% in premarket action after reporting better-than-expected quarterly revenue and a breakeven quarter in the face of an expected bottom-line loss. The fintech company also issued an upbeat current-quarter revenue forecast.

JD.com (JD) – JD.com reported better-than-expected profit and revenue for its latest quarter as more shoppers used its e-commerce platform. But the China-based company also reported its slowest revenue growth since early 2020. Its stock slid 6.5% in the premarket.

Wheels Up Experience (UP) – The private aviation company reported a quarterly loss of 31 cents per share, 6 cents wider than the consensus estimate. Revenue, however, was well above estimates at $345 million, representing an increase of 64% over a year earlier, while active membership grew by 31%. Wheels Up shares gained 4% in the premarket.

Anthem (ANTM) – The health insurer plans to change its name to Elevance Health, according to the Wall Street Journal. The move, which will require shareholder approval, is designed to reflect the broadening of its corporate portfolio.

Genesco (GCO) – The footwear and accessories retailer reported better-than-expected quarterly revenue and profit, with same-store sales rising 10% and e-commerce sales jumping 36%, compared with a year ago.

Market News

A majority of the U.S. House of Representatives on Wednesday voted to approve a $1.5 trillion bill that would provide $13.6 billion in aid for Ukraine and fund the federal government through Sept. 30.

Bitcoin and other cryptocurrencies fell on Thursday as some of the initial excitement around U.S. President Joe Biden’s executive order on digital assets faded. Bitcoin was down more than 7% at $39,077.79 at 6:55 a.m. ET on Thursday, according to data from CoinDesk.

Shares of Nio Inc. began trading in Hong Kong on Thursday after the Chinese electric-car maker chose a listing path that doesn’t involve selling new shares or raising funds.

Electric-car maker Tesla Inc on Wednesday raised prices of its U.S. Model Y SUVs and Model 3 Long Range sedans by $1,000 each and some China-made Model 3 and Model Y vehicles by 10,000 yuan ($1,582.40), according to its website.

TSMC today announced its net revenue for February 2022: On a consolidated basis, revenue for February 2022 was approximately NT$146.93 billion, a decrease of 14.7 percent from January 2022 and an increase of 37.9 percent from February 2021. Revenue for January through February 2022 totaled NT$319.11 billion, an increase of 36.8 percent compared to the same period in 2021.

Rio Tinto Group has joined the ranks of multinationals shunning Russia following the Ukrainian war, calling into question the fate of its alumina joint venture with Moscow-based United Co. Rusal International PJSC. “Rio Tinto is in the process of terminating all commercial relationships it has with any Russian business,” a spokesman for the global miner said in an emailed statement Thursday.

Comments