Summary

- Rivian Automotive has seen its stock valuation collapse in recent months.

- Rivian has a well-capitalized balance sheet. The cash balance is enormous in comparison to market capitalization.

- Rivian will be able to scale production faster than any other EV company.

- RIVN stock now looks attractively priced.

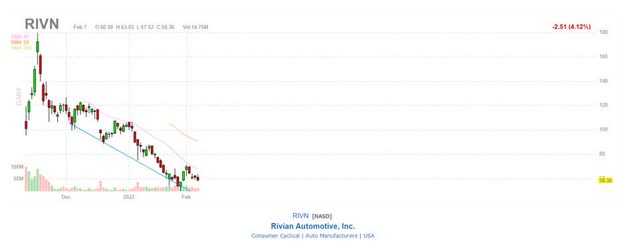

Rivian Automotive Inc.'s (RIVN) valuation has been significantly reduced in recent months. The stock is now trading 67% below its high and is on the verge of being oversold. Rivian Automotive is on track to deliver a significant number of electric-vehicles this decade, with excellent prospects for future growth. I believe the stock has fallen too far and now offers an appealing risk/reward ratio.

A Drop In High-Volume Stocks Creates An Opportunity To Purchase Rivian Automotive.

No matter which electric-vehicle manufacturer you look at right now, you will find a deeply discounted market price in comparison to the valuations we saw months ago. In 2021, electric-vehicle stocks, including Rivian Automotive's, skyrocketed due to growing investor interest in EV companies that promise phenomenal growth in deliveries and revenues.

Rivian Automotive's IPO in November 2021 was conducted at a price of $78. Only four months later, Rivian's stock is trading at a 25% discount to its IPO price. The stock has also fallen 44% since the beginning of 2022.

The question for investors, whether they are already invested or looking for an opportunity to get in, is whether Rivian's prospects for growth in the electric-vehicle industry have deteriorated or if the stock is simply the victim of a significant change in investors' risk tolerance with regard to high-multiple stocks.

Given how consistently the stock of Rivian Automotive has dropped since November, I believe the second factor is at work here. Rivian Automotive has been (and continues to be) a high-multiple stock in one of the fastest-growing industries today: electric vehicles.

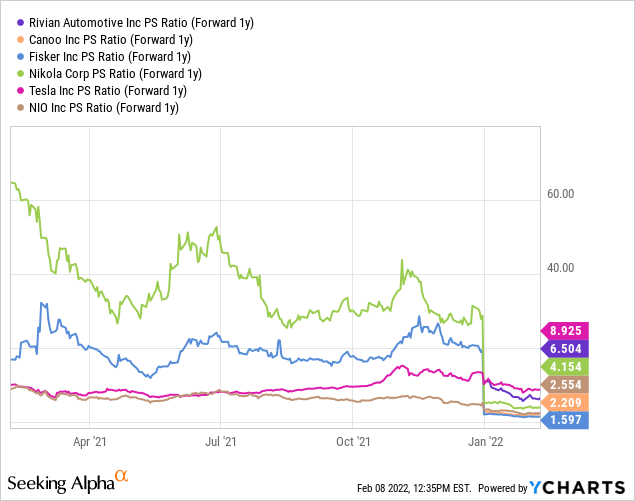

Rivian Automotive is not the only fast-growing company whose multiple has shrunk. We have seen a significant redistribution of investment funds in the stock market over the last four months, with investors exiting growth names and investing in value names. Many growth stocks, including Rivian Automotive, still have high multiples, but the EV maker's valuation has dropped so dramatically that it may now make sense to capitalize on the shakeout in the growth sector.

Well-Funded Balance Sheet Can Finance Production Growth For Many Years

The balance sheet is what differentiates Rivian Automotive from other EV companies. Rivian Automotive's shareholder structure includes cash-rich investors such as Amazon and Ford, which provided financial support as well as orders: Rivian has received an order from Amazon for 100,000 delivery vans for its commercial delivery fleet.

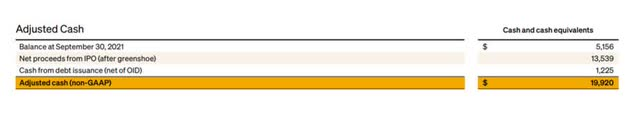

Rivian Automotive's cash reserves grew as a result of its initial public offering in 2021. The cash and cash equivalent position on Rivian's balance sheet, after adjusting for IPO proceeds, showed a balance of $19.9 billion. No other electric-vehicle manufacturer, in my opinion, has this much cash firepower available to expand production and deliveries. The adjusted cash position post-IPO represents 38% of Rivian's market capitalization.

This cash balance specifically benefits Rivian Automotive by allowing the company to finance its significant investments in production scale. Rivian Automotive will be able to scale faster than any other EV company. The company currently has a production capacity of 150K electric-vehicles, which includes all three major models, the R1T and R1S, which are based on the R1 platform, and the EDV 700, which is based on the RCV platform. Additional investments will be made in order to increase annual production capacity to 200K electric-vehicles by 2023.

Rivian's Financial Condition Is Going To Improve

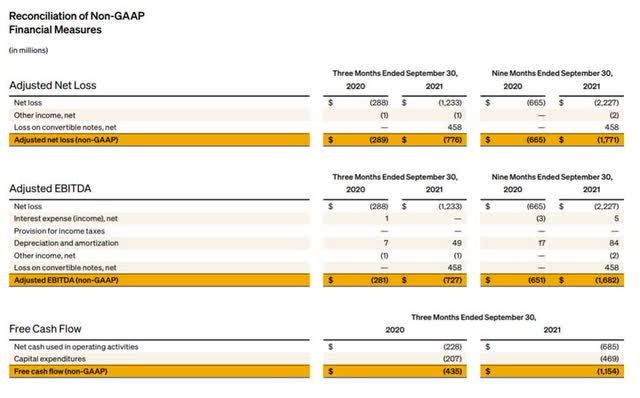

Rivian Automotive began making deliveries in the fourth quarter of last year. The absolute number of deliveries in 2021 is negligible, at around 1K. The financial situation reflects a company that is just getting started with its business model.

Rivian Automotive's adjusted net losses tripled to $1.8 billion from January to September, and adjusted EBITDA and Free Cash Flow were also negative, but the scaling of production and deliveries expected over the next two years will result in a much better-looking financial score card.

Diversified Electric-Vehicle Business Limits Company Risks

Rivian Automotive created three electric-vehicle models at the same time: the R1T, R1S, and EDV 700. The advantage of parallel development is that the company will attack three electric-vehicle segments at the same time. In my opinion, the EDV 700, which is based on Rivian Automotive's RCV platform and has been custom-designed for Amazon, is particularly promising.

The EDV 700 is a commercial delivery vehicle powered by batteries that can travel up to 201 miles on a single charge, according to internal testing using official EPA test procedures. Most EV companies are launching electric-vehicles in consumer markets, but not in commercial markets, which presents Rivian Automotive with an undervalued growth opportunity.

Rivian's EDV 700 commercial delivery van will compete with Ford's recently launched E-transit. Rivian Automotive's focus on the commercial van segment of the electric-vehicle market could prove to be a profitable strategic gamble, as the market is much less competitive than the truck and SUV consumer segments.

Rich Multiple Conforms To Growth Expectations

Rivian Automotive is expected to ramp up production quickly in 2022 and 2023. Rivian's EV sales are expected to skyrocket from $57 million in 2021 to $3.5 billion in 2022. Rivian Automotive could generate $7 billion in annual revenue from truck, SUV, and commercial van sales by 2023.

This growth potential translates to a sales multiple of 7, which is not an unusually high sales multiple in the electric-vehicle industry. Most multiples, including Rivian's, have dropped significantly in recent months, and the sales potential implied by the multiple now looks very appealing to me.

My Conclusion

Rivian Automotive has an excellent growth outlook, and the fact that Amazon and Ford have invested in the company strengthens the investment case even more. Amazon also ordered 100K delivery vehicles from Rivian Automotive, and sales projections will skyrocket once the electric-vehicle manufacturer begins scaling R1T, R1S, and EDV 700 deliveries.

Given the size of the cash balance in relation to Rivian's market capitalization, Rivian stock may now be considered inexpensive. As a result, the valuation cut represents a chance to double down.

Comments