Netflix Inc. (NASDAQ:NFLX) has a had a turbulent 2022; the company reported its first subscriber loss in 10 years and investors simply abandoned the stock to make it one of the worst S&P 500 performers so far. Despite falling more than 70% from the high, questions remain over whether the company can return to growth again. I believe that those fears are justified over an 18-24 months time frame, but investors with a longer time horizon would benefit from buying the stock now as the company is likely to continue adding subscribers, and analysts have completely ignored the potential for ARPU expansion as Netflix grows its non-streaming verticals.

The Streaming Business

The streaming market is far from saturated. You hear a lot of analysts saying Netflix will not add subscribers anymore. Note that such remarks are contrary to what management say. I think most would agree that it is not a wild claim to suggest that all TV viewing will move to the internet in the future. This may take 5 years, or 20 years, but eventually it will happen. There are currently almost 2 billion TV households in the world. Out of them 378 million are in China, let's call it 400 million. So that means the market opportunity today is almost 1.6 billion households. Netflix has 222 million of them, and another 100 they are trying to add by charging a fee on password sharing. So there are still more than 1.3 billion that are untouched, and you get a free option on China opening its 400 million TV household market to foreign streamers. That sounds like a big growth opportunity to me. It might not materialize over the coming 24 months and certainly no single streamer will ever penetrate all 1.6 billion homes, but investors who are able to look past short-term concerns over subscriber adds will be rewarded in my view.

Future subscribers will come with a higher margin profile than in the past 10 years. As Netflix increases its foreign mix of originals, its margins will improve. A Korean show for example is cheaper to make than an American one, but all customers will pay in Dollars. Sure, non-US customers pay lower subscriptions, but not that much lower.

Something else many miss about Netflix originals is that the level of hits the company produces is not as low as many believe. Netflix has only been leaning heavily into originals since 2016, that's only six years ago. They still managed to make the most successful show in history and produce multiple hits in those six years (The Crown, La Casa De Papel, Stranger Things, Ozark, Squid Games, Emily in Paris, The Queen's Gambit, Bird Box, 13 Reasons Why, should I go on?).

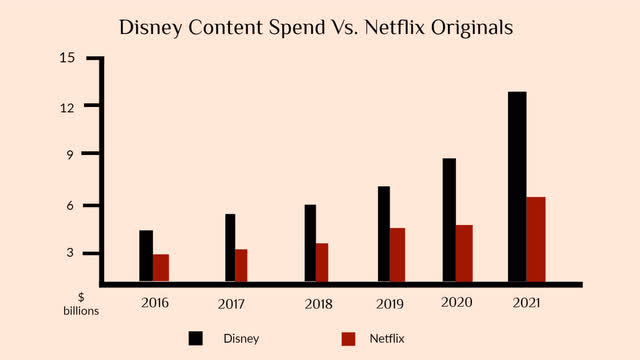

Other critics will say sure Netflix did manage to make hits, but not enough compared to the amount they spent on content. Again, that's not true. The majority of Netflix' content spend is on licensing content. Its only between 15-40% of the content budget that goes towards making original shows and movies. So sure, if the company spent $70 billion on original content since 2016 to make those hits then that's bad. But if the number is actually $22 billion then that's really impressive, simply because The Walt Disney Company (DIS) will spend more in 2022 than Netflix spent over the past six years combined on making original content. I am almost certain that the number of hits Disney makes this year will not come even close to matching what Netflix produced over the past six.

Disney spend is much higher than investment in Netflix Originals (Image created by author using regulatory filings for Disney and Netflix)

Then there is password sharing. The current experiment is to charge customers a few extra dollars for sharing the account with additional households. Sure some will choose not to continue subscribing, but others will pay that extra amount. Management has been focused on this issue way before they started losing subscribers by the way.

Netflix isn't just a streaming company

The shock of subscriber losses have diverted attention away from all the efforts management is making to enter new ventures. Gaming is one of the most covered developments to the company's product. I discussed in my other article why gaming is very important to media companies. For Netflix, introducing gaming, would increase engagement and lower churn, which is the recipe for higher ARPU. Here is Netflix COO Greg Peters on price increases:

Mostly, we're listening to our members and sort of iteratively doing this walk where the metrics that we see in terms of engagement and churn and acquisition and those kind of things are really our signal that we've done a good job at sort of creating this more value and it's the right time to ask for a little bit more to keep that going.

If a customer can play a Stranger Things game after season 4, or play chess against Beth Harmon after finishing the Queen's Gambit, then they would spend more time on the service. That higher level of engagement means less churn, and potentially higher subscription prices down the line.

Another criticism aimed at Netflix is that it doesn't have the diversified revenue streams like legacy media. Those have advertising, theme parks, theatrical releases, and consumer products among others. But just because Netflix doesn't have that now does not mean they will not build those businesses in the future. Read Reed Hastings comment in 2021 Q3 earnings call:

And then, of course, you've got your off Netflix aspects, the experiences that we're building out, consumer products, all of that coming together. So Company like Disney is still ahead of us in some of those dimensions of putting that whole experience together. But we're making progress, and it's so exciting over the next 3 to 5 years, kind of closing that gap and hopes to pass them on that spectacular all-around experience.

In 2020, Netflix hired Josh Simon as the new VP for Consumer Products. They recruited him from Nike where he was Head of Global Strategy for Product, Design, Merchandising and Categories. In those two turbulent years, Netflix signed multiple partnerships with retailers such as Walmart Inc. (WMT). It also launched its own e-commerce store. Sure all this counts for nothing now, but why have it been counted it for nothing forever?

Here is a quote from a Netflix job posting for a marketing manager:

Netflix is pursuing consumer products because we believe it will drive meaningful show awareness/buzz with more tangible, curated ways to interact with our most popular content and in effect, drive long-term revenue.

Someday, Netflix will cross-sell its online shop to its streaming subscribers. If the 1% super fans of the subscriber base buy a $50 item a year, Netflix will have $100 million business. Through hard work they can increase the customer penetration to 10% and sales to $100 a customer per year and suddenly they have a $2 billion business, or 7% of current sales. It's being open to these kinds of overlooked possibilities that help investors make big returns.

Netflix has additional business verticals it can expand to in addition to commerce. This year, the company organized the Netflix is a Joke comedy festival. The estimate is that 250,000 people attended the 11-day event. I don't know how many actually attended and there is no way to know. What I do know is festivals are not small businesses; Coachella for example brings in hundreds of millions in economic activity. Can Netflix make its comedy festival an annual thing? sure. Can it become massive and create hundreds of millions in economic activity? may be. Will Netflix participate in that economic activity through ticket sales? possibly. Would they stick a couple of merch stands and sell even more consumer products during those events? hopefully. Is any of this priced into the stock? definitely not. What we also know is that Netflix will release some of the stand up performances from the festival to its subscribers to stream. That means the company is getting paid to produce content, or at least that the subscription business is subsidizing its nascent experiences business.

Add to that the ad-supported tier, which I don't like that much but think it will be priced-in higher than analysts' projected $6 a month. I don't have all the data to back my statement yet, but the logic of the math is you want a tier that entices high-churn/non-subscribers to subscribe while simultaneously avoiding the cannibalization of the $20 a month subscription business. That seems hard to do. But even if I don't like the ad-supported tier, it is likely to increase the number of subscribers and may be ARPU as well in some regions.

Valuation

The factors I consider in valuing any business are its return on equity, its market structure and competitive advantages that would help it maintain or improve its ROE, it's price to book multiple, and its potential to grow book value.

Netflix has higher ROE than the average S&P 500 company. Its large spending on streaming content creates some barriers to entry as it rules out many potential competitors. This suggests that it would be able to maintain a higher than average ROE in the long-run and earn a higher P/B than the average S&P 500 company. However, Netflix has low switching costs, since customers can cancel anytime. The company also has plenty of substitutes like TikTok, YouTube, and video games among other things. As a result, the current average S&P 500 multiple of 3.9x book value seems fair.

The company has currently a book value of $38.7, so 38.7 * 3.9 = $150.93 a share. Netflix is growing Book Value by $11 a share every year based on its TTM earnings. The article tried to make the case why the company will be able to add subscribers and expand margin in the long-run, meaning the company is likely to continue earning at least $11 in the long-run. This implies the company would more than double its book value four years from now to $82.7 a share. Assuming the S&P 500 maintains its P/B multiple then the stock could go to $320 (almost 15% CAGR in nominal terms based on June 6 closing price). Each investor should apply their own discount rate to get the present value of the shares. I'll leave the process of determining the appropriate discount rate to the reader. I will only note that Netflix' debt trades at a 4% yield, so equity investors would likely want to get a higher reward than their debt counterparts.

An important subject every investor should ponder when valuing Netflix is the company's amortization of content costs. The estimation of this cost has enormous consequences for the company's profit. Currently, Netflix amortizes 90% of its content costs over four years. This estimate is in line with GAAP accounting principles and is fair in my opinion. Other investors might feel that the life of the content produced does not merit an amortization period of four years or that the fraction of content amortized over four years should be lower. Investors who hold that opinion should adjust the company's EPS numbers accordingly.

Risks

The biggest risk currently not priced into NFLX is the sharp rise in the dollar that took place during Q2 of 2022. That increase means that Netflix will almost certainly miss its numbers due to FX. It might also put pressure on many of its consumers in emerging markets, potentially accelerating subscriber losses to more than the 2 million forecast.

A further increase in yields could suppress stock valuations and lead to further stock price declines. Persistent high levels of inflation could affect the health of the consumer, leading to higher churn levels. Ironically, there is also the risk that interest rates and inflation have hit a peak. If rates on the 10-year or inflation start declining, then Netflix stock will almost surely move sharply higher and the valuation provided in this article will prove to be too conservative. However, these risks are cyclical in nature and the company could ride them out.

More structurally, it is possible that subscription to streaming services is hit-driven and that the low switching costs will mean it will be difficult for any streamer to hold onto their acquired customers. Additionally, Netflix' form of entertainment so far is heavily linked to streaming, and any technological changes in entertainment (such as advances in AR/VR) could be more detrimental to Netflix than its peers.

Management may also fail to expand into those other verticals mentioned in this article.

Conclusion

Netflix stock was dumped in 2022 as investors panicked over growing risks, but the company has more opportunities than challenges over the next 5 years. Investors who look past the volatility of the next 18-24 months might end up owning a media tech company with diversified revenue streams from streaming, advertising, commerce, and experiences. Those opportunities do not mean however that the stock wont trade lower in the coming months, as it seems susceptible to higher interest rates. Investors must proceed with caution.

Comments