David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Sea Limited (NYSE:SE) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Sea

What Is Sea's Net Debt?

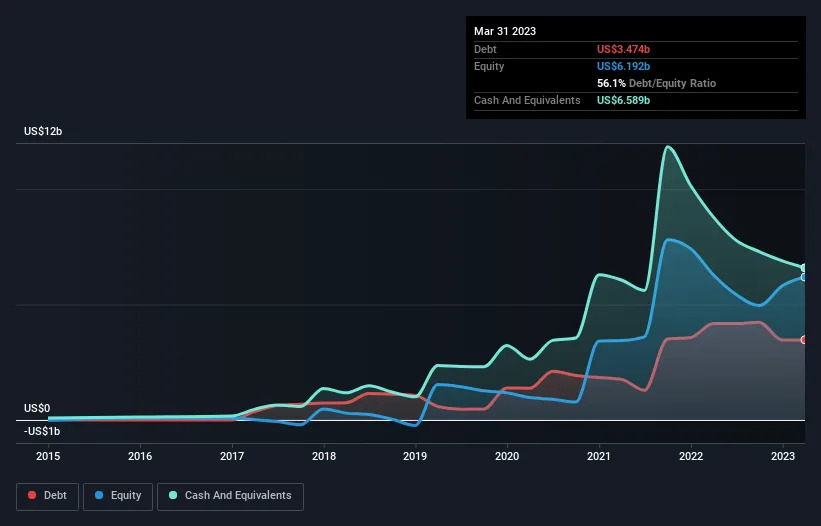

As you can see below, Sea had US$3.47b of debt at March 2023, down from US$4.18b a year prior. But it also has US$6.59b in cash to offset that, meaning it has US$3.12b net cash.

How Healthy Is Sea's Balance Sheet?

According to the last reported balance sheet, Sea had liabilities of US$6.66b due within 12 months, and liabilities of US$4.39b due beyond 12 months. On the other hand, it had cash of US$6.59b and US$2.25b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.22b.

Since publicly traded Sea shares are worth a very impressive total of US$32.5b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Sea also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Sea's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Sea wasn't profitable at an EBIT level, but managed to grow its revenue by 14%, to US$13b. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is Sea?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Sea had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through US$804m of cash and made a loss of US$984m. But the saving grace is the US$3.12b on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Sea's profit, revenue, and operating cashflow have changed over the last few years.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Comments