Summary

- Qualcomm and MediaTek are distinct brands in the smartphone chipset market supplying the crucial application processors essential for smartphones to function.

- We analysed the market leadership trends in terms of their market share of the smartphone application processor market.

- Another factor is the performance advantage and profitability where Qualcomm commands superior margins.

- Qualcomm is also more diversified and seeking to expand into the automotive computing platform market, leveraging its Snapdragon capabilities to support ADAS and AV.

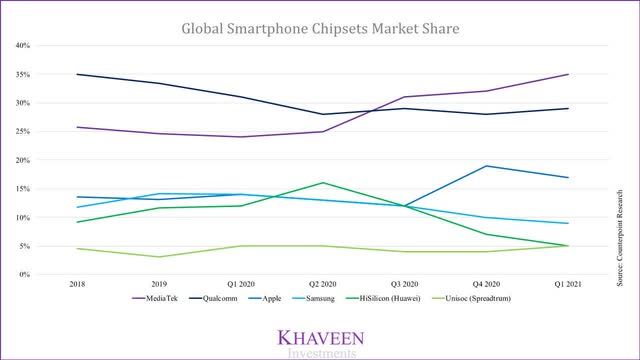

In the smartphone market, both Qualcomm Incorporated(NASDAQ:QCOM)and MediaTek Inc.(OTCPK:MDTKF)are prominent suppliers of application processors which is a chipset essential to power a smartphone device. In terms of market share, both companies are dominant players, accounting for over 50% of the smartphone application processor market combined. Qualcomm has its renowned Snapdragon series of chipsets while MediaTek has the featured Helios and expanded Dimensity lineup. However, MediaTek has been more successful with its lineup, securing design wins with major smartphone manufacturers leading to it gaining share at the expense of Qualcomm.

MediaTek’s market share gains have been impressive and are attributed to its cost-effective Dimensity series, which the company has introduced with 5G compatibility. Its expanded lineup has secured design wins with key customers such as Xiaomi (OTCPK:XIACF), Samsung (OTC:SSNLF), and Oppo. MediaTek is also gaining popularity in developing markets where it has edged out Qualcomm for market leadership in markets including China, LATAM, EMEA, and India. However, we highlighted Qualcomm’s performance advantage leading to superior profitability with higher margins. Fundamentally, both SoCs consist of ARM-based CPU but Qualcomm uses a 5nm process technology for its latest and most advanced Snapdragon 888 powering the premium-tier smartphones.

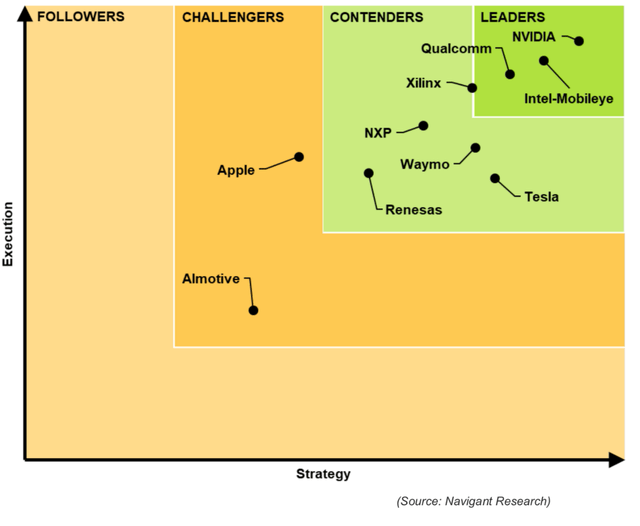

Besides the smartphone market, Qualcomm is also setting its sights to expand into the automotive market where it is planning to leverage its CPU and GPU expertise to extend the Snapdragon capabilities to handle ADAS and self-driving technologies and competing against Nvidia(NASDAQ:NVDA)and Intel’s(NASDAQ:INTC)Mobileye, whereas MediaTek maintains a more focused approach on the smartphone markets which faces the threat of stagnation owing to high smartphone ownership rates. Finally, we compared the company’s financials and applied a DCF analysis to value both companies.

MediaTek Stealing Qualcomm’s Crown by Supplying Chinese Smartphone Manufacturers

In 2020, MediaTek overtook Qualcomm to be the largest smartphone application processor supplier. While both companies remain as leaders of the global smartphone application processor market, MediaTek has displayed rapid growth whereas Qualcomm’s market share leadership has eroded since 2018. This trend is attributed to several factors including growing orders from key smartphone OEMs, the Huawei ban, and the company’s expanded 5G portfolio with the Dimensity 800 series targeted towards low to mid-tier devices. Based on the market share chart below, MediaTek has been gaining market share while Qualcomm’s market leadership has eroded. Though, the impact on Qualcomm has been cushioned by Samsung’s decision to outsource rather than using its unpopular Exynos chip among fans.

Both companies supply to Samsung, Xiaomi, Oppo, and Vivo. These are key customers for Samsung,representing more than 10% of revenues each according to its annual report. On the other hand, MediaTek does not disclose its revenue contribution figures from customers. However, MediaTek has witnessed tremendous growth from Xiaomi and Samsung as it secured design wins to supply these companies with its newly launched 5G smartphone chipsets as well as trade tension pressures leading Chinese chipmakers to diversify their supply chain from the US-based Qualcomm. Additionally, Qualcomm was reported to have faced supply chain issues due to the production shutdown of Samsung’s Austin fab in Q1 2021, which manufactures some of Qualcomm’s chips. In terms of shipments, Xiaomi was the company’s biggest customer and reportedly shipped 223% more smartphones with the company’s chips as compared to 2019. Oppo was MediaTek’s second-biggest customer in 2020, shipping 19% more chips than 2019. Samsung also saw demand for MediaTek smartphones grow by over 250% in 2020 over 2019 while demand for Qualcomm declined by 53% based on estimates derived from its market shares.

Top Customers |

Qualcomm 2020 Shipments ('mln) |

Growth (%) |

MediaTek 2020 Shipments ('mln') |

Growth (%) |

Xiaomi |

82.9 |

-21% |

63.7 |

223% |

Oppo |

56.5 |

-23% |

55.3 |

19% |

Samsung |

22.7 |

-53% |

43.3 |

255% |

Source:GSM Arena,SamMobile,Xiaomi,Counterpoint Research

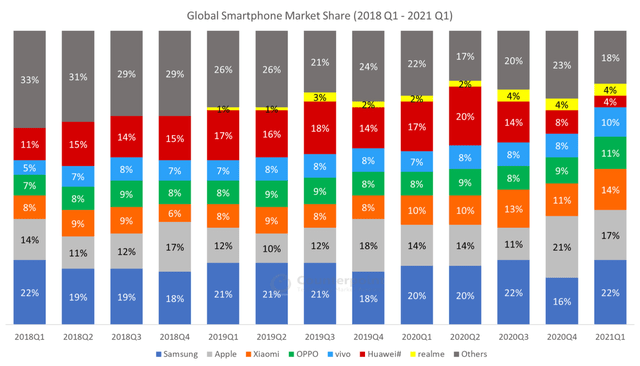

The exposure that MediaTek has obtained from its relationship with Chinese smartphone manufacturers, Xiaomi and Oppo, has been highly beneficial as these companies are cannibalizing Huawei’s sales which have felt the impact of the trade embargo by the US. As shown in the chart below, Chinese smartphone competitors have gained market share at the expense of Huawei.

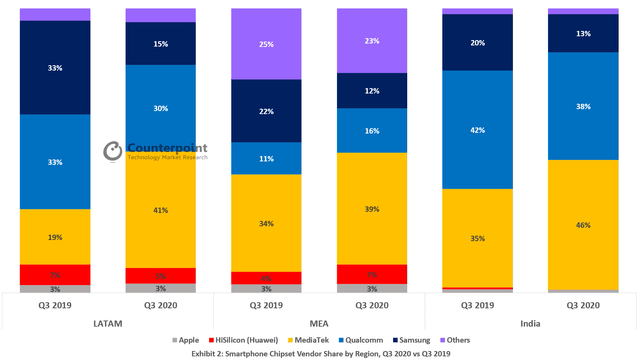

Besides winning Chinese smartphone manufacturers, another factor that is attributable to the rise in MediaTek is in developing countries where its affordable chipsets are seeing rising adoption. This is evident in the largest smartphone market in the world,China, accounting for 26.6% of global smartphone shipments. Here, MediaTek’s market share among China’s 5G smartphones has risen rapidly in 2020 with the expansion of its 5G lineup and design wins by Chinese smartphone manufacturers. At the end of Q4 2020, it has attained a market share of 40.4% which is ahead of Qualcomm at 20.1%.

Besides China, other developing regions are seeing rising adoption of MediaTek’s application processors. This includes LATAM, MEA, and India, where MediaTek has become the largest supplier of smartphone chipsets ahead of Qualcomm with its affordable 5G lineup. Also, the chart highlights Samsung’s Exynos chip decreasing market share as it outsources instead.

Market Share Growth by Region

Moreover, the developing countries make up some of the largest smartphone markets globally with China, India, Indonesia, and Brazil being among the top 5 markets. These growth markets are only about 60% penetrated in terms of smartphone ownership. India has the lowest penetration at only 31.8%, which shows a significant opportunity for high potential for growth in the country. In 2020, the global smartphone market wasvaluedat $714.96 bln and is forecasted to grow at a CAGR of 11.2%.

Worldwide Smartphone Sales by Region ('mln')

Region |

2020 |

2021F |

Growth (%) |

Eastern Europe |

43 |

49 |

14.91% |

Emerging Asia/Pacific |

337 |

366 |

8.61% |

Eurasia |

43 |

47 |

8.71% |

Greater China |

368 |

410 |

11.40% |

Latin America |

116 |

134 |

15.52% |

Mature Asia/Pacific |

26 |

30 |

15.76% |

Middle East and North Africa |

71 |

79 |

10.68% |

North America |

136 |

152 |

11.37% |

Sub-Saharan Africa |

84 |

94 |

11.67% |

Western Europe |

125 |

143 |

13.85% |

Japan |

27 |

30 |

10.90% |

Grand Total |

1,379 |

1,535 |

11.36% |

Source:Gartner, Khaveen Investments

Overall, MediaTek has been able to deepen its relationship with Chinese smartphone manufacturers by securing new design wins with its expanded 5G Dimensity lineup while Qualcomm, which has had an early advantage, is starting to feel the pinch from MediaTek. This has also enabled MediaTek to secure large parts of the developing markets including China, LATAM, MEA, and India which account for over 60% of the smartphone market. These factors are attributable to MediaTek’s rising share in the past 3 years and edging out Qualcomm’s market leadership.

Qualcomm Still Maintains Superior Technology with Greater Profitability

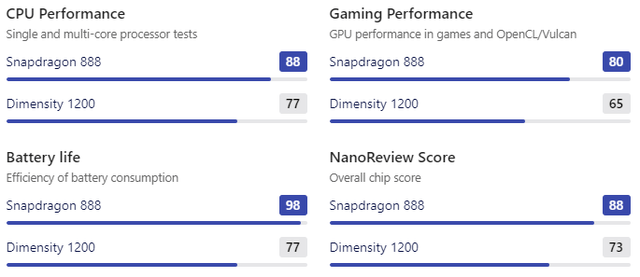

Although MediaTek has claimed market leadership over Qualcomm, another aspect that contrasts both companies are in terms of performance. Historically, Qualcomm has maintained an edge over MediaTek in terms of application processor performance. However, both companies utilize the same ARM-based processors. Qualcomm derives its performance advantage from its process technology at the premium tier and the Adreno GPU component of its SoC which is more customized than MediaTek.

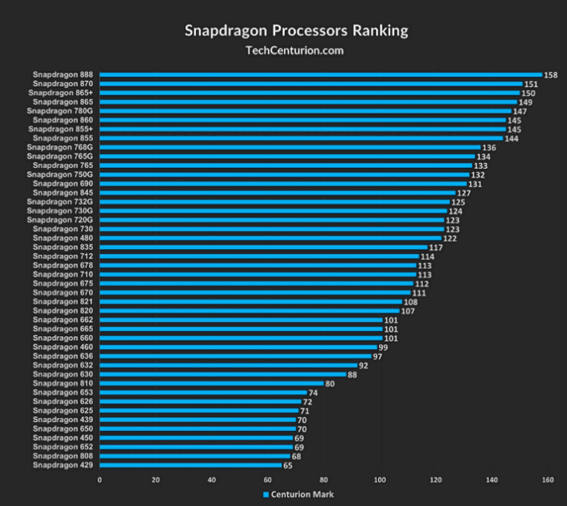

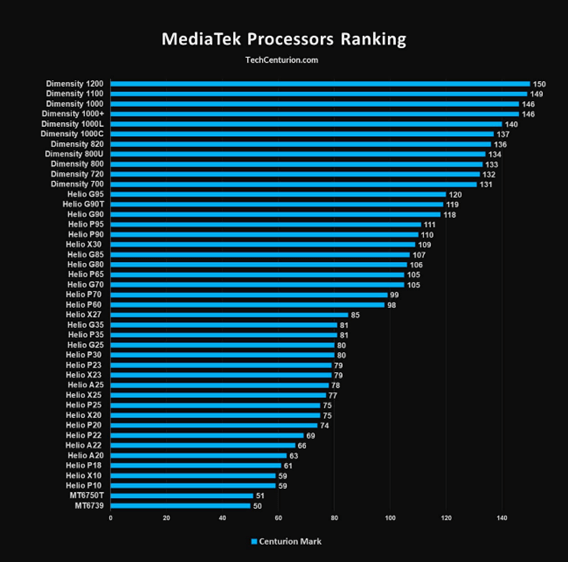

To compare the performance of the companies’ chipsets, we referred to benchmarks from Centurion Mark, which is a well-regarded benchmark used to analyze the performance of each series of application processors. Centurion Mark is determined by testing the processors on over 20 different parameters. Some of these parameters such as User Experience and Raw CPU Performance have a significant impact on the score while there are some minor parameters as well that make a little difference (For example, Dual VoLTE Support). These are the 5 major factors that influence Centurion Mark: User Experience, Real-World Performance, Raw CPU Performance, Raw GPU Performance, Features and Technologies Present. The graphs below show the centurion mark for both Qualcomm and MediaTek chips. Based on the centurion mark, Qualcomm appears to have better performing chipsets with a higher score.

For the premium tier, the Snapdragon 888 is Qualcomm’s latest and most advanced chipset which is compared to MediaTek’s Dimensity 1000 series. The Snapdragon 888 has a Centurion Mark score of 156 which is higher than Dimensity 1000 at up to 150 only. Specification wise, both chips have the same number of ARM Cortex cores but the fundamentaldifferencesbetween these chipsets are the process technology used to manufacture them. Qualcomm uses a 5nm process by Samsung while MediaTek uses 6nm for the Dimensity chip leading to better CPU performance and battery life from more efficient power consumption. Additionally, Qualcomm’s Adreno GPUs are semi-customed by Qualcomm while MediaTek uses a standard ARM Mali GPU which also explains the better GPU performance for Qualcomm.

The reason this performance advantage for Qualcomm is significant is because of the superior profitability it commands. In terms of pricing, Qualcomm’s average chip price is $51.70 which is significantly higher than MediaTek’s average chip price of $32.55. We calculated this price by dividing the revenue by the total shipments of 2020.

Company |

Revenue ($ mln) |

Shipments ('mln') |

Average Chipset Price ($) |

Qualcomm |

16,493 |

319 |

$51.70 |

MediaTek |

11,457 |

352 |

$32.55 |

Source: Qualcomm, MediaTek,Omdia

This higher pricing power of Qualcomm improves its margins as the company has about 60% gross margins. In comparison, MediaTek’s gross margins are only about 42%. This difference shows that although MediaTek has more shipments and is currently the market leader, Qualcomm is the more profitable company.

Company |

Gross Margins (%) |

Qualcomm |

60.67% |

MediaTek |

41.85% |

Source: Qualcomm, MediaTek

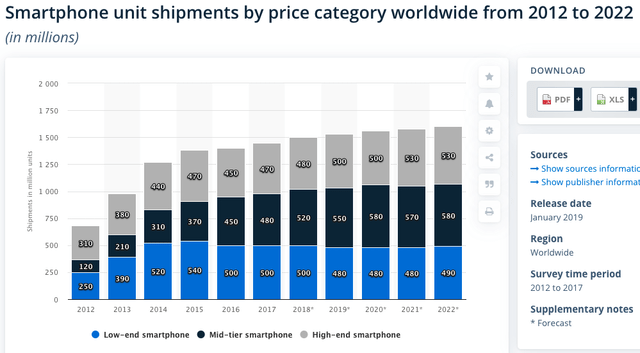

That said, the performance advantage is likely less to price sensitive consumers in the lower-tier market which is why MediaTek is still gaining market share. Additionally, MediaTek is also believed to be beefing up its Dimensity series with the help of TSMC touseits 5nm process technology which may close the performance gap with Qualcomm in future lineups. However, Qualcomm is still the superior company in terms of performance and commands higher profitability. Moreover, the high-end smartphone market share is expected to remain stable as seen in the chart below.

Expansion Opportunities Beyond Smartphones with Automotive SoCs

Apart from emerging markets, the ownership rate of smartphones is already at a mature rate in more developed countries. In 2020, the global smartphonepenetration rateis estimated to be around 78%. This presents a long-term risk to both companies which depend heavily on the smartphone application processor market. However, Qualcomm has a relatively more diversified business structure and intends to expand into the automotive chipset market.

Qualcomm leverages its wireless and connectivity expertise to cater to the automotive infotainment chip market. In 2021, the company and General Motors(NYSE:GM)announced an agreement for the Qualcomm Snapdragon Automotive Cockpit Platforms to power digital cockpits and next-generation telematics systems. Moreover, the company is seeking to expand into the ADAS and AV chip market, leveraging its CPU and GPU capabilities and competing against Nvidia’s DRIVE and Intel’s Mobileye. The company intends to scale its Snapdragon automotive processor for ADAS and self-driving vehicles promising performances of up to 700 TOPs. Management claims that its Snapdragon Ride ADAS system could be launched by 2022. In relation, the company is partnering with Veoneer (VNE), a previous partner of Nvidia, which provides ADAS and AV solutions including its Arriver software which the companies plan to integrate with the Snapdragon Ride Platform. In terms of design wins, Mobileye and Nvidia have secured a greater network of automakers compared to Qualcomm. The company is believed to have landed GM as a major customer to implement its ADAS.

According to Navigant Research, the research firm ranks Nvidia and Intel Mobileye ahead of Qualcomm in the automotive self-driving compute platform but still a leader in this area. Overall, Qualcomm has set its sights in the automotive market in contrast to MediaTek which remains focused on the smartphone market. This means that Qualcomm is in a better position to reap the benefits of the rising global automotive chip market size which is forecasted to reach $56.24 bln by 2025, growing at a CAGR of 10.7%, driven by rising ADAS applications.

Trade Tensions Risk Impacting the Smartphone Application Processor Market

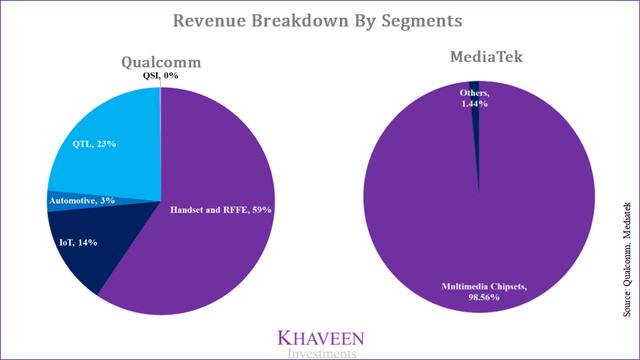

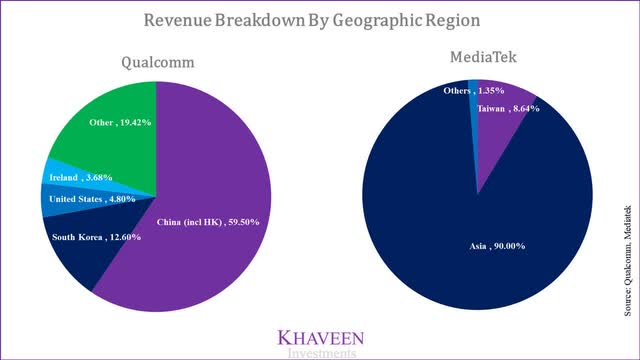

Comparing both companies’ revenue breakdown by region, both Qualcomm and MediaTek derive a significant portion of their revenues from the Asia Pacific region with Qualcomm making 59% of revenue from China.

We believe the greatest risk for Qualcomm is the escalating trade tensions between the US and China. In 2020, the company was barred from doing business with Huawei like other US companies until it was later modified to allow older generation 4G chips to be supplied to Huawei. This may have provided some relief for Qualcomm but the restriction on 5G technology remaining in place affects both Qualcomm and Huawei negatively. Though, the wider implication of rising dispute between the two largest economies may impact Qualcomm. This is the case where other Chinese smartphone manufacturers may be diversifying their supply chain benefitting MediaTek to prevent the threat of trade embargoes against them in the future. If trade tensions continue to escalate between the countries’ governments, Qualcomm stands to lose as it is heavily reliant on the Chinese market. Additionally, this could lead to a shift that may see MediaTek benefit from orders redirected from Qualcomm to it by Chinese manufacturers.

Valuation

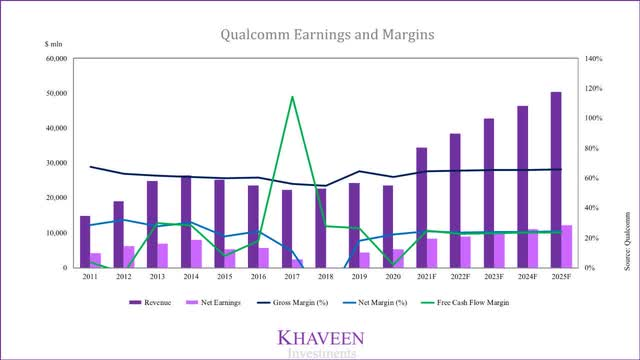

The 5-year average revenue growth of Qualcomm is -1.3%. The 5-year average gross and net margins are 59.3% and 10.68%, respectively.

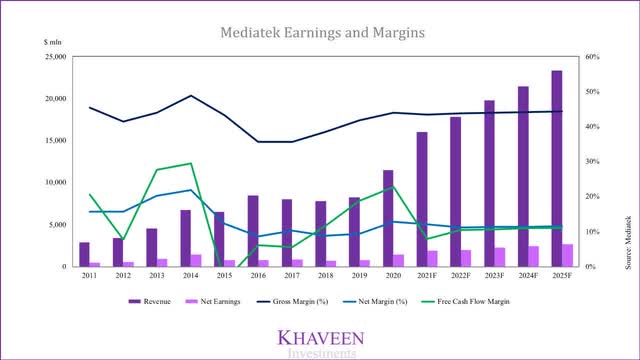

The 5-year average revenue growth of MediaTek is 13.6%. The 5-year average gross and net margins are 39.1% and 9.92%, respectively.

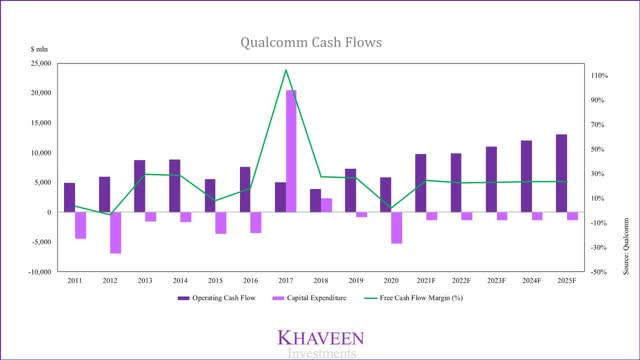

Qualcomm’s 5-year average free cash flow margin is 37.71%. The extremely high positive capex in 2017 is due to the sale of marketable securities for $41,715 mln.

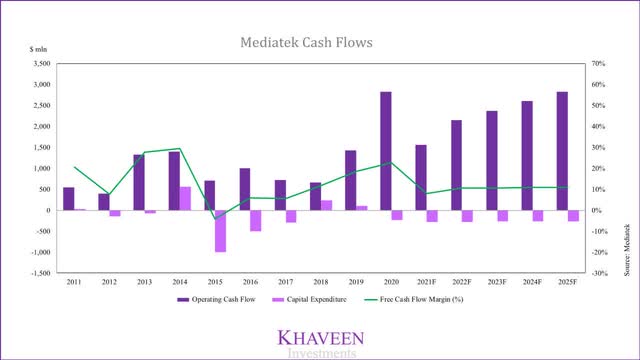

In comparison, MediaTek’s 5-year average free cash flow margin is lower than Qualcomm at 12.95%.

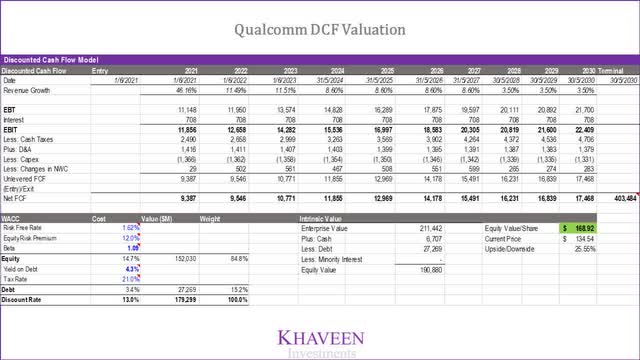

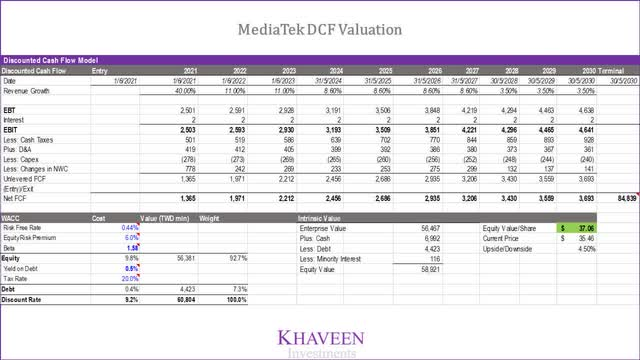

Since both companies have positive free cash flows, we used a DCF model to accurately value the companies. The industry average EV/EBITDA is 16.96x, as shown in the table below.

Company |

EV/EBITDA |

Qualcomm |

15.03x |

MediaTek |

20.52x |

Qorvo (QRVO) |

15.04x |

Skyworks (SWKS) |

15.61x |

Broadcom (AVGO) |

18.61x |

Average |

16.96x |

Source: Seeking Alpha

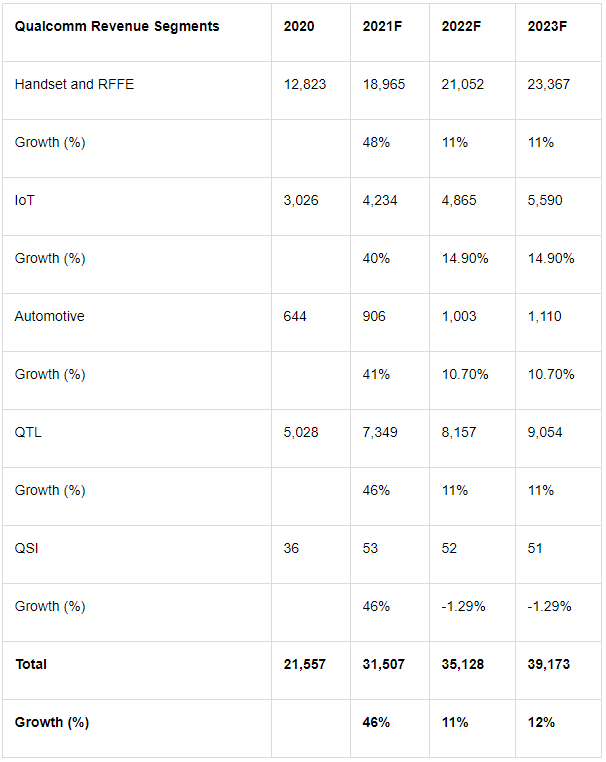

The revenue projections for Qualcomm in 2021 are based on the prorated figure. We used the revenues obtained in the first 2 quarters, along with the third quarterguidance, to forecast the full year revenue. For 2022 and 2023, the forecasted revenues are based on the market CAGR for each of the segments. The handset and RFFE segment is expected togrowat 11% which is the market forecast for the global smartphone application processor market. The QTL segment is also based on the same growth rate as the segments are interlinked. The IoT segment is expected togrowat 14.9% which is the market forecast for the global IoT chip market. Similarly, the automotive segment is expected togrowat 10.7% which is the global automotive chip market CAGR. Overall, the revenue growth for 2021 is forecasted at 46%. For 2022 and 2023, the revenue growth forecast is 11% and 12%, respectively.

For MediaTek’s revenue projections, we based the 2021 forecast based on companyguidanceof 40% year-on-year growth in revenue. For 2022 and 2023, we based the revenue growth on the global smartphone application processor market CAGR of 11%. Based on these forecasts, the revenue growth for 2021 is 40%, with 2022 and 2023 revenue growth at 11%.

MediaTek Revenue Segments (USD mln) |

2020 |

2021F |

2022F |

2023F |

Multimedia Chipsets |

11,292 |

15,809 |

17,548 |

19,479 |

Others |

165 |

231 |

256 |

285 |

Total |

11,457 |

16,040 |

17,805 |

19,763 |

Growth (%) |

40% |

11% |

11% |

Source:Market Research Future,MediaTek, Khaveen Investments

Based on Qualcomm’s discount rate of 13% (company’s WACC), the upside is 25.55%.

Based on MediaTek’s discount rate of 9.2% (company’s WACC), the upside is -4.74%.

Company |

Current Price |

Target Price |

Upside (%) |

Qualcomm |

$134.54 |

$168.93 |

25.55% |

MediaTek |

TWD978.36 |

TWD1,021 |

-4.74% |

Source: Khaveen Investments

Verdict

The market share trends are favouring MediaTek due to its expanded product lineup of affordable 5G chipsets securing design wins with Chinese smartphone manufacturers and Samsung. This is also significant as Chinese smartphone manufacturers are cannibalizing Huawei’s market positioning. This has also enabled it to gain ground in developing markets where smartphone ownership rates are still low compared to more developed regions. Despite that, we believe Qualcomm still edges out over MediaTek as it has superior profitability and maintains a performance advantage over MediaTek. Qualcomm’s focus on R&D and strong relationship with foundries solidified the Snapdragon 888’s performance advantage to cater to the premium tier and leading to higher margins than MediaTek. Additionally, Qualcomm is building on its efforts to leverage the Snapdragon platform across adjacent markets, especially in automotive where it is developing an auto compute platform with ADAS and AV capabilities, while MediaTek remains focused on the smartphone market. Overall, we rate Qualcomm as a Buy with a target price of $168.93 and MediaTek as a Hold with a target price of TWD1,021.

Comments