Investors are looking ahead to 2023—and with a cautious eye. Inflation is still mighty high and coming down exceedingly slowly, despite signs that it has peaked. Interest rates are climbing, and Fed officials promise to hold them steady for some time. The result could be a recession, which seems to be everyone’s base case for 2023. It’s a tough setup, but it doesn’t mean investors can’t find stocks that can withstand the trifecta of macro complications.

It isn’t easy, however. Oil and gas shares may make good inflation hedges, and their issuers have much cleaner balance sheets after a year of ample cash flows. But a recession will hit demand for energy—with oil down 42% from its 2022 high, the anticipation may already have—and their results may suffer. Grocery stores can withstand a recession and tend to have low leverage, but thin profit margins mean that rising costs can take a bite out of profits. Software stocks may have ample growth, but there are signs of a peak in enterprise spending, and higher rates have caused fast-growing but low-profit companies to fall out of favor.

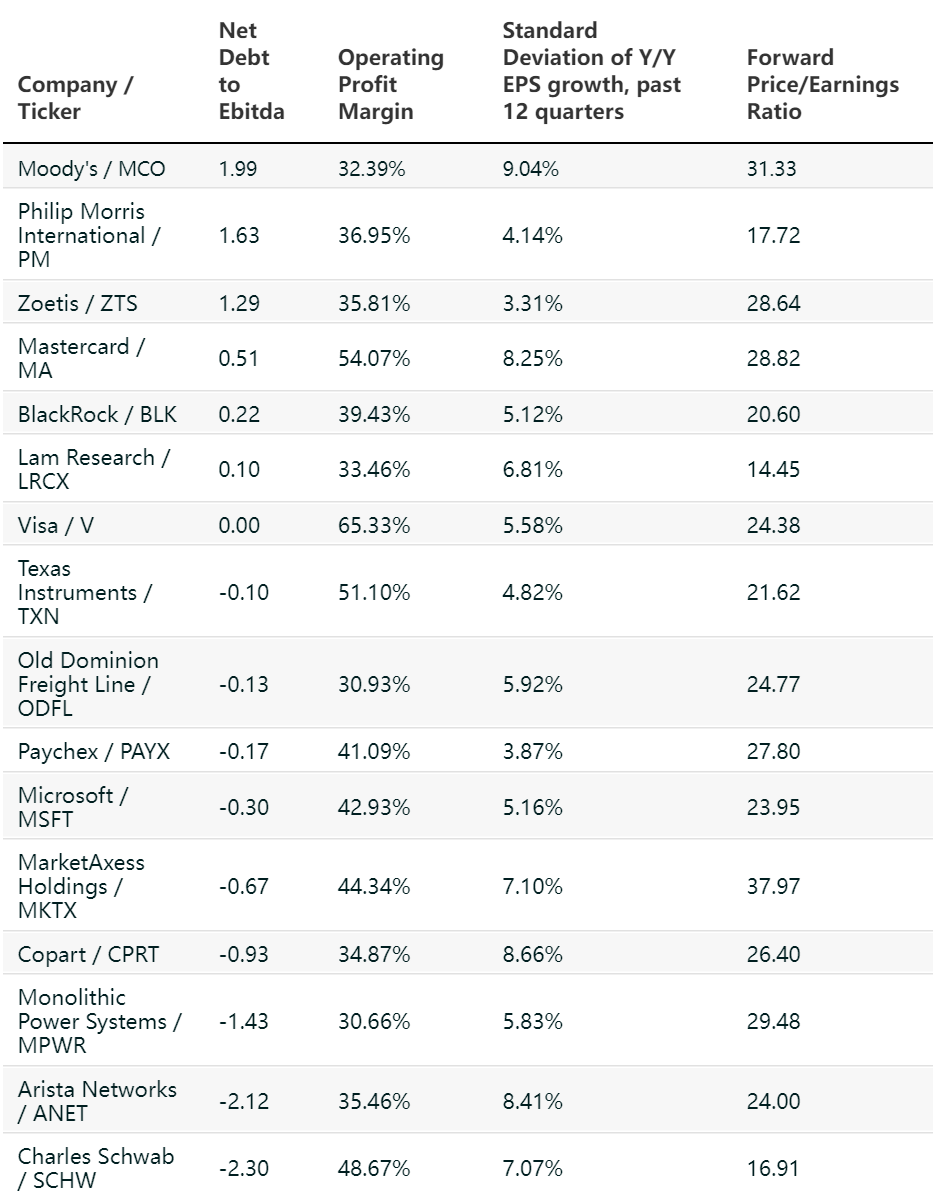

To find companies resistant to inflation, recession, and rate hikes, we focused on those with low debt, strong profitability, and steady growth. Ratios of net-debt to Ebitda—short for earnings before interest, taxes, depreciation, and amortization—below two signal solid balance sheets and lower interest-rate sensitivity. Companies with operating profit margins of at least 30% should have the pricing power to weather inflation.

2023-Proof Stocks

These 16 stocks screen favorably for resistance to inflation, recession, and rising interest rates.

Finally, to make the cut, companies need consistent earnings gains. Those whose year-over-year earnings growth has a standard deviation—a statistical measure of average variability—of less than 10 percentage points over the past 12 quarters should fit the bill.

That period included a pandemic-induced shutdown of the economy, a rapid rebound, and a year of tightening monetary policy and decelerating economic growth. If companies’ annual earnings-per-share growth was within a tight range for all 12 of those periods, there’s a good chance they’ll be able to generate more consistent profit growth through a 2023 recession than the overall market.

Our screen yielded 16 names in the S&P 500,including credit-rating firm Moody’s(ticker: MCO), payroll processor Paychex(PAYX), trucking firm Old Dominion Freight Line(ODFL), animal healthcare company Zoetis(ZTS), semiconductor company Texas Instruments(TXN), and asset manager BlackRock (BLK).

Payments giants Visa(V) and Mastercard(MA) both passed the screen. They’ve got minimal debt and some of the widest profit margins in the S&P 500. And their business models have built-in inflation protection: Swipe fees are a percentage of each transaction, so as prices rise, so do Visa and Mastercard’s sales. Visa was a recent Barron’s stock pickfor those very reasons.

Microsoft(MSFT), which also made the cut, has more cash than debt on its balance sheet and has been a consistent profit grower through the past few years thanks to increasing demand for several of its businesses: cloud computing, videogames, and office and productivity software.

Few of these stocks are cheap, however. Lam Research(LRCX), at less than 15 times 2023 earnings, is the least expensive of the group, while cigarette maker Philip Morris International(PM) and broker Charles Schwab(SCHW) are the only other stocks passing the screen that trade for below the S&P 500’s average valuation multiple. Investors need to pay up if they want quality.

Comments