Advanced Micro Devices stock rallied again Wednesday, this time after the possibility that a $40 billion acquisition by rival Nvidia might be blocked by British regulators.

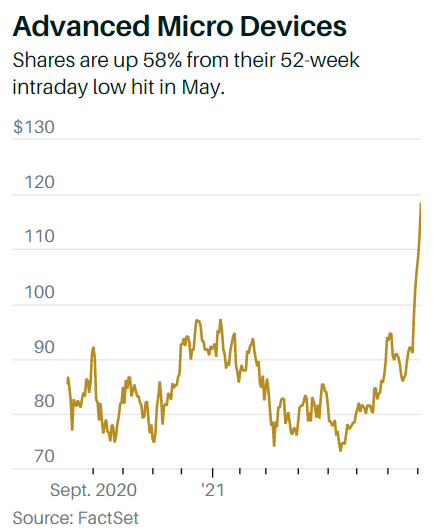

Shares of Advanced Micro Devices (ticker: AMD) were up 5.5%, to $118.77, in afternoon trading—the sixth consecutive day of advances after the chip maker posted strong second-quarter earnings. The stock had been relatively flat heading into last week. In all, shares have gained 33% since July 27. They need to close above $112.56 to set a record.

AMD’s (ticker: AMD) gains are part of a broad rally by chip stocks. The benchmark PHLX Semiconductor index, or Sox, has advanced 7.2% in the past six days and 23% this year. The Sox, too, marked a new high if it closes with a gain Wednesday.

What may have heartened investors Wednesday is the chance that Nvidia’s (NVDA) takeover over of Arm, a closely held chip technology provider, might fall through. Regulators in the U.K. are considering whether to block the deal due to potential national security risks,Bloomberg News.

Now, Nvidia competes with AMD in the graphics processor segment. But if the Arm acquisition goes forward, Nvidia would have a portfolio of central processor technology that could use to take on AMD’s data center and personal computer processor businesses.

On Tuesday, AMD announced a new line of its Radeon graphics processors for Apple’s Mac Pro. The stock jumped again after strong earnings from Xilinx,which AMD plans to buy for $35 billion.

AMD’s second-quarter financial report was bullish on the coming year. Executives expect revenue growth of 60% for the full year, an increase of 10 percentage points from prior guidance. The company, according to chief executive Lisa Su, is seeing strong demand across all of its businesses, and growing faster as a result.

Comments