Summary: PayPal will release its second-quarter financial report before the market opens on July 29, 2025. Currently, the market is most concerned about whether its revenue scale and profitability can maintain steady growth.

First quarter review

Revenue in the first quarter of fiscal year 2025 was US$7.791 billion, compared with US$7.699 billion in the same period last year, a year-on-year increase of 1.19%; net profit was US$1.287 billion, compared with US$888 million in the same period last year, a year-on-year increase of 44.93%. In terms of payment scale, PayPal's total payment volume (TPV) was US$417.2 billion, a year-on-year increase of 3%.

Second quarter outlook

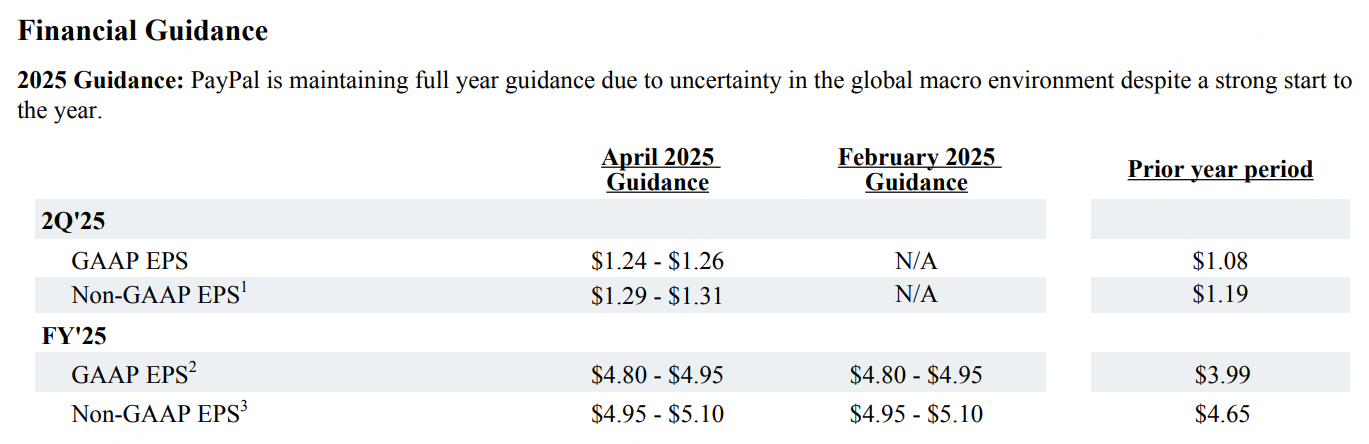

PayPal expects adjusted earnings per share of $1.29-1.31 in the second quarter. At the same time, the company reiterated its full-year adjusted earnings per share forecast of $4.95-5.10.

Continuously optimized payment services

The company will provide users with a comprehensive and convenient multi-scenario payment experience with more complete technology and systems. Social payment and cross-border payment are regarded as new growth points. By integrating the needs of different regions, languages and currencies, the management seeks to further amplify transaction activity. Researchers pointed out that the fully upgraded payment process will make merchants and consumers feel convenient, so there is potential for revenue growth.

Development of mobile payment

The company is optimistic about the future development of mobile payment in the long term and will invest more resources in e-wallets, peer-to-peer transfers and small payments. When the APP can accept currencies from more countries, users can make cross-border consumption more easily, which can bring incremental benefits.

Opportunities for digital value-added services

On top of the basic payment system, the company began to guide more users to more flexible value-added financial services. From installment payments to one-click foreign exchange settlement, to personalized payment methods in vertical scenarios, they can provide new opportunities for profit growth. The market speculates that the demand for online marketing tools and financial technology services by retailers is rapidly expanding, and PayPal can obtain relatively stable income in these areas.

Development of cryptocurrency business

Alex Chriss, CEO of PayPal, said that PayPal has established a unique leading advantage in the field of cryptocurrency payments. Currently, hundreds of millions of PayPal and Venmo users around the world can directly buy and sell digital currencies through digital payment accounts, and tens of millions of merchants can also realize the collection and payment of crypto assets such as Bitcoin through corporate accounts. Various cryptocurrencies and stablecoins are the focus of market speculation at present, and it is necessary to pay attention to the company's business outlook in this direction.

Risks

Although PayPal occupies a leading position in the field of payment technology, the market competition is becoming increasingly fierce, and the digital transformation of emerging payment platforms and traditional financial institutions may pose a challenge to its market share. In addition, global economic fluctuations and changes in regulatory policies may also have an impact on PayPal's business development.

Comments