Following up on "Seizing Opportunities: 2000% Earnings from Earnings Reports," where we discussed Friday's short squeeze during earnings week. Today, we'll further explore non-event-triggered Friday short squeezes.

Last Friday, January 3rd, NVIDIA opened high and continued climbing, starting at 140 and reaching 143-143.9 between 10:30 AM and noon. Having observed intentional bullish positions in NVIDIA's weekly call options over the previous days, and considering the possibility of a short squeeze triggered by overnight margin checks, I bought calls expiring on the 10th $NVDA 20250110 150.0 CALL$ to further test the squeeze theory.

While same-day options would have been more fitting for a "doomsday" trade with better-looking returns (1200% for same-day vs 230% for next week), readers of the previous article know that after a Friday squeeze, Monday typically opens higher, allowing next-week options to catch two moves.

However, waking up Saturday, I discovered that Tesla, not NVIDIA, triggered the afternoon squeeze!

Both stocks traded sideways before 1 PM, so why did Tesla get squeezed while NVIDIA remained unremarkable?

Let's analyze the details of both stocks' same-day options to better distinguish such situations in the future.

1.Lower Open Interest Actually Facilitates Squeezes

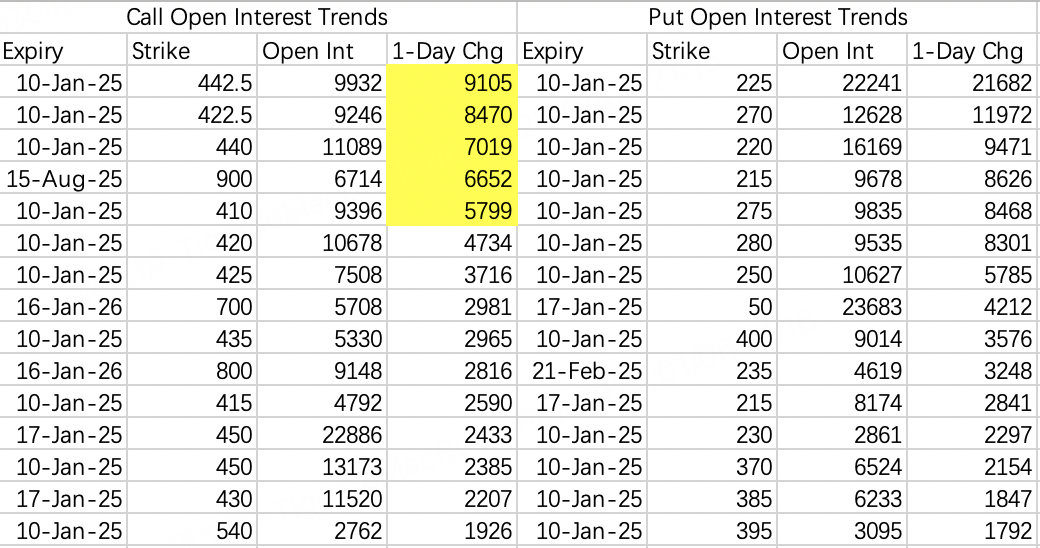

As mentioned in the previous article about Broadcom's Friday call options trading, volume during a squeeze typically exceeds open interest by 10x or more. Tesla exhibited this characteristic: the 395 call saw 89,800 contracts traded versus just 5,250 open interest.

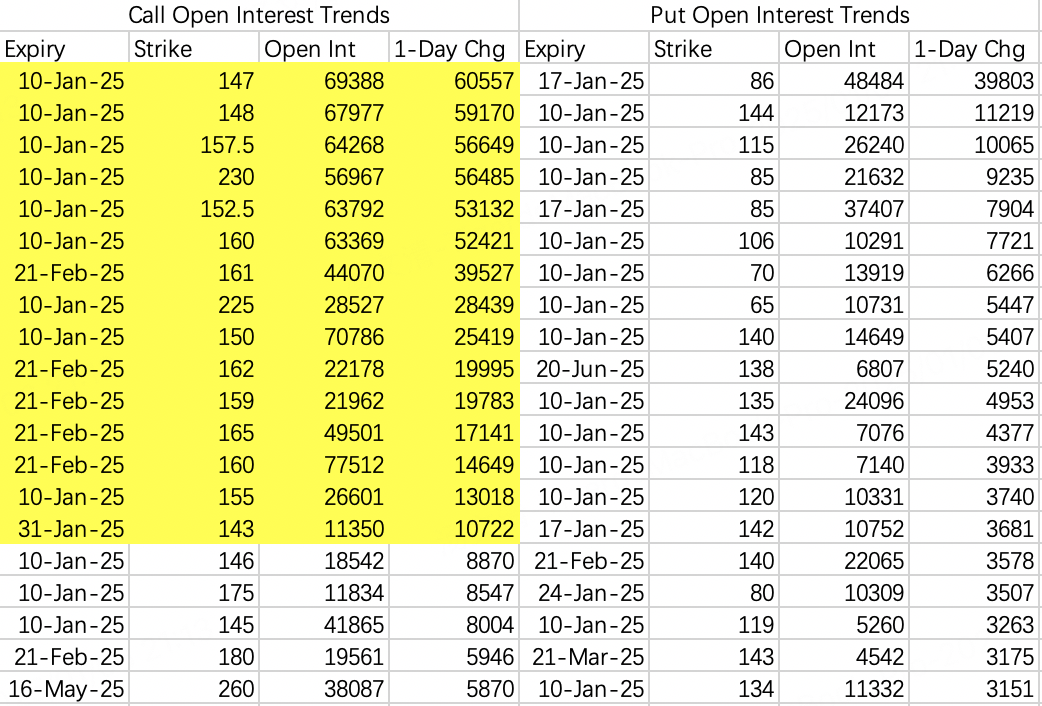

While NVIDIA's volume was also high, the volume-to-open-interest ratio was far lower than Tesla's. Theory suggests NVIDIA had sufficient bullish pressure; we'll explain this discrepancy below.

2. Focus on At-the-Money Options Volume at Open

When price stabilizes at a level before 1 PM, and the at-the-money calls there show volume reaching 10x open interest, consider the squeeze potential.

Tesla traded below 390 until 11:30 AM. The 390 calls $TSLA 20250103 390.0 CALL$ saw 120,000 contracts traded mostly before noon, versus just 8,047 open interest. When at-the-money call volume exceeds 10x open interest, it's a trigger signal.

Compare this to PLTR's normal Friday options trading - similar thousands-level open interest, but despite a 6% gain, option volume remained normal.

3. Dispersed Forces, Next Week Bets

This was the biggest difference between NVIDIA and Tesla. Due to the January 8th CES event, NVIDIA's bullish forces spread to next week, with both retail and institutional traders choosing January 10th expiry over January 3rd. Next week's options don't involve exercise, so overnight margin checks weren't a factor, preventing a squeeze formation.

NVIDIA's Friday options details show surging open interest in January 10th calls.

Tesla had no major events this week, with normal January 10th call opening interest below 10,000, as market participants favored same-day expiry options.

4. Classic Monday Gap-Up, But Different

Post-squeeze short covering and forced exercise buyers typically cause Monday gap-ups, as seen in both Tesla and NVIDIA. However, Tesla's rise was more purely short-squeeze covering, while NVIDIA had some squeeze elements but stronger theoretical upward momentum due to this week's call open interest showing bullish expectations.

Conclusion:

For future same-day squeeze plays, don't rush at open. Wait until 11 AM to see if price stabilizes, check at-the-money option volume versus open interest (looking for 10x ratio), and remember to choose non-exercise if buying same-day calls, as in-the-money calls face exercise requirement checks that can trigger random liquidation. For those wanting to play both same-day and Monday moves, next week or later expiries work.

However, this is just for fun - showing off 1200% return screenshots is nice, but don't count on this for major purchases. I can't guarantee I've identified all the risks, and there might be future installments in this series. Manage your own risk accordingly.

Comments