Investors 'feel a credible Fed is a strong Fed': analyst

A brief wobble aside, the U.S. stock market is taking Federal Reserve Chairman Jerome Powell's decision to fully unleash the inflation-fighting side of his monetary policy persona in stride.

That may be a surprise to some investors as Treasury yields soar and money-market participants price in an aggressive round of benchmark interest rate increases after Powell on Monday made clear the Fed is ready to deliver 50 basis point rate hikes, something it hasn't done since 2000, in coming policy meetings if necessary to fight inflation.

"The equity rally is of clear interest, and we see in the [Nasdaq-100] that there is solid support below 14,000" even as the U.S. 10-year Treasury yield continues to surge well above 2% and threatens to break its multidecade downtrend, said Chris Weston, head of research at Australia-based Pepperstone, in a note to clients.

"We should consider why equities didn't get smoked," Weston said.

For his part, Weston argued that the fact the Fed is potentially "bringing out the big guns in May and using forward guidance to set the scene ahead of this may be welcomed by the equity market -- they've weighed up the outlook and feel a credible Fed is a strong Fed, and higher rates are better than entrenched inflation."

The Nasdaq-100 rose 1.9%, while the also tech-heavy Nasdaq Composite finished 2% higher. Technology and growth stocks are seen as the most sensitive to rising Treasury yields, which lessens the present value of their future earnings and cash flow and which is used to justify their high stock prices. The Nasdaq, however, already slumped into a bear market earlier this month, falling more than 20% from its November record close.

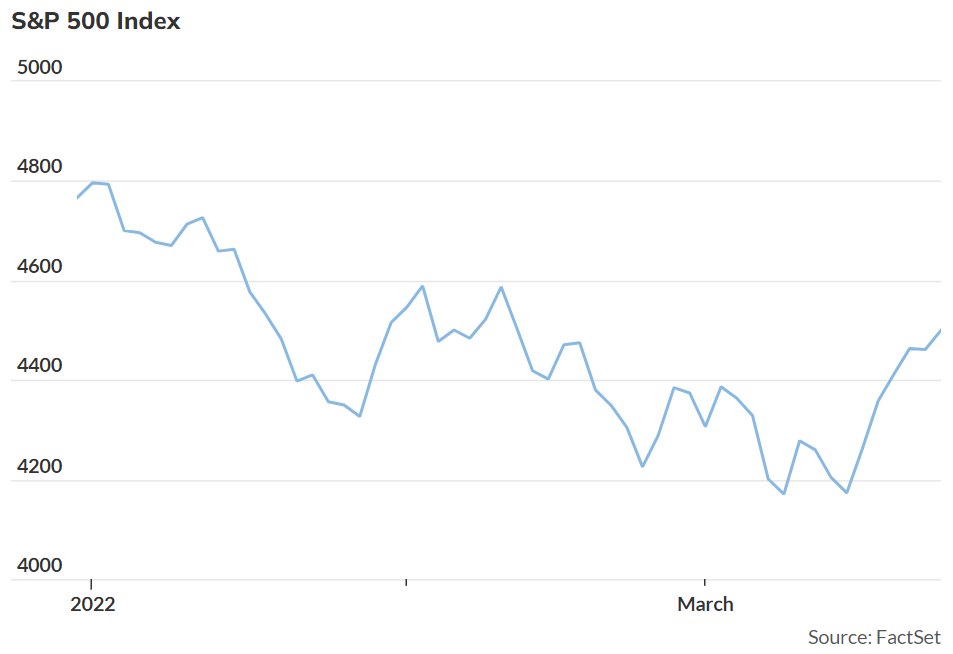

However, stocks have bounced significantly since the Fed last week kicked off the rate-hike cycle with a 25 basis point increase to the fed-funds rate and signaled substantial monetary tightening is yet to come. Stock indexes are now also trading above levels seen ahead of Russia's Feb. 24 invasion of Ukraine.

The Dow Jones Industrial Average rose around 255 points, or 0.7%, on Tuesday. The S&P 500 gained 1.1%, with the large-cap benchmark posting its highest close since Feb. 9.

It's important to remember the S&P 500 index had pulled back nearly 15% through the Feb. 24 low, which means "a lot of bad news was priced in," and which means the risk/reward outlook has improved since the beginning of 2022, said Tom Lee, founder of Fundstrat Global Advisors. in a note.

The current market environment, however, is one in which investors shouldn't attempt to "be a hero" or make a "big call," he said, with markets likely to remain volatile.

Pepperstone's Weston noted that the Russia-Ukraine war has served to stoke inflation worries as crude oil and other commodity prices have surged in volatile trading. While that's translated into periods of rough sledding for equities, it appears that funds are "well hedged, there's tons of cash on the sidelines, and rotation is real," he said, with traders moving into energy stocks as crude soars and increasing defensive positioning in sectors like utilities.

Comments