$United Continental(UAL)$ 24Q4 earnings highlights

Solid rebound across all business segments (Passenger, Cargo, Corporate), with strong results amid strong economic activity in North America;

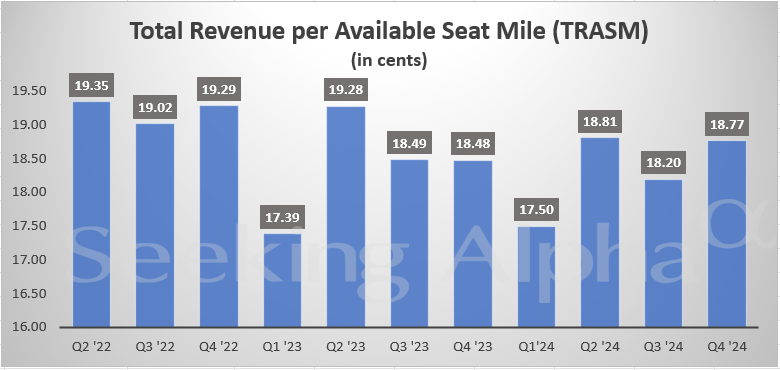

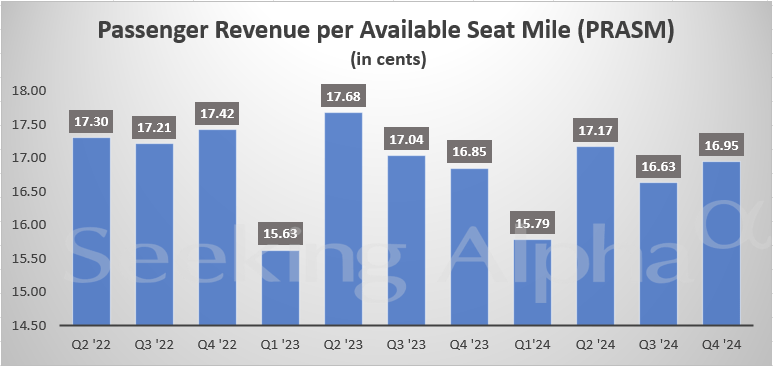

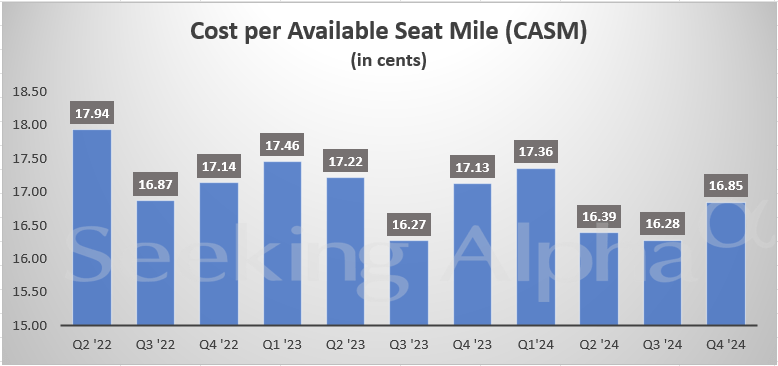

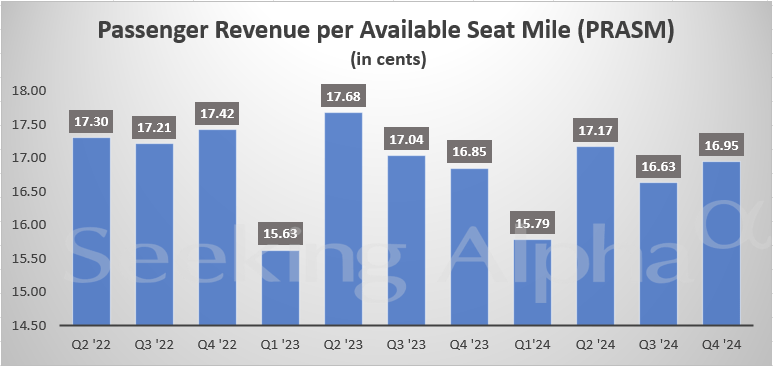

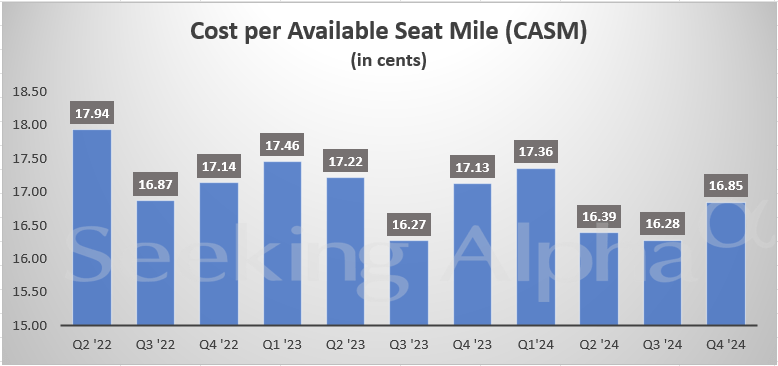

Passenger Transportation Open Source: Passenger Revenue per Available Seat Mile (PRASM) snapped a six-quarter streak of declines and turned +0.6% year-over-year; Cost per Available Seat Mile (CASM) declined 1.6%;

International revenue growth rebounded to 8.7%, following a decline in growth in the previous three quarters;

Passenger load factor remained around 82.3%, with European routes picking up year-on-year to at 81.6% and Asia-Pacific routes currently at 76%, still with room to rise;

Considering the likelihood of continued encryption of US-China routes in FY25 (which could be a factor in Trump's presidency negotiations), Asia-Pacific revenues could rebound to pre-pandemic levels (and are currently the only region that has yet to reach pre-pandemic new highs)

Trump 2.0 Begins: How Do You Position Your Portfolio?

On January 20, Donald Trump takes the oath of office at the White House, officially beginning his second presidential term.

Are you paying attention to Trump trades? Are you ready for Trump 2.0? Which company do you favor the most? Which stock is a buy during overnight session? Would you short DJT and go long on energy?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments