Hong Kong stocks rose, extending last week’s gain, after Chinese regulators said they would support financing activities by property developers, adding to optimism about a stabilisation of economic growth.

The Hang Seng Index climbed 0.98 per cent to 17,625.83 just before 11am on Monday. The Hang Seng Tech Index also gained 1.21 per cent, while the Shanghai Composite Index retreated 0.2 per cent.

Developer Longfor Group advanced 1.9 per cent to HK$13.02 and China Resources Land gained 1 per cent to HK$29.30 after China’s financial regulators said that they would support property developers in receiving loans, issuing bonds and obtaining reasonable equity financing from capital markets.

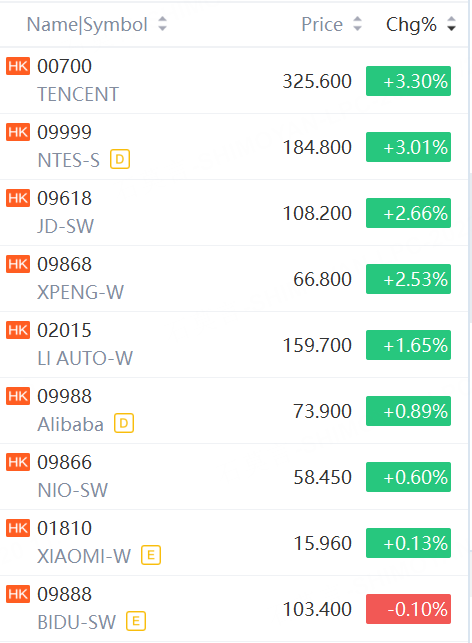

Alibaba Group, which owns this newspaper, rebounded 0.89 per cent to HK$73.9 after the office of founder Jack Ma said he remained positive about the company in a clarification of his shares disposal plan.

Limiting the gains, smartphone maker Xiaomi rose 0.13 per cent to HK$15.96 before its earnings release later on Monday.

The Hang Seng Index rallied 1.5 per cent last week as better-than-expected China economic data, a softening of US inflation. The gains were tempered by Alibaba’s decision to scrap the spin-off of its cloud computing business and founder Jack Ma’s share disposal plan.

Elsewhere on Monday, Chinese electric-vehicle maker Li Auto jumped 1.65 per cent to HK$159.70 and pharmaceutical company Wuxi Apptec advanced 2 per cent to HK$95 after Hang Seng Indexes said that the two stocks would j oin the city’s stock benchmark next month.

Some 28 companies that are components of the Hang Seng Index have released their third-quarter results, posting an average of 6.2 per cent year-on-year profit growth, according to Bloomberg data. That compares with a 7.7 per cent increase in first-half earnings.

Comments