Summary

- Nobody seems to be discussing some of the key positives in Palantir's Q2 earnings report.

- Palantir's shares are attractively valued in its peer group after the recent crash.

- Any weakness in its shares can be construed as a buying opportunity for investors with a long-term time horizon.

Profitability Green Shoots

One of the key items that triggered panic selling amongst Palantir's shareholders, was its negative bottom line. The company reported a net loss of $179.3 million during the quarter, or $0.09 per share, which left investors worried about the company’s breakeven point, especially during times of macroeconomic turmoil. Palantir has been operational as a company for over 18 years now and shareholders are losing trust in the management’s ability to turn a profit. While I understand the shareholder's frustration, the fact of the matter is that on the ground, reality isn’t all that bad.

See, Palantir’s net loss of$179.3 millionwas primarily driven by non-recurring "other expenses".

Other income (expense), net changed by $137.9 million for the three months ended June 30, 2022 compared to the same period in 2021 primarily due to unrealized and realized losses, net from our investments in marketable securities.

The company had invested in several early-stage growth companies, such as Celularity (CELU), Faraday Future (FFIE) and many other names. But since shares of these companies rapidly declined in value in recent months, Palantir booked these losses under its “other expenses” head. These other expenses were nearly 3-times the company’s actual operating losses, they bloated its overall net loss figure and most importantly, these expenses are non-recurring in nature.

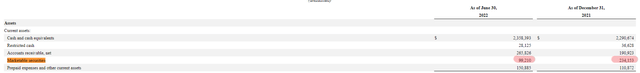

Palantir's 10Q Filing

An interesting picture comes to light when we focus on Palantir’s operating profitability. Surely, the company posted operating losses to the tune of $41.7 million, but this loss narrowed from $146.1 million on a year over year basis. On a per share basis, Palantir’s operating loss in Q2 amounted to $0.02 per share, narrowing from $0.08 last year. This improvement highlights that Palantir is making tangible and meaningful progress towards its path to profitability.

Palantir's 10Q filing

Also, Palantir held just $99.2 million worth of marketable securities at the end of the last quarter. This means the worst is almost over for the company and its path to profitability is getting clearer. Therefore, I expect Palantir to become profitable at an operating level sometime in FY23 and on net-basis in FY24/25. The company is debt-free and it held approximately $2.36 billion in cash and cash equivalents last quarter, which is sufficient to comfortably fund operations (and its growth initiatives) amidst these recessionary times.

Growth Resilience

Secondly, Palantir’s year-on-year revenue growth for Q2 amounted to nearly 26%. While this is a healthy pace of growth on a standalone basis, it’s significantly lower than management’s prior growth guidance of 30%. This growth deceleration has fuelled speculation of all kinds. While some bears believe the company has lost its customer appeal and is succumbing to competitive pressures, others feel that Palantir has hit a saturation point and is facing scalability issues.

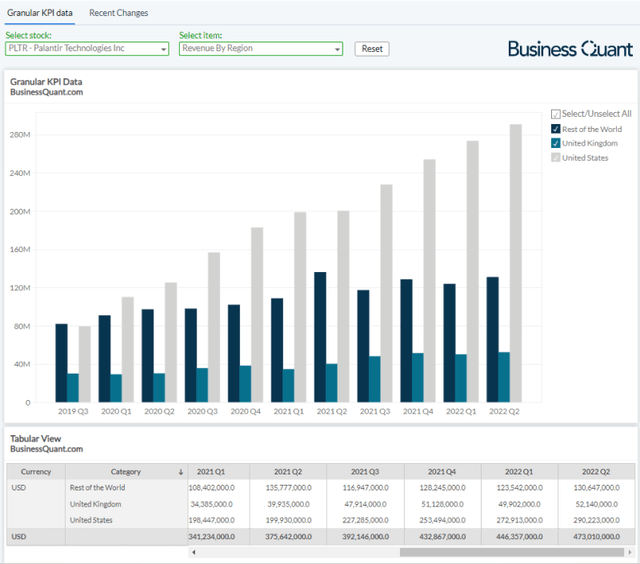

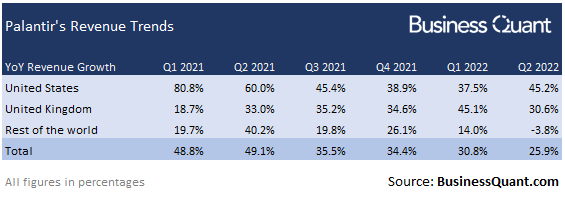

While these are legitimate concerns, I don’t necessarily share the same conclusion. The chart below highlights Palantir’s revenue across different geographies. Note how Palantir’s international segment performed poorly and dragged the overall company’s growth lower. But the interesting piece of information here is that Palantir’s revenue growth from the US actually accelerated during the quarter.

BusinessQuant.com

This is rather counterintuitive considering that the Fed has been aggressively hiking interest rates and enterprises have had to cut back on discretionary spending. Although European and Asian economies have also hiked interest rates, their pace of rate hikes hasn’t been as aggressive. If anything, I would have expected Palantir’s growth momentum to slow down in the US before international markets. But clearly that wasn’t the case.

BusinessQuant.com

Having said that, if Palantir was truly losing market share to its peers and/or was bottlenecked with customer onboarding, its sales growth should’ve decelerated across all geographical markets. Rather, its sales growth acceleration in the US suggests that the company is still growing well and its platforms remain a value proposition to its customers.

Therefore, I contend that Palantir’s revenue growth moderation is a seasonal factor persisting largely in international markets.

Valuation Absurdity

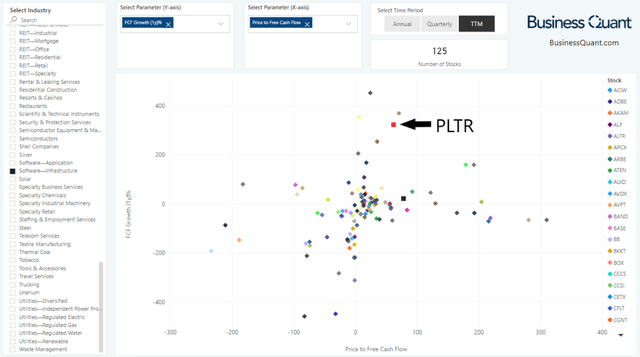

Moving on, bears argue that Palantir’s shares are grossly overvalued and overdue for correction. Its shares are, after all, trading at nearly 63-times its trailing twelve-month free cash flows, which seems quite high at the first glance. But let’s look at the chart below to get a better sense of its valuation.

The X-axis highlights Price-to-Free Cash Flow (or P/FCF) multiple for 130 stocks classified under the software infrastructure industry. Note how Palantir is horizontally positioned slightly towards the right, indicating that it's trading at a modest premium compared to a broad swath of its peers.

BusinessQuant.com

Now, let’s shift attention to the Y-axis, which plots the free cash flow growth for the same set of companies. Note how Palantir is vertically positioned much higher than most of its peers, indicating that its pace of free cash flow growth is one of the highest in its industry.

The takeaway from both the axes, combined here, is that Palantir’s relatively higher valuation is justified by its elevated pace of growth. Essentially, investors are paying a premium to own this rapidly growing company. There are just two other stocks that are growing faster than Palantir but trading at a lower P/FCF multiple, however.

Final Thoughts

There’s no denying that Palantir is trading at a premium compared to its peers, and its growth moderation resulted in its sell-off. But I think of this as a temporary setback. The stock is attractively priced in its industry after its recent price correction, green shoots are emerging with regards to its profitability and its pace of revenue growth is robust in the US market at least. So, investors with a multi-year time horizon may want to consider accumulating Palantir’s shares on potential price corrections. Good Luck!

Comments