Big-Tech’s Performance

Trump's inauguration this week captured the world's attention and entered the 2.0 era, with a considerable number of policy announcements made as soon as he took office, but so far there has been no major surprises in relation to his previous announcements, and the market has come to expect them.In addition to the obvious changes to sectors such as immigration, energy, and digital currencies, there was also a call for the Federal Reserve to "lower interest rates" (although this is unlikely to be successful, as the Fed is an independent private institution).

But the point is, through the president's influence shouting, will be a certain degree of distortion of the market on the current expectations of rate cuts, and even some members of the Federal Reserve will also have a subtle influence.Even if the January meeting does not cut rates, but in the U.S. bond market is relatively extreme, as well as full support for rate cuts in front of the economic data, Powell "dovish speech" to appease the market will increase the likelihood.

Therefore, the overall market is also in this kind of "both worried about the uncertainty brought about by Trump, but also reveled in the strong economy and gradually loose policy" in the new highs.

The last week of January is also the most important big tech company earnings, another "All Eyes On AI" market test, the establishment of Stargate and let the AI concept of a wave of strength, Nvidia also once again overtook Apple as the largest market capitalization of the company.

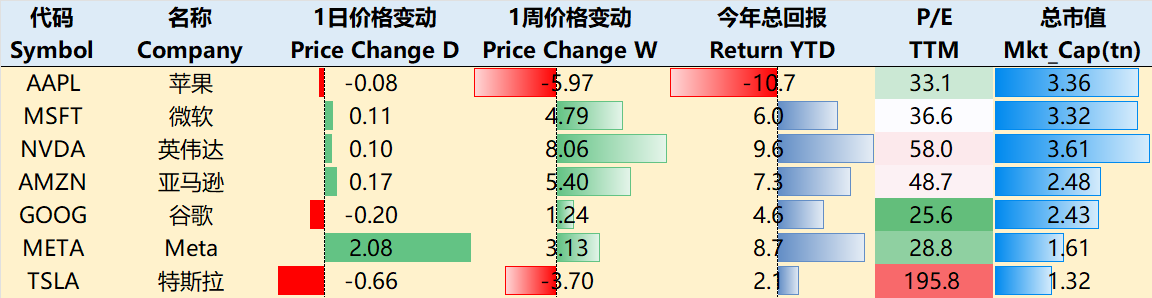

To the close of trading on January 23, the past week, big technology companies continue to diverge. $Apple(AAPL)$ -5.97%, $NVIDIA(NVDA)$ +8.06%, $Microsoft(MSFT)$ +5.68%, $Amazon.com(AMZN)$ +5.40%, $Alphabet(GOOG)$ $Alphabet(GOOG)$ +1.24%, $Meta Platforms, Inc.(META)$ +3.12%, and $Tesla Motors(TSLA)$ -3.70%.

Big-Tech’s Key Strategy

Stargate is MSFT’s easy money?

Unlike Apple's single day plunge of 4%, Microsoft's single day gain of over 4% on January 22 ranks high in history.NVIDIA's market capitalization surpassed Apple again this week to become the world's No. 1, and on this trend, Microsoft could also surpass it if it performs better after next week's earnings report.

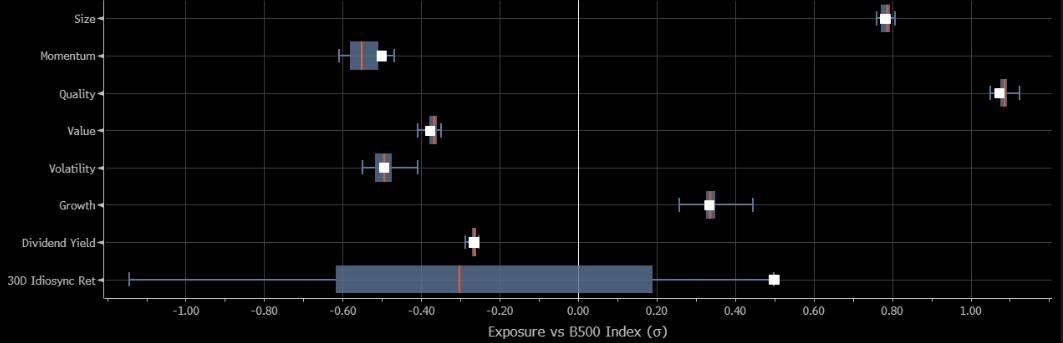

Microsoft's performance over the past three months has been determined by its "Large Cap(size)", "Company Quality (Profitability, Stability)", but the "Momentum" factorhas also recently outperformed the average despite being relatively low overall.

However, the "Momentum Factor" has recently outperformed the average even though it is relatively low overall.And more factors may still be coming from the new incremental growth from AI.

There are several main sources of this optimistic expectation

Estimate on 2026: Azure AI revenues picking up speed in the second half of the year?

Microsoft's calendar year 2026 revenues will be $8 billion-$10 billion higher than the $338 billion the market generally expects, according to research published by Bloomberg.This assumes, of course, that OpenAI-Microsoft remains firmly at the top of the big language modeling cloud vendors and that supply constraints ease, assuming higher enterprise AI adoption and against the backdrop of greater competition from Amazon AWS and Google.

Among the improved enterprise purchases is mainly GitHub Copilot, which is likely to continue to lead in terms of adoption, because of the tool's ability to shorten time-to-value for software developers.So market readings are optimistic for now

Management has previously indicated that Operation Margin may decline by 100bps in FY2025, mainly due to higher depreciation expense as a result of higher AI workload and related capex.

Re-signed agreement with OpenAI, relationship changed but still dominant.

Microsoft still invested $750 million in OpenAI's recent $6.6 billion funding round, for a total investment of nearly $14 billion, but is only mentioned as a "technology partner" in the program;

Microsoft is allowing OpenAI to use competitors' cloud services to train and run AI models, downplaying the exclusive partnership agreement;

For Microsoft, the revised partnership agreement retains the revenue share and also allows it to continue to use its models.In addition, the new partnership model lets Microsoft shift some of its AI spending to competitors, easing funding pressures.

Stargate's joint venture, although once controversial, for example, Musk accused the backers of the project of insufficient funds, but it is beneficial to Microsoft anyway, on the one hand, if the investment is really in place, there can be more money to invest, and sit on the output of OpenAI themselves, on the other hand, if the investment is not in place, it can also alleviate the pressure of competition, and continue to expand market share.

There are also a couple of gossip-type concerns:

The sale of Tik Tok US: when TikTok sought a sale four years ago, Microsoft was one of the early bidders.Given that it has acquired LinkedIn and has a relatively mature product in the social networking space, it cannot be ruled out as one of the bidders again;

Games industry chaos. Given the recent downturn in EA's earnings guidance, investors are more sensitive to the now intensifying competition in console gaming.Following the acquisition of Activision Blizzard, the Xbox ecosystem and Game Pass service have simplified the process and are prone to improve user retention.However, some investors believe that the absence of a response to Black Myth: Goku may have impacted this quarter's results.

Options Observer - Big Tech Options Strategy

This week we look at: will Tesla earnings be the second watershed?

Trump scrapped Biden's subsidy policy for EVs on his first day in office.The U.S. Environmental Protection Agency's emissions reduction rules for model years 2027-2032 may be scaled back by the Trump administration, and if so, Tesla could be the biggest beneficiary of reduced competitive pressure on automakers, which it faces instead, though of course traditional carmakers could benefit as well.

On the other hand, the Electric Vehicle Tax Credit in the Inflation Reduction Act could be eliminated, and Tesla doesn't rely on the credit as much as other manufacturers do, so the elimination of the credit would have less of an impact on it, and it might even profit from it.

Next week is Tesla's first earnings report of the year, and with overall Q4 deliveries slightly weaker than the market Consensus, margins are likely to take a similar hit.However, with the market now expecting a more optimistic name for its energy storage and AI, including FSD, and with deliveries likely to continue to recover in Q2, this point on margins is likely to continue to fluctuate with expectations as it is digested.

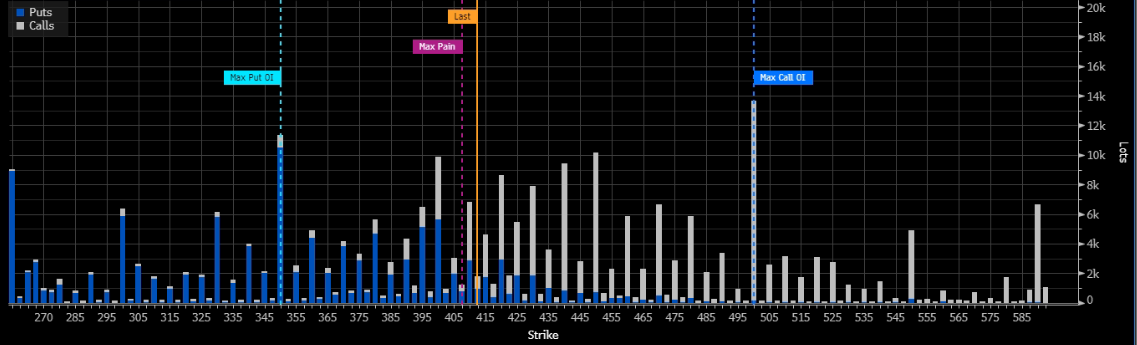

31 expiration of the options, the current ATM Call (415 or so) is not the largest volume, both Put and Call have in the up and down within the $50 fluctuation of the consideration, especially the 440-450 Call of the trading volume is also quite large (Vol/OI>1.5), the whole in the 350-420 PUT and the 400-500 CALLare very active.

Big-Tech Portfolio

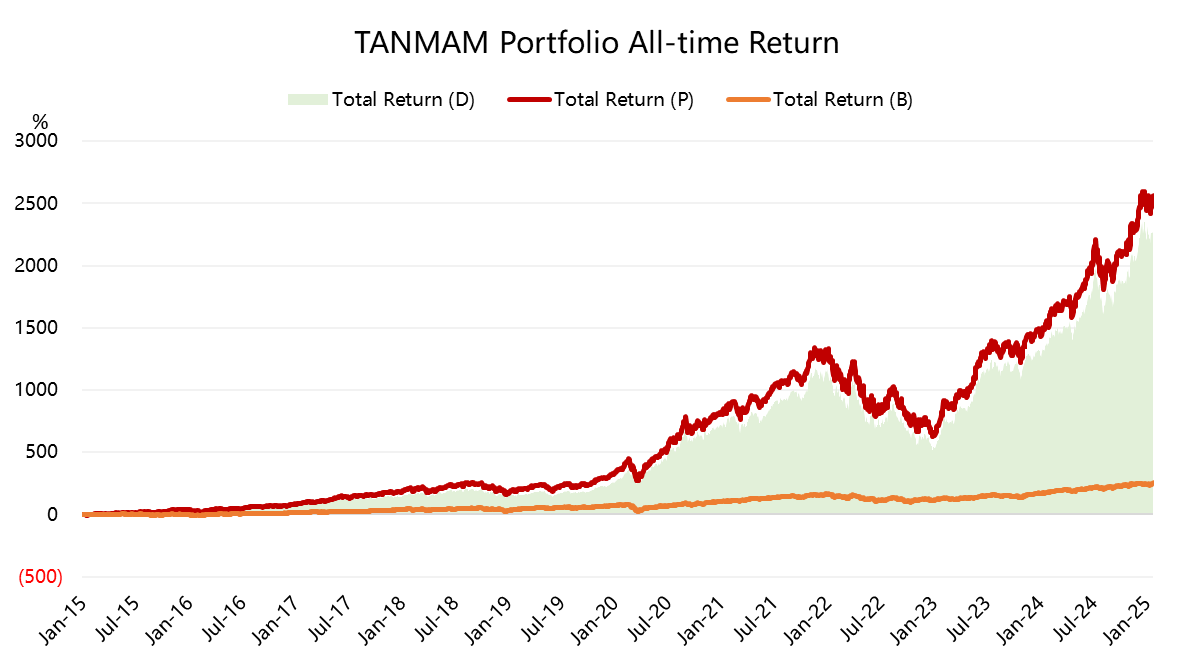

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtest results are far outperforming the $.SPX(.SPX)$ since 2015, with a total return of 2,561.16% and a $SPDR S&P 500 ETF Trust(SPY)$ eturn of 253.41% over the same period, for an excess return of 2,307.71%.

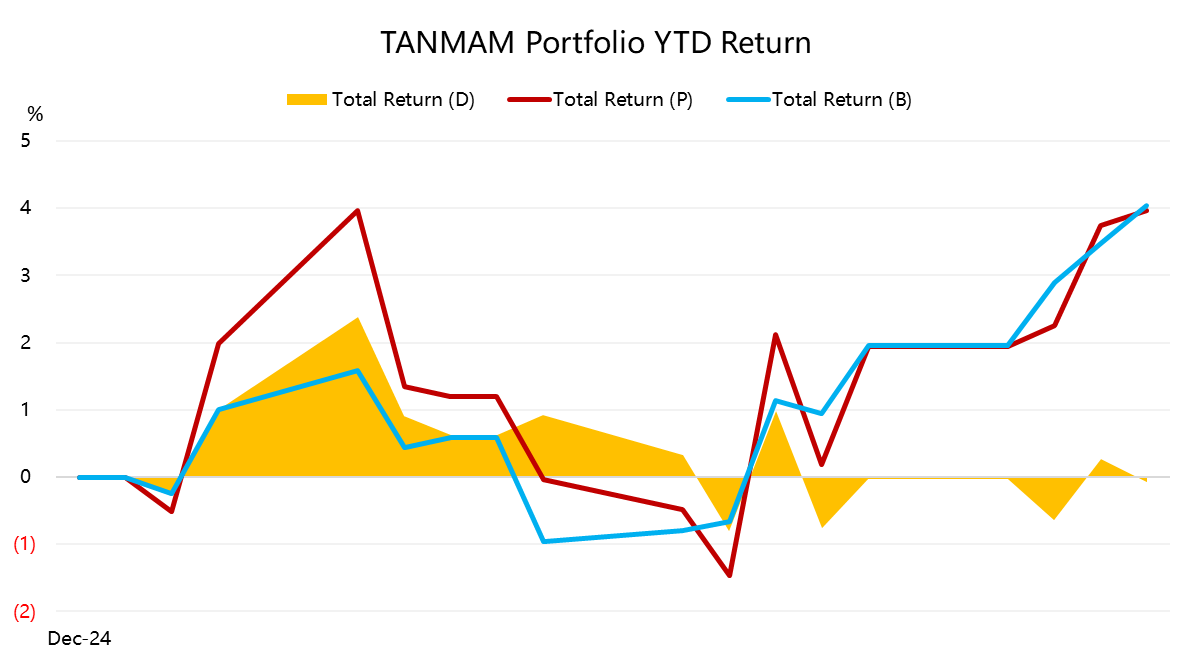

Big tech has pulled back so far this year, returning 3.96%, less than the SPY's 4.04%, but the gap has narrowed through the week's recovery, with some drag from major AAPL and TSLA;

The portfolio's Sharpe ratio over the past year has rallied to 2.51, the SPY is at 1.83, and the portfolio's information ratio is 1.99.

Comments