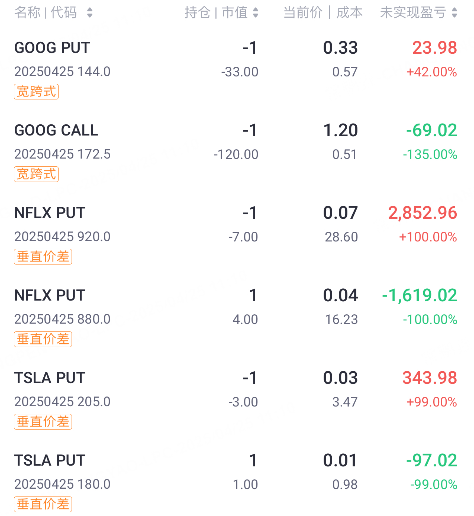

In the past two weeks, we have made financial reporting strategies including Netflix, Tesla, and Google.

After the market closed, Google's financial report was also officially announced. The financial report showed that Alphabet achieved revenue of US $90.23 billion in the first quarter, a year-on-year increase of 12%, higher than market expectations of US $89.1 billion; Non-GAAP net profit was US $34.54 billion, a year-on-year increase of 46%; Diluted earnings per share were $2.81, beating consensus estimates of $2.01.

After the financial report was released, Google's after-hours stock price once rose by more than 5%. So far, Google's night trading price is 169.23. It is also within the earnings range of the financial reporting strategy.

In terms of yield calculation, the single yield and compound yield of these financial reporting strategies are amazing.

Two of the main strategies utilized are the bull put spread and the short wide straddle strategy.

Bull Put Spread

The bull put spread is a strategy suitable for use when you think the stock won't go down, and may even go up a little bit.

Operationally, you will do two things at the same time: sell a put option with a higher strike price and buy a put option with a lower strike price at the same time. The two options have the same expiration date.

The nice thing about this strategy is that you can receive a premium income at first. As long as the stock price doesn't fall below the strike price of the put option you sold at expiration, you can make this money. Even if it falls, as long as it doesn't fall too much, the loss is limited. Overall, this is a strategy that uses limited risks to earn stable returns.

Short-selling wide straddle strategy

The short-selling wide straddle strategy is suitable for use when you judge that the stock will not fluctuate too much, that is to say, it will not rise or fall sharply.

The specific method is to sell a put option with a lower strike price and a call option with a higher strike price at the same time. The expiration dates of these two contracts are also the same.

The benefits of this strategy come from the two premium you collect. As long as the stock remains between these two strike prices at expiration, you can earn both premium. But the risk is that once the stock rises too much or falls too hard, the losses can become huge. Therefore, although its winning rate is good, its risk exposure is greater, and it is suitable for use when volatility is reduced.

To sum it up in one sentence:

The bearish spread in the bull market is to bet that "the stock price will not fall", the risk is small, and the return is stable;

Short-selling wide straddle is to bet that "the stock price will not move", which makes a lot of money, but the risk is high.

Comments