Palantir Technologies (NYSE:PLTR) is scheduled to announce Q1 earnings results on Monday, May 9th, before market open.

The consensus EPS Estimate is $0.04 (flat Y/Y) and the consensus Revenue Estimate is $443.51M (+30.1% Y/Y).

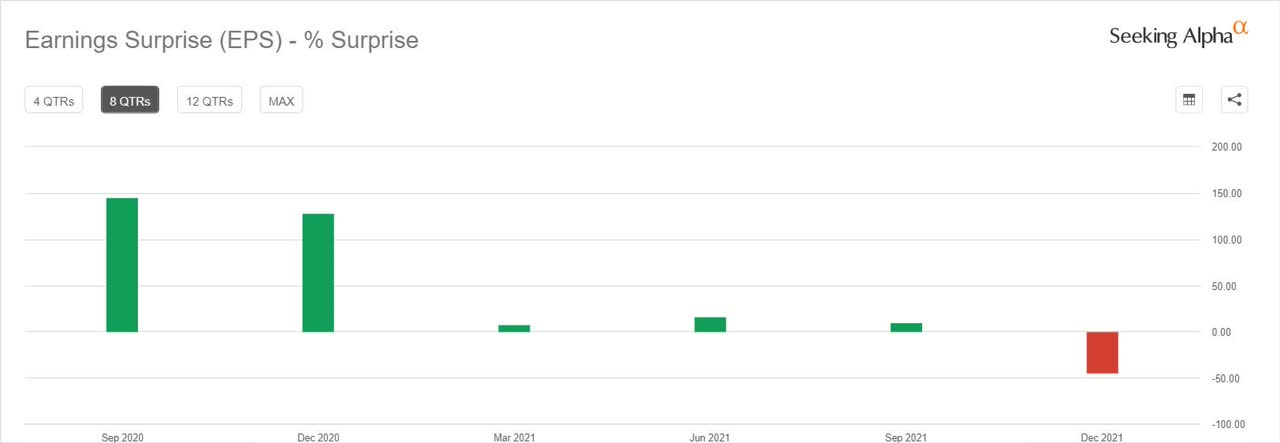

The data analytics software company posted mixed Q4 results with earnings falling short of Wall Street's expectations.

During Q4, Palantir (PLTR) said it signed 34 net new customers and closed 64 deals worth $1 million or more, including 19 worth more than $10 million. For Q1, it expects to generate $443 million, compared to expectations of $439.6 million, with adjusted operating margin of 27%.

Piper Sandler recently raised its price target on the company, noting it should see growth in its U.S. government business. Palantir "has gained traction with agencies beyond Defense, such as the [Department of Veterans Affairs] and [Department of Energy], which could provide it with ongoing upside" according to the analyst.

During the latest quarter Palantir (PLTR) won a $5.3M contract from the Centers for Disease Control and Prevention (CDC) for expanding its role as a partner in the federal COVID-19 response by supporting key distribution and supply-chain efforts. It also signed a collaboration with Jacobs (J) to introduce and commercialize a joint data analytics solution for water infrastructure.

Palantir signed on IT solutions provider Carahsoft Technology as its U.S. Federal Distributor under a new channel partner program. Earlier in April it bagged an extension and expansion of its work with the CDC "through the outbreak response and disease surveillance solution for the Data Collation and Integration for Public Health Event Response Program."

Piper Sandler had started coverage on Palantir in March, noting the Ukraine war could accelerate adoption. RBC also cited the war as a reason for its upgrade, suggesting that it will give a boost to government spending on cybersecurity.

Morgan Stanley upgraded the company too, but said it is "awaiting more visibility of positive catalysts around a durable government business and yields on recent investments in commercial."

SA contributors have been largely bullish on Palantir, with exponential levers driving growth according to one analysis, and impending net income profitability according to another.

Over the last 1 year, PLTR has beaten EPS estimates 75% of the time and has beaten revenue estimates 100% of the time.

Over the last 3 months, EPS estimates have seen 0 upward revisions and 4 downward. Revenue estimates have seen 4 upward revisions and 1 downward.

Comments