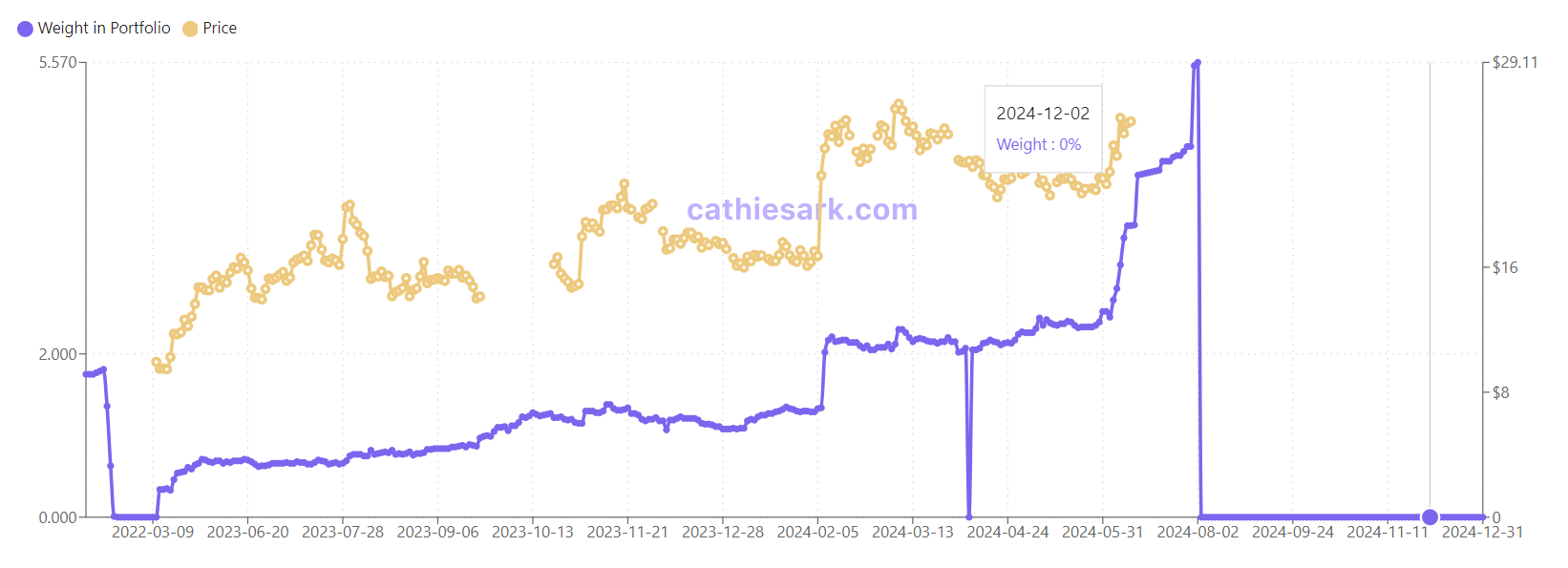

$Palantir Technologies Inc.(PLTR)$ ell nearly 8% on Tuesday after Cathie Wood's Ark Investments ETF "liquidated" $15 million worth of shares.

The $ARK Innovation ETF(ARKK)$ now has almost no position in PLTR, which at its peak made up more than 5% of ARK's portfolio.

Separately, $Morgan Stanley(MS)$ also initiated coverage on the stock on Monday with a "hold" rating and a $60 price target.

Currently, the market is not expecting much from PLTR through 2025, and believes that

Palantir's valuation is unsustainable, trading at extremely high multiples, with a price-to-sales ratio of 64.7x and an expected price-to-earnings ratio of 203x, well in excess of the industry median.

Heavy reliance on government contracts, particularly defense contracts, creates volatility and risk of significant revenue loss due to termination clauses and annual renewals.And government sector cost reductions are inevitable during Trump's presidency, and the leader is Elon Musk.

With slowing growth and lots of insider selling, 2025 could see a major correction.

Of course, there are still several optimistic factors:

Unicron Peter Thiel's close relationship with Vice President-elect J.D. Vance;

U.S. government contracts still sustainable;

Potential inclusion in the Nasdaq 100 could bring more capital inflows.

As a result, 2025 is likely to be more volatile and the key is how much of this optimism is "Price-in" versus pessimism.

Comments