Summary

- The consumer staples sector is potentially riskier due to inflation and lower profit margins, impacting companies like Hormel Foods.

- Hormel Foods is facing pressure on profit margins through difficulty passing rising input costs onto product prices.

- The company's inventory buildup and shortage of meats indicate ongoing input cost troubles that may persist into 2024.

- I do not expect Hormel's EPS to recover as quickly as other analysts, but the stock appears to be discounted accordingly.

- Hormel may not continue to raise its dividend as its coverage ratio falls closer to one.

David McNew

It has been a long-standing view of mine that the consumer staples sector is likely riskier than many believe. There are two reasons for this. Firstly, with inflation a primary negative catalyst, many consumer staples firms are at greater risk because they have naturally lower profit margins. Thus, rising labor and goods costs negatively impact their net income, particularly if they cannot pass those costs forward. In many instances, these firms are so established with deeply entrenched supply chains and contracts that they also cannot reduce their production levels inexpensively, meaning some may sell at a loss under a stagflationary economic environment.

The secondary issue facing consumer staples is their valuation. Many investors place a valuation premium on these firms due to their age and the perception of low risk. Even if the income of these companies does not decline, an increase in EPS volatility that causes the risk profile to rise hurts the valuation, as the low-risk premium is lost. Further, the rise in interest rates, particularly real interest rates (or rates after inflation), naturally causes valuations to increase, disproportionately harming stocks at the highest valuations.

These issues appear to impact Hormel Foods Corporation (NYSE:HRL) negatively. Hormel Foods is a multinational food company headquartered in Austin, Minnesota. The company was founded in 1891 and has since grown to become one of the largest meat processing companies in the world. Hormel Foods operates in two primary segments: refrigerated foods and grocery products. Its refrigerated foods segment produces and markets various meat products, such as bacon, ham, sausages, and other processed meats. The company's grocery products segment manufactures and markets multiple shelf-stable food products, such as canned meat, chili, and ready-to-eat meals.

Hormel Foods generates the most revenue from its refrigerated foods segment, which accounted for about 53% of total revenue in 2022. The company's pork business is the most significant contributor, followed by turkey and chicken. Its bacon and ham products are particularly popular in the US market. Hormel Foods' grocery products segment accounted for an additional 27% of revenue, with its shelf-stable foods contributing the most. This segment has improved income since 2020 as many people have looked to increase stores of unperishable food.

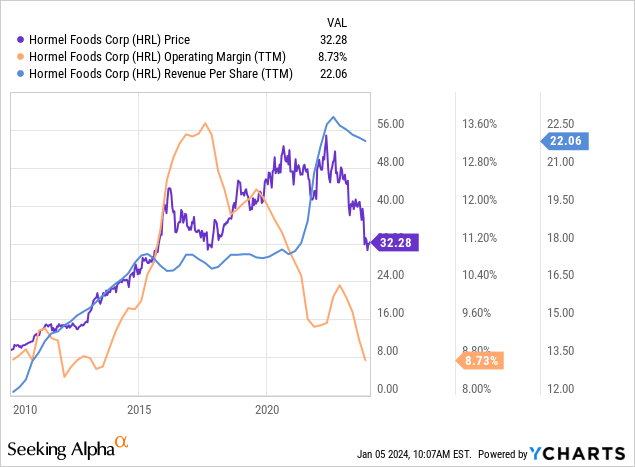

Lately, the company has faced significant pressure on its profit margins. The firm's revenue remains near its post-COVID peak but shows signs of slowing as consumers decrease spending, particularly on canned foods. That said, its most significant issue appears to be difficulty pushing rising input costs, particularly meat, forward into its product prices. Despite substantial sales growth in recent years, it may lose much of its operating income. Hence, its stock fell by around 30% in 2023 and is around 40% below its 2022 peak price.

Hormel's Operating Margin Pressure

The strains seen in Hormel are akin to those seen in Tyson Foods, Inc. (TSN), which I covered recently, albeit not quite as extreme. The company is old, large, and has a profoundly entrenched supply chain. While these are good qualities in most periods, they also make the firm a bit more challenging to navigate during volatile and changing economic periods. The company's products are also generally lower-cost items, which have a disadvantage with inflation because rising input costs will lift the price of all items, naturally lowering the price gap between cheaper items and higher-quality goods.

To explain that point further, consider the sharp rise in meat prices since 2020. Beef spot prices have been up by around 70% since then, meaning Hormel and other meat companies (perhaps more expensive ones) will pay more for meat. However, because Hormel's items are likely cheaper, it would need to increase the prices of its items by a more significant percentage (than a costlier peer) to push the cost forward.

That is to say, increasing a canned item from $1 to $2 vs. a meat section cut from $8 to $9 represents the same total increase but a much higher proportional increase for the canned item. However, consumers will likely be more frustrated with paying twice as much for a can than $1 more for an $8 item. Of course, this example is a hypothetical extreme, but it illustrates my point that supply-side inflation harms low-price sellers the most.

This is also why inflation has the most significant negative impact on low-income people because they're more likely to buy items that have a higher "beta" to inflation. Thus, it is no surprise that Hormel is failing to push higher goods and labor input costs forward. See below:

Data by YCharts

Data by YCharts

Virtually all of the declines in Hormel's profit margins are due to a reduction in gross margins. Its operating expenses are essentially unchanged compared to its sales. That strongly indicates that its primary strain is an increase in goods input costs, not in its operating overhead. Hormel's sales shot up after 2020 as people raced to buy non-perishable and frozen food items, likely as an emergency measure due to the food shortages that persisted from 2020 to 2022. Since last year, there has been a notable decline in Hormel's sales as people have slowed this emergency purchase binge. We should note that the actual decrease is more significant if we were to adjust for inflation.

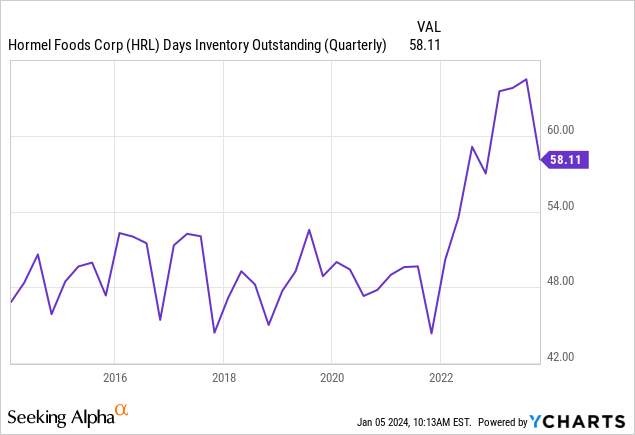

Notably, the company's COGS declined in 2023 while its total sales volume in pounds was nearly constant (10-K pg. 16), implying its reductions were due to price cuts. Unsurprisingly, that had come with a buildup in inventory compared to sales, implying the company ramped up production, assuming demand would remain high when it did not. See below:

Data by YCharts

Data by YCharts

Hormel still has a ways to go in reducing its inventory, a potentially problematic issue for a food company as its inventory will naturally lose value the longer it is not sold. As discussed in its last investor call, it is actively working to reduce inventory, likely pointing toward a price reduction and potentially a cut to production. This temporary issue may further hamper its profits over the coming quarter or two, but should not last as long as the company normalizes its production levels to meet demand.

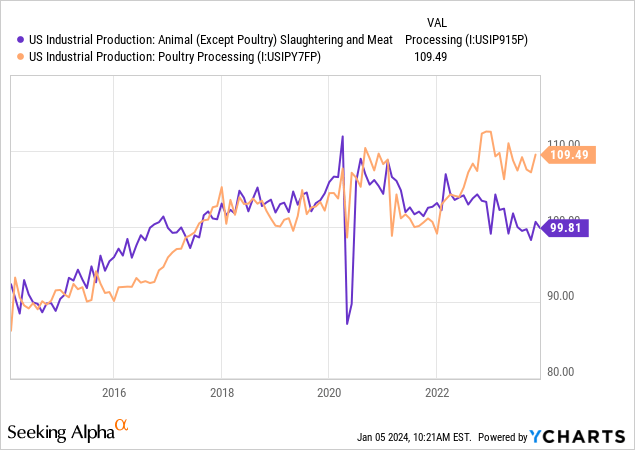

Still, the company's most significant issue is the slight shortage of many meats. This factor ultimately stems from drought and labor issues negatively impacting farm production. In general, poultry and egg production have risen to offset this, but poultry farmers are also facing some problems relating to rising feed prices and the bird flu, which are, in part, creating the egg shortage in 2023. Overall production for poultry remains stable, while it is still trending down for other meats:

Data by YCharts

Data by YCharts

This indicates that Hormel's input cost troubles may persist into 2024 and beyond. Pork has a particularly significant labor shortage due to the industry's higher labor needs, causing a positive outlook for pork product prices with lower expected production. Hormel can adapt to these changes by increasing its focus on less inflationary turkey products, which it appears to be doing. That said, we can expect profit margin strains as it continues to make these changes, as a large and established firm may not be able to adapt as quickly.

What is Hormel Worth Today?

My outlook for Hormel is not as negative as it is for Tyson Foods, primarily because it has greater isolation from the meat market issues. Hormel is still exposed to meat cost inflation but sells more diverse prepared products that lower its direct exposure. That said, Hormel still struggles with rising costs and labor issues as it faces an anti-trust lawsuit regarding allegedly conspiring to suppress wages in agreement with its peer Smithfield. If true, we could see a continued increase in Hormel's COGS at the cost of its overall profitability.

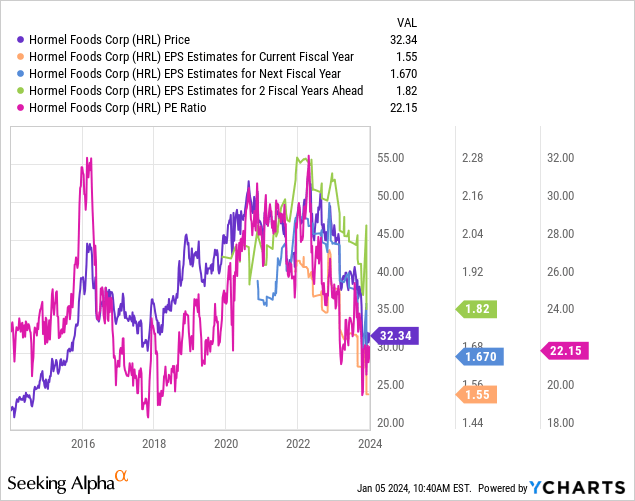

Over the past two years, Hormel's immediate and long-term EPS outlook has fallen dramatically. Its two-year ahead EPS estimate in late 2021 was around $2.20, but its EPS is currently around $1.55. Investors still expect its income to rebound in the future, though, with its two-year ahead EPS around $1.82. See below:

Data by YCharts

Data by YCharts

Hormel's TTM "P/E" ratio is back at the low level set in 2018. In my view, the issues the company is facing now are more significant than the struggle it had then. Ultimately, it faces similar issues in that the increase in food goods prices disproportional to consumer prices began around that time. That said, HRL's valuation is lower today than it usually is by around 20% to 35%, depending on the measure, but is still slightly above most consumer sector firms.

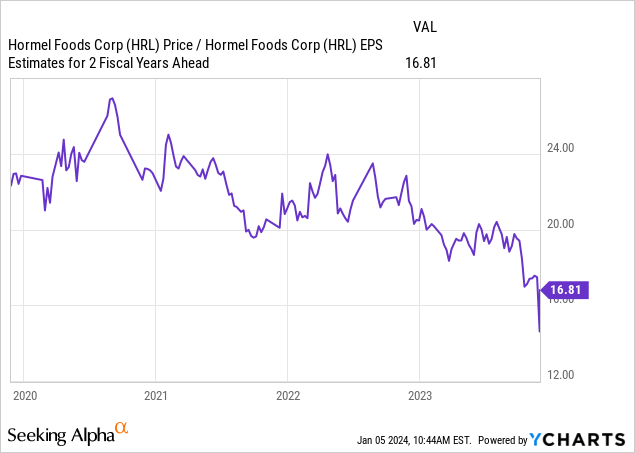

That said, its valuation is particularly low if we look at its forward "P/E," which uses two-year advanced EPS estimates. Currently, that figure is 16.8X, down from around 24X in late 2020. See below:

Data by YCharts

Data by YCharts

This is likely one of the most telling signals that Hormel is discounted today. Investors are no longer valuing the stock as if it is an impenetrable consumer staples giant. It is now being priced more reasonably, accounting for the risks facing its profitability. Unlike Tyson Foods, I do not expect Hormel to face losses or an excessive decline in income without a significant external shock. That said, I doubt its EPS will recover as quickly as many expect because the core issues creating supply-side inflation in food products (particularly animal food products) continue today.

Overall, I am neutral on HRL and believe it is fairly valued, given its risk profile. It could appear highly discounted today by many measures, but only if we assume that its profit margins are untouchable, which is clearly not true. Hormel is a lower-risk company among consumer staples. Still, consumer staples are generally overvalued due to their negative exposure to inflationary factors, which I expect will persist to a degree for some time. The company's dividend coverage ratio has declined steadily from 3.6X in 2010 to 1.3X today. That does not point toward a dividend cut, but it certainly implies its dividend growth days will end, likely in 2024, and potentially remain stagnant for an extended period.

Comments