Summary

- Nvidia is scheduled to report its Q1 FY23 results on May 25.

- Its revenue is likely to amount to $8.05 billion, up 42% year-over-year.

- But Nvidia's management may issue a conservative guidance in light of worsening chip shortages.

NVIDIA Corporation (NASDAQ:NVDA) is slated to release its Q1 FY23resultsnext week on May 25. Investors would be curious to see if the chipmaker can continue on with its streak of revenue outperformance this time as well, amidst a challenging supply chain environment. But in addition to tracking its revenue figure, investors may also want to monitor its purchase obligations, its segment financials, its management's remarks around their supply situation and their outlook for Q2. These items will highlight Nvidia's near-term prospects and are likely to have a bearing on where its shares head next. Let's take a closer look.

Gauging the Supply Situation

Let me start by saying that Nvidia's management has done a terrific job at growing their business rapidly in the last decade. They've successfully tapped pockets of growth within the consumer and enterprise computing space, far before their peers, which has been the main driver for its consistent growth. To put things in perspective, its revenue has risen sequentially in 11 of its last 12 quarters. This is a commendable feat and an enviable position to be in.

Having said that, Nvidia's growth momentum could temporarily slow down in Q1. I say this because China imposed strict COVID-19-related lockdowns in the first half of April, which has worsened chip shortages globally. It's gotten to a point where companies are stripping washing machines for semiconductor chips and/or foregoing installing infotainment functionality in cars. Nvidia's Q1 typically ends in the first week of May or in the last week of April, which means that it may have borne the brunt of these shortages for a good 3 weeks at least and its revenue for the period may have taken a hit.

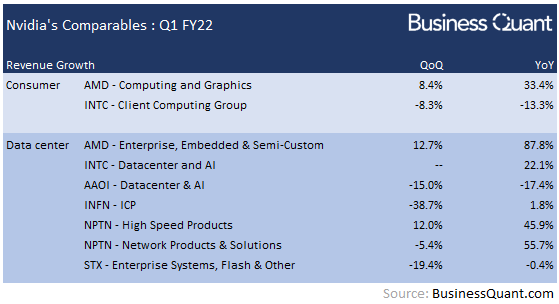

One might argue that the chipmaker's peers, Intel (INTC) and Advanced Micro Devices (AMD), did not report any such supply disruptions in their Q1 results, and, so, Nvidia will also be unfazed. However, that isn't necessarily a given, considering that both AMD and Intel closed their quarters within March, well before China imposed widespread lockdowns. So, the first order of business for readers should be to listen to Nvidia management's remarks on how adversely has their business been affected by these lockdowns and chip shortages.

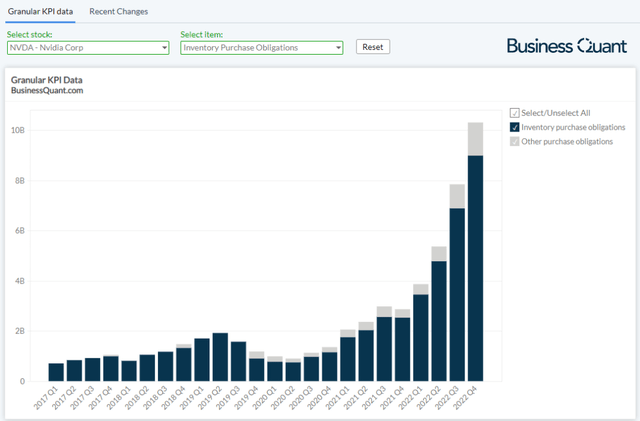

If Nvidia's management doesn't provide clarity around their supply situation, then fret not. We'll have a data point to rely upon, called "inventory purchase obligations," which can act as a proxy for management's outlook. It's basically the total dollar-amount that the chipmaker has committed, for purchasing inventory from its vendors, suppliers and channel partners. Companies typically book inventories by forecasting their demand-supply trends.

BusinessQuant.com

If the figure is flat sequentially, then it would suggest that Nvidia isn't experiencing any major supply setbacks and that it is business as usual. On the other hand, a dramatic buildup in its purchase obligations would imply that Nvidia is experiencing strong customer demand and/or that it's rushing to book inventories amidst intensifying chip shortages. So, make sure to also monitor Nvidia's purchase obligations in its upcoming Q1 earnings report.

With that said, let's now shift attention to financial expectations from Nvidia's Q1 earnings report.

Financial Breakdown

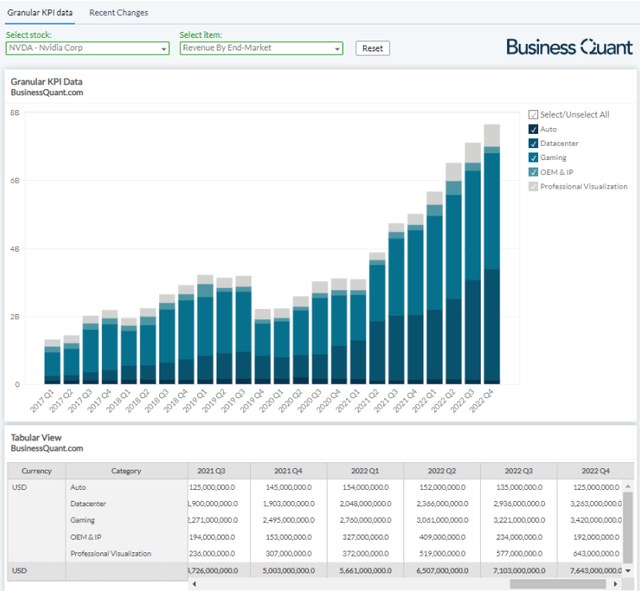

It's worth noting that Nvidia generates its revenue from five end-markets namely, data center, gaming, OEM & IP, automotive and professional visualization. Amongst these, the bulk of its revenue (44.7% in Q4 FY22) comes from its gaming-related SKUs.

BusinessQuant.com

Nvidia's gaming market is seeing a few trends of its own:

- The recent selloff in cryptocurrencies makes crypto mining less lucrative and is likely to reduce the demand for GPUs;

- ASPs for all GPUs, be it Nvidia or AMD, has declined during the quarter and approached their MSRP-levels;

- The declined prices and heightened availability of stocks should, ideally, boost the demand from the PC builder's segment;

- There may be supply-side constraints given China's strict COVID-19 lockdowns that were recently imposed.

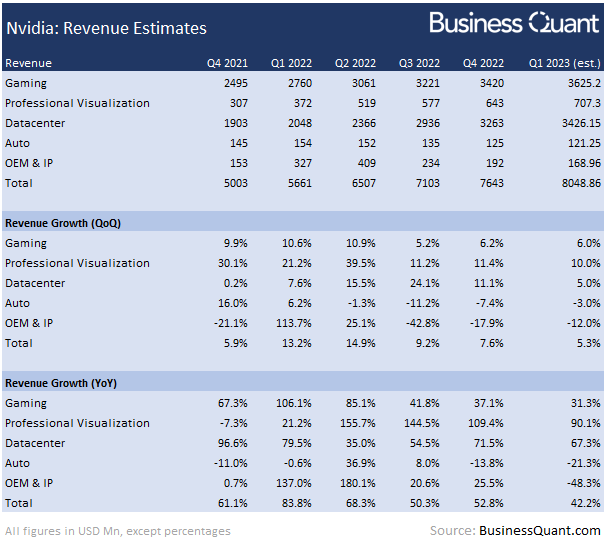

So, while I'm bullish on Nvidia's gaming business over the longer run, I contend that its growth momentum is likely to take a breather in Q1 and in Q2. I expect its gaming revenue growth to slow down to around 6% sequentially, and estimate it to post revenue of $3.62 billion in the said quarter.

Moving on, Nvidia's data center business is its second-largest breadwinner, and it accounted for roughly 43% of the chipmaker's total revenue last quarter. The vertical has performed really well in the past few years, posting sequential revenue growth in each of its last 12 quarters.

Having said that, enterprise sales were subdued during the quarter, at least for other chipmakers that cater to an identical set of customers. So, due to this channel seasonality, I expect Nvidia's data center revenue to remain under pressure during Q1. I believe the division's sequential revenue growth will simmer down to mid single digits (~5%) in its upcoming earnings report and that its actual revenue figure will hover around $3.46 billion.

BusinessQuant.com

Its professional visualization revenue seems poised grow 10% sequentially due to improving pricing and volume mix. However, its automotive and OEM/IP revenue streams don't have any material catalysts to reverse or stabilize the ongoing decline in their revenue. So, I expect these verticals to, once again, report revenue declines in Q1, albeit at lower rates compared to prior quarters.

This brings us to a company-wide revenue estimate of $8.05 billion. Interestingly, my estimate happens to be in-line with the Street'sestimatesthat currently span from $8.01 billion and $8.33 billion.

BusinessQuant.com

But with that said, also pay close attention to Nvidia management's revenue outlook for Q2 and for the rest of the year. If its supply situation actually deteriorated due to lockdowns in China, then the chipmaker's top brass is likely to issue a rather conservative guidance for the foreseeable future.

Final Thoughts

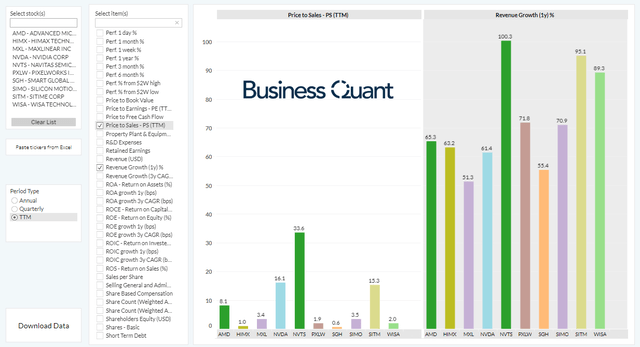

There's no denying that Nvidia is a rapidly growing company and a technology leader in its space. However, the stock is trading at a significantly higher Price-to-Sales (or P/S) multiple when compared to some of the other rapidly-growing semiconductor companies, suggesting that this might not yet be the ideal time for bottom-fishing.

BusinessQuant.com

Comments