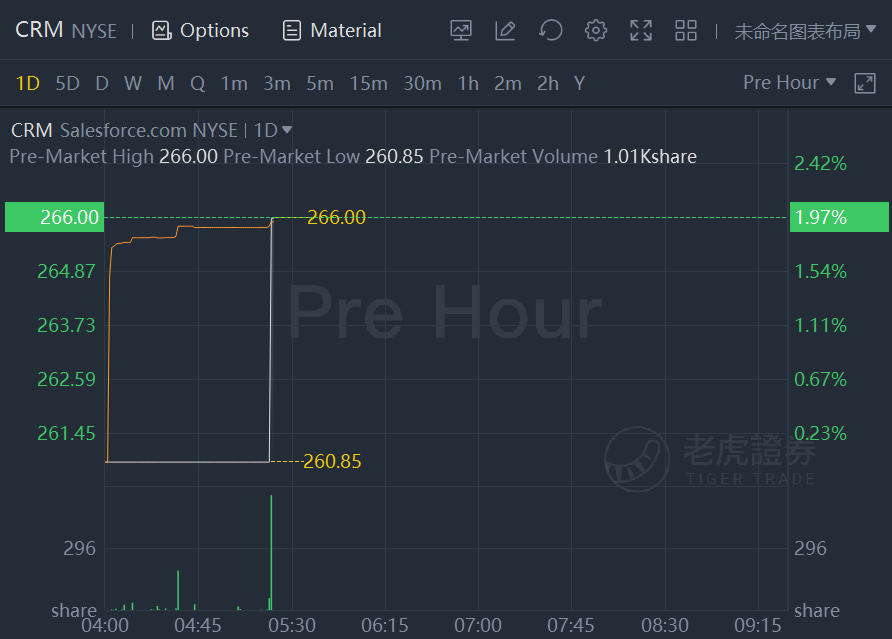

Salesforce shares rose nearly 2% in premarket trading on strong quarterly results.

Salesforce.com Inc. reported a boost in quarterly sales and again lifted its full-year outlook in a sign that companies continue their bet on cloud computing for business applications as the Delta variant of Covid-19 spreads.

The business-software provider has been one of the big beneficiaries of the pandemic, as companies embraced the kind of cloud-based enterprise tools Salesforce offers to connect users with customers and staff.

Salesforce’s stock has jumped more than 75% since the formal start of the pandemic.

San Francisco-based Salesforce on Wednesday posted revenue of $6.34 billion, up 23% from the same quarter a year ago, topping Wall Street expectations, according to analysts surveyed by FactSet. The company generated earnings per share of 56 cents.

The spread of the more infectious Delta variant has only reinforced the adoption of digital tools, Salesforce Chief Operating Officer Bret Taylor said in an interview Wednesday. “Delta has shown this virus is not going away,” he said.

Salesforce is seeing a workplace response to Delta with its own employees, Mr. Taylor said. The company had opened half of its offices after pandemic lockdowns, but since the new strain appeared people are showing up less frequently, he added.

Since the close of the most recent quarter, Salesforce completed its $27.7 billion acquisition of chat-based business communication company Slack Technologies Inc. last month.

The acquisition underpins Salesforce’s push to become a more formidable rival to Microsoft Corp. that has been pushing its Slack competitor called Teams, which combines both chat and videoconferencing capabilities.

Teams usage has grown rapidly during the pandemic to help with remote working but could grow quickly again as it will soon be integrated free into Microsoft’s coming Windows operating system due out later this year. Microsoft last month also signaled sustained strength in its cloud business.

Salesforce has said it would begin integrating Slack more closely with its sales software. Slack enjoyed 39% sales growth from the year-ago quarter and 41% year-over-year growth in customer deals valued at above $100,000, Mr. Taylor said. The workplace collaboration software provider also roughly tripled sales linked to one of its recent priority projects, called Slack Connect, that lets users message with users outside their immediate organization.

Salesforce also said it saw strong demand among government customers. Four of its top 10 deals in the most recent quarter were struck with public-sector organizations, the company said.

For the current quarter, the first to include Slack, Salesforce projects sales of $6.78 billion to $6.79 billion, slightly ahead of Wall Street expectations. The company also raised its full fiscal-year revenue forecast that includes Slack to between $26.2 billion to $26.3 billion, or around $300 million above the prior quarter’s projection. Salesforce said it expects earnings per share to be stronger than previously expected.

Salesforce shares rose 2.9% in after-hours trading. Before that, the stock closed Wednesday at $260.85, up 17% so far in 2021.

Slack was only the latest move by Salesforce Chief Executive Marc Benioff to expand Salesforce through acquisitions beyond its core customer relationship management software. In 2019,it acquired Tableau for $15.7 billion in what was then its largest-ever acquisition. Some investors have been wary about the amount of deal making, including the purchase of Slack, which was losing money.

Salesforce and Slack have long competed with Microsoft. In 2016, Salesforce, after it lost out to its larger rival in buying LinkedIn Corp., urged regulators to examine the proposed deal on antitrust grounds. The transaction ultimately passed regulatory scrutiny. And last year, Slack filed a complaint with the European Union over alleged antitrust behavior by Microsoft in using its market dominance to push Teams.

Comments