Alphabet (GOOG) peaked earlier last month at over $127, but now it's off 2.72% at $116.87 on Monday, July 10. This makes GOOG stock appear to be cheap to some investors.

One reason is GOOG stock is still trading below its average earnings valuation metrics.

Valuation Metrics

According to Yahoo! Finance GOOG stock still trades for just 22.4x forward earnings. Compared to the historical average forward P/E of 25.17x, according to Morningstar, this implies GOOG stock is too cheap.

In fact, it implies that the stock could rise by over 12%. This is because the 25.17x average multiple is 12.3% higher than its existing P/E multiple of 22.4x. As a result, a good target price for GOOG stock is $133.23 (i.e., $118.64 x 1.123).

Short Put Trade Strategy Makes Sense

As a result, traders who short out-of-the-money (OTM) puts can make good income here. In fact, this strategy worked in our last article from June 13, “Alphabet Stock Is Powering Higher, But Is Still Cheap Based On Historical Metrics.”

For example, we discussed not only how GOOG stock was trading below its average P/E (price-to-earnings) multiples, but also suggested shorting OTM puts expiring on July 7.

We recommended shorting the $119.00 strike price which was 4.75% below the spot price with 24 days to go before expiration.

The premium received at the time was 97 cents, giving the OTM short-put trader an immediate yield of 0.815%. Since GOOG stock closed on July 7 at $120.14, those puts expired worthless. That means the OTM short put trader made money, even though GOOG stock fell over that period.

Traders can repeat that strategy again and likely still make good money.

Shorting OTM GOOG Puts

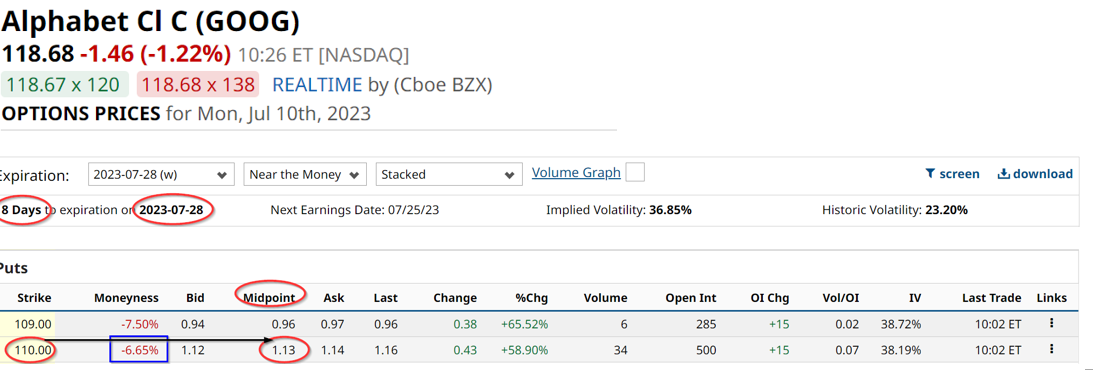

For example, for the July 28 expiration period, put premiums for the $110 strike price are attractive. That strike price is over 6,6% below today's price. The premium is $1.13, which provides an immediate yield to the short put trader of 1.027% (i.e., $1.13/$110.00).

If this can be repeated each month for a year, the annualized return will be 12.3% (i.e., $1.027% x 12 = 12.3%).

In fact, since this trade is only 3 weeks to expiration, the annualized return will be higher at 17.5%. That is because there are 17 periods of 3 weeks in a year, so the annualized return is 17x 1.027%, or 17.5%.

Here is how this strategy can be practically done by investors. First, put $11,000 in a brokerage firm and get approval to do short-put option trades. Then you can enter an order to “Sell to Open” 1 put contract at the $110 strike price.

This is because $110 x 100 shares equals $11,000, so the potential exercise of the put contract is fully “covered.”

The account will then immediately receive $113 (i.e., $1.13 x 100 shares per put contract). That is why the immediate yield is 1.03% since $113/$11,000 equal 1.027%.

This shows that investors can still make good money in GOOG stock even though it has been weak lately.

Comments