- Tech stocks lead the decline as the Netherlands proposes curbing exports of machines that are critical to producing advanced chips

- The new rules add to investor concerns about China stepping up financial oversight and the Fed chairman’s warning of more policy tightening

The Hang Seng Index flattened. The Hang Seng Tech Index dropped 0.27 per cent.

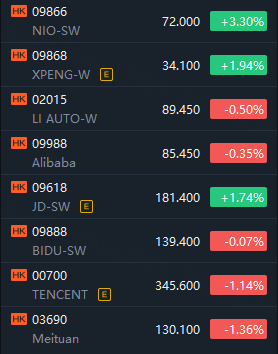

Alibaba Group Holding slipped 0.35 per cent to HK$85.45, and Tencent Holdings lost 1.14 per cent to HK$345.60. Meituan shed 1.36 per cent to HK$130.10. E-commerce giant JD.com added 1.74 per cent to HK$181.40 before the release of its results later on Thursday.

The Netherlands isproposing new rulesthat would curb exports of so-called immersion DUV lithography machines, which are critical to producing the world’s most advanced chips. The rules are expected before the summer, according to a letter sent by the minister of foreign trade to lawmakers on Wednesday.

The slide on Thursday follows a 2.4 per cent drop in the Hang Seng Index and a 3.2 per cent decline in the Hang Seng Tech Index on Wednesday, amid moves by China to strengthen its regulatory oversight of the financial markets and comments from Fed chair Jerome Powell that the US central bank could quicken rate increases as needed.

Three companies started trading on Thursday. Logory Logistics Technology, an operator of a digital freight platform, dropped 3.5 per cent to HK$2.80 in its debut in Hong Kong. Mloptic, a maker of optical components, surged 157 per cent to 178.12 yuan in Shanghai and Hangzhou Huasu Technology, which makes battery-management products, gained 38 per cent to 77.98 yuan in Shenzhen.

Other major Asian markets were mixed. Japan’s Nikkei 225 climbed 0.6 per cent, while South Korea’s Kospi retreated 0.2 per cent and Australia’s S&P/ASX 200 added 0.1 per cent.

Comments