Upgrade to neutral by Wedbush's Michael Pachter comes after stock loses half its value in 4 months to reach his price target

Shares of Netflix Inc. bounced off a two-year low Wednesday, after prices have tumbled far enough to prompt a long-term bearish analyst to upgrade the streaming video services company.

The stock charged up 5% on Wednesday, after falling 13.4% amid a six-day losing streak through Tuesday. The stock closed Tuesday at $341.76, the lowest close since March 20, 2020, and 50.6% below its Nov. 17, 2021 record closing price of $691.69.

In a research note with "Hell Freezes Over" in its title, Wedbush analyst Michael Pachter raised his rating on Netflix to neutral, after being at underperform for at least the past three years. He said the upgrade comes after the stock fell to reach his price target of $342, which he's had since April 2021.

"The recent share price decline reflects that Netflix investors have begun to appreciate that the company's long-term prognosis is as a low growth, extremely profitable enterprise," Pachter wrote in his note to clients.

He said Netflix has appeared to "hit a ceiling" on subscribers in the U.S. and Canada (UCAN), the company's most important region, and has been pulling new levers in an attempt to hold on to existing customers as subscription price hikes kick in. Meanwhile, countries in other regions with relatively lower economic growth per capita were still showing subscriber growth.

The company's price increases announced in January in UCAN, a region with relatively higher economic growth per capita and above-median income subscribers, was needed to offset rising content costs.

"Netflix is 'soaking' its highest revenue subscribers to fund future growth overseas, suggesting the UCAN market is relatively price inelastic, while the other regions may be more price sensitive," Pachter wrote.

Pachter's upgrade leaves only 3 of the 46 analysts surveyed by FactSet in the bearish camp, while 24 are bullish and 19 are neutral on the stock. The average price target is $509.60, which implies about 49% upside from Tuesday's close.

While Pachter is neutral on Netflix, given near-term valuation concerns, he is bullish on the company's long-term prospects.

"While we do not anticipate significant share price appreciation in the near term, Netflix's first-mover advantage and large subscriber base provides the company with a nearly insurmountable competitive advantage over its streaming peers," Pachter wrote.

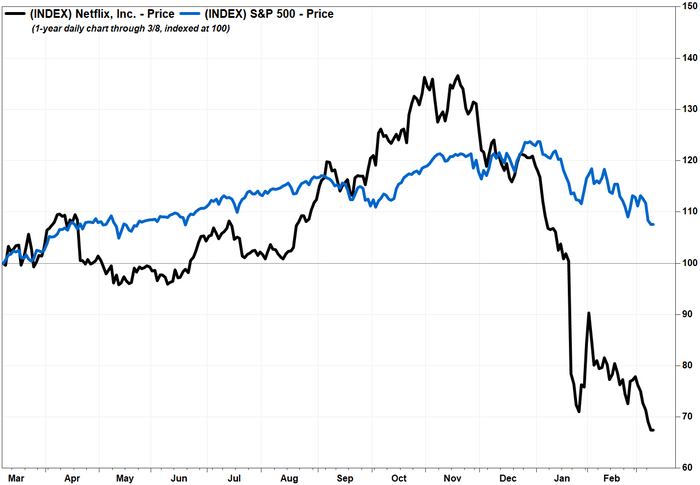

Netflix shares have dropped 28.9% over the past 12 months, while the S&P 500 index has gained 9.9%.

Comments