After a record plunge in April, Americans' incomes were expected to shrink further in May as 'stimmies' dry up and recovery begins (while spending was expected to rise marginally - but less than in April). The data was mixed (and not good) with incomes -2.0% (slightly better than the -2.5% expected, but still down) but spending was unchanged MoM (missing expectations of a 0.4% MoM rise after a big upward revision in April to +0.9% MoM)

On a YoY basis, income growth accelerated modestly while spending growth slowed notably (but remains dramatically higher)...

Citi says the revision in spending largely reflects rising prices in components such as airfares, rental cars, and used cars, and adds that while these abnormally strong price increases should ultimately prove temporary, very strong price increases could continue for another month or two.

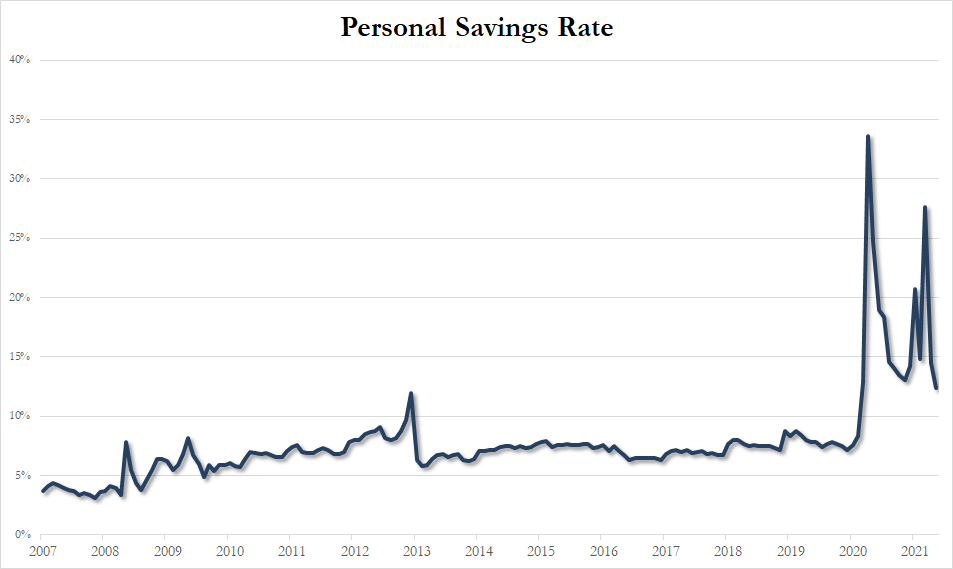

The shift in spending vs income has pushed the savings rate lower...

Which leads us to the most important aspect of today's data - The Fed's most-watched inflation indicator, the core PCE Deflator, which soared to +3.4% YoY (as expected).This is the highest level of core inflation since 1991.

Hot enough for you Mr.Powell? Or is that all transitory too?

Comments