The 1Q22 IPO market ended with another quiet week. Just two SPACs priced.

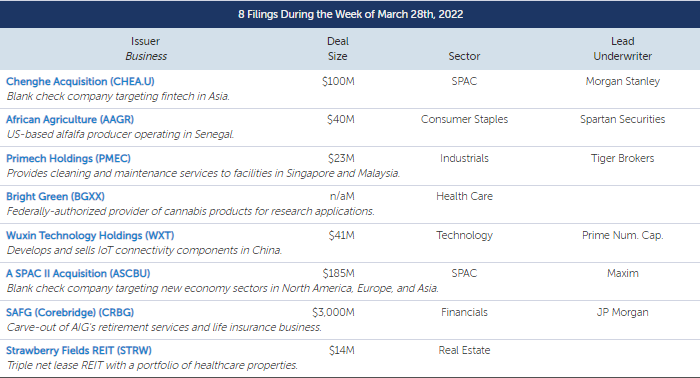

The most notable news came from the IPO pipeline. Four IPOs and two direct listings submitted initial filings, led by AIG carve-out SAFG Retirement Services (SAFG), which could raise up to $3 billion. Four issuers also refreshed their filings with updated financials, including billion-dollar deal Bausch + Lomb (BLCO).

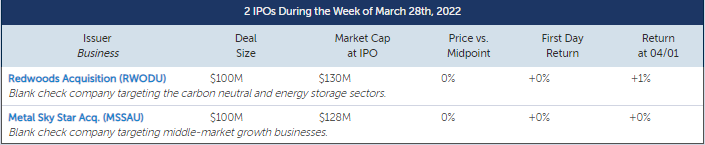

The week’s only pricings came from energy SPAC Redwood Acquisition (RWODU) and growth-focused SPAC Metal Sky Star Acquisition (MSSAU), both of which raised $100 million.

While not counted below, two other deals came to market: Railway safety micro-cap Rail Vision (RVSN) raised $16 million in a warrants-attached IPO, and nano-cap Expion360 (XPON) raised $15 million at a market cap less than Renaissance Capital’s $50 million cutoff.

Two SPACs also submitted initial filings. A SPAC II Acquisition (ASCBU) filed to raise $185 million to target new economy sectors, and Chenghe Acquisition (CHEA.U) filed to raise $100 million to target fintech in Asia.

The Renaissance IPO Indices are market cap weighted baskets of newly public companies. As of 3/31/2022, the Renaissance IPO Index was down 23.9% year-to-date, while the S&P 500 was down 4.6%. Renaissance Capital's IPO ETF (NYSE: IPO) tracks the index, and top ETF holdings include Uber Technologies and Snowflake . The Renaissance International IPO Index was down 21.9% year-to-date, while the ACWX was down 5.3%. Renaissance Capital’s International IPO ETF (NYSE: IPOS) tracks the index, and top ETF holdings include Volvo Car Group and Kuaishou.

Comments