Ahead of the publication of his periodic long-term study which is coming out next week, Deutsche Bank's Jim Reid has shared some advance highlights including one remarkable chart.

Using 25 years of data for the US high yield market, Reid finds that the annual real return over the last quarter of a century has been 4.48% p.a. (6.75% p.a. nominal). Well, not any more: the index currently sports a nominal yield of just 3.87% and with headline CPI at 5.4%, Reid says that we are seeing anegative gap of -1.53% between the two - around 6% below the long run excess real return."This pretty much ensures that historical returns are absolutely no template for the future",according to the DB strategist.

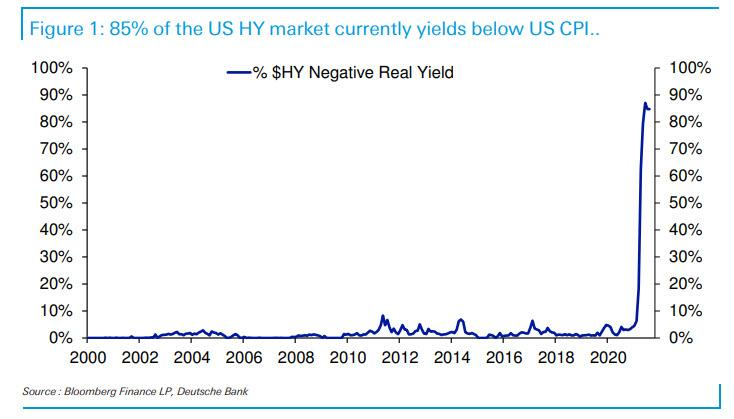

Reid then shares the following chart showing that a "stunning" 85% of the US HY market has a yield below the current rate of inflation. While that proportion has been elevated for a few months now ever since the advent of the Fed's covid response policy,it had never been above 10%, and rarely been much above zero. In fact, at the end of last year it was less than 4%.

While many expect CPI to start descending over the coming months, "it will likely stay elevated for many quarters to come" according to Reid, jeopardizing the Fed's "transitory" narrative. Yet even at 3%, CPI would still be above 35% of the US HY market by yield.

As Reid concludes, "Financial repression has indeed stretched a long way down the credit curve and you have to take more and more risk to beat inflation these days. Indeed the current yield on US single-Bs is 4.3% and on CCCs 7.1%."

Comments