Change is in the air – one that has not arrived for the last 14 years.

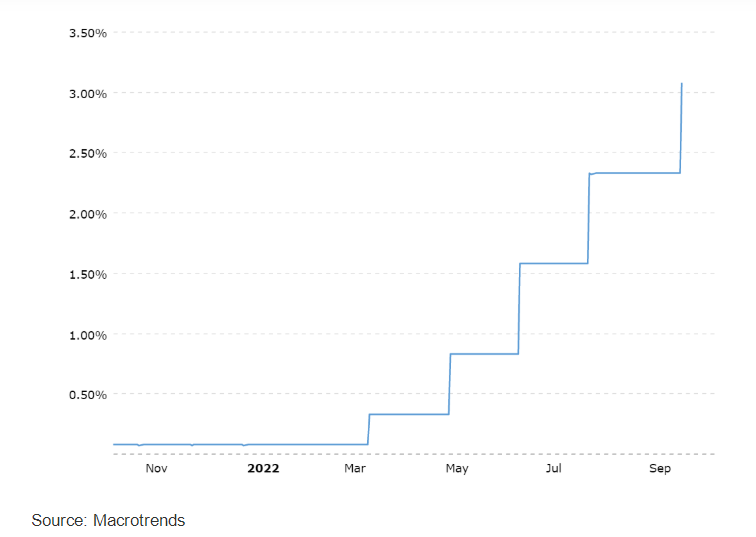

Yes, I am talking about how interest rates have surged in the last couple of months to levels not seen since 2008.

The cause of this change?

The US Federal Reserve as it stands determined to fight the highest inflation the US has witnessed in four decades.

The Federal Funds Rate was hovering at near-zero levels at the start of 2022 but has now been raised to the range of 3% to 3.25% in five consecutive increases.

Half a world away, Singapore banks are watching closely.

After all, banks are known to be sensitive to interest rates due to their lending activities.

How will these higher rates impact the three local lenders DBS Group(SGX: D05), United Overseas Bank Ltd(SGX: U11), or UOB, and OCBC Ltd(SGX: O39)?

Repricing their loans

Higher interest rates will allow all three banks to immediately re-price their loan offerings to higher rates..

The most obvious area where rates are increasing is housing loans, which the majority of homeowners are saddled with.

Back in late June, home loan rates were already hitting new highs as all three banks updated their home loan packages.

Two-year fixed-rate loan packages for UOB’ hit 2.98% while DBS raised the interest rate for its two-year fixed-rate loan package to 2.75%.

Then, just last week, both DBS and UOB announced that they were “reviewing” their fixed-rate home loans, with the latter pulling its two-year and three-year fixed rate packages from the market.

The implication here is that both banks are due to raise rates even higher as they incorporate the latest news of the Federal Reserve rate hike.

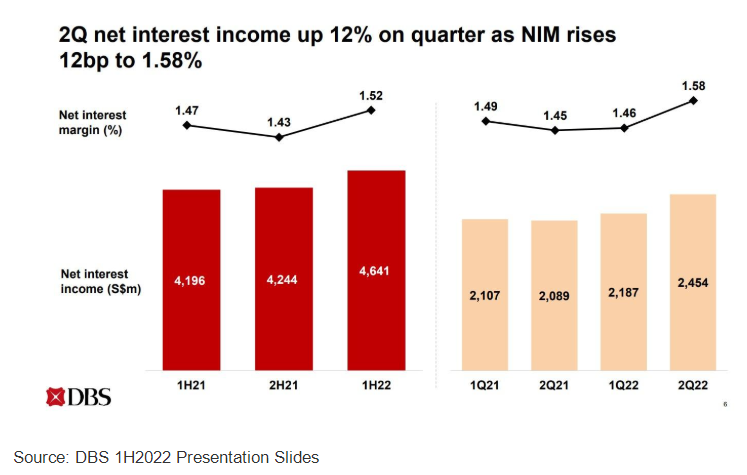

The result of all these moves should raise the net interest margins (NIM), and by extension, the net interest income, for all three lenders.

NIM had risen to 1.52% in 1H2022, up from the low of 1.43% in the second half of 2021.

For the second quarter of 2022, NIM hit 1.58% and was much higher than the previous quarter’s 1.46%.

In addition, CEO Piyush Gupta had also disclosed that July’s NIM was above 1.8%.

The implications are clear: the swift rise in rates will strongly boost NIMs and lift the net interest income for all three banks.

Is the Fed going overboard?

The Federal Reserve has strongly suggested that it’s not done yet with rate increases.

It foresees its policy rate rising faster than expected as it seeks to tame inflation and bring it back to the target 2% level.

New projections now forecast that the rate could hit the 4.25% to 4.5% range by year-end and hit the 4.5% to 4.75% level by the end of 2023.

Even at current interest rates, the US 30-year fixed-rate mortgages have risen to alarming levels, inching close to 6.3% recently, a 14-year high.

Should the policy rate rise further, there is a probability of the mortgage rate hitting the 7% mark in the US and for Singapore’s fixed-rate home loan to breach the 4% level.

While higher interest rates are good for their NIM, there are downsides to consider too.

A sharp slowdown may loom

Higher rates will not only cause more pain for homeowners who have to fork out higher interest payments.

Corporations also rely heavily on loans to fund projects and capital expenditures.

With higher loan rates, companies may pull back on their expansion plans and take on less debt, thus stunting the growth of the economy.

And with more people tightening their belts due to a mix of high inflation and more expensive loans, consumer demand may also plunge in tandem.

The result is that a recession may hit our shores and put many businesses in jeopardy.

Banks will have to contend with two negative impacts should an economic slowdown occur.

First, their loan growth will be impacted as fewer companies and individuals borrow.

Next, more loans may also turn sour as borrowers find it tougher to service their principal and interest payments, resulting in higher provisions and a larger non-performing loans (NPL) ratio.

Get Smart: The effects are uncertain

The above analysis shows that the effects of higher rates are uncertain for now.

While the banks may enjoy higher NIMs in the interim, there is a chance that the economy may dive if rates go too high.

Hence, investors need to be mindful of the pros and cons of higher interest rates and their effects on these financial institutions.

Comments