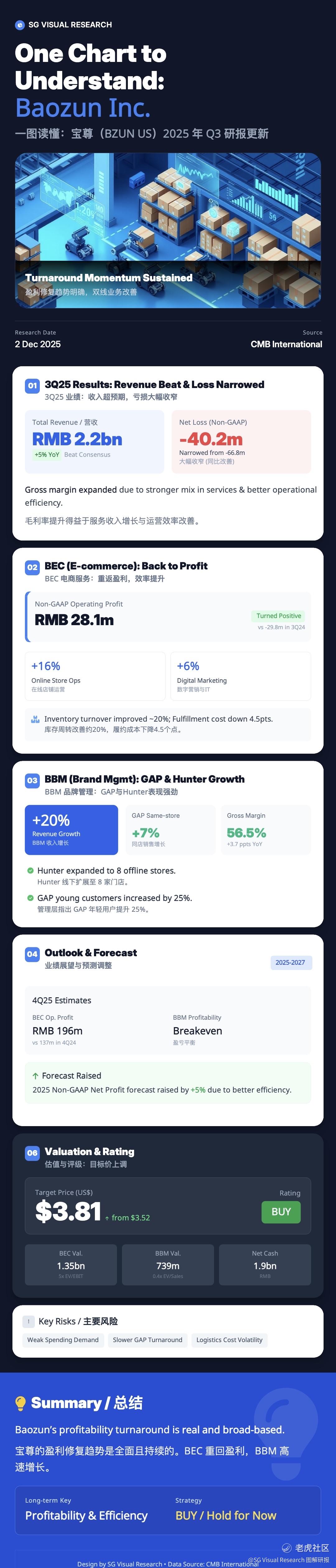

Baozun just posted one of its most encouraging quarters in years.

🔥 Non-GAAP net loss narrowed sharply to RMB –40m

🔥 BEC (e-commerce services) returned to profit with RMB 28m OP

🔥 BBM (brand management) revenue jumped 20%, driven by GAP and Hunter

🔥 GAP’s young customer base up 25% thanks to targeted campaigns

Operational efficiency is clearly improving:

Fulfilment cost ratio dropped –4.5pts YoY

Inventory turnover improved ~20%

Service revenue mix continues to rise

CMBI now expects:

✔ BEC profit to surge in 4Q25

✔ BBM to break even by 4Q25

✔ Target price raised to US$3.81, BUY maintained

Key question for investors:

Is Baozun entering a multi-quarter recovery cycle?

Or will category volatility still hold back margins?

Comments