The current market situation shows Trump officially taking office, and S&P 500 Q4 earnings per share beating expectations, largely eliminating downward trend risks. No need to worry about major pullbacks before next week's tech earnings; selling puts carries lower risk.

Not much to say here - just maintain the bullish outlook.

After the CES conference in early January, institutions set a target price of 160. The stock price will likely align with this before earnings disclosure, with minimal pullback risk.

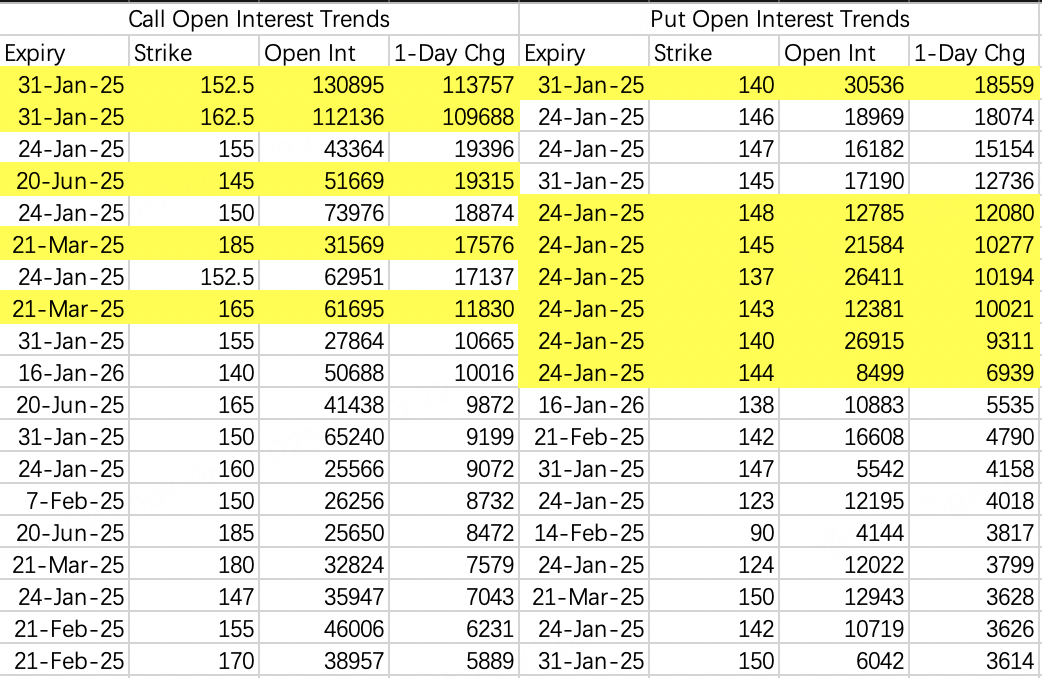

Wednesday's options activity shows long-term bullish sentiment with some pullback trend this week - sell puts on dips. Friday closing >140.

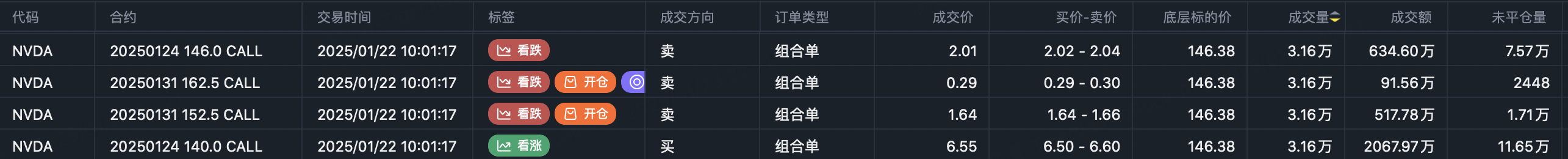

Institutional sell calls got squeezed again, they've rolled positions to next week's 152.5-162.5:

Sell $NVDA 20250131 152.5 CALL$

Buy $NVDA 20250131 162.5 CALL$

Besides NVIDIA, TSMC is another stock suitable for selling options.

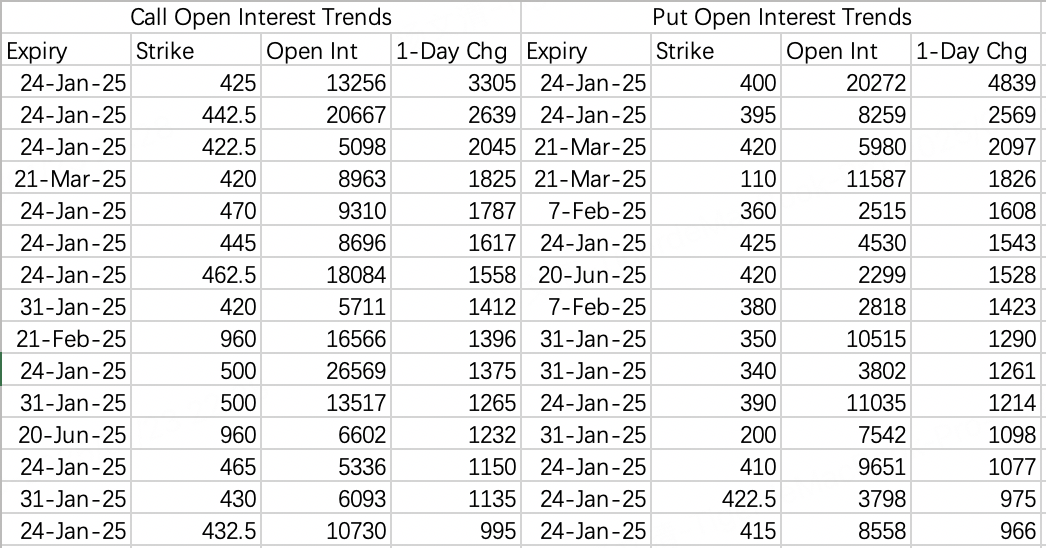

Tesla faces two potential pullback catalysts: market crash and earnings. Market crash seems unlikely now, so focus on next week's earnings.

Tesla shouldn't drop significantly before earnings, making 350 puts suitable for selling.

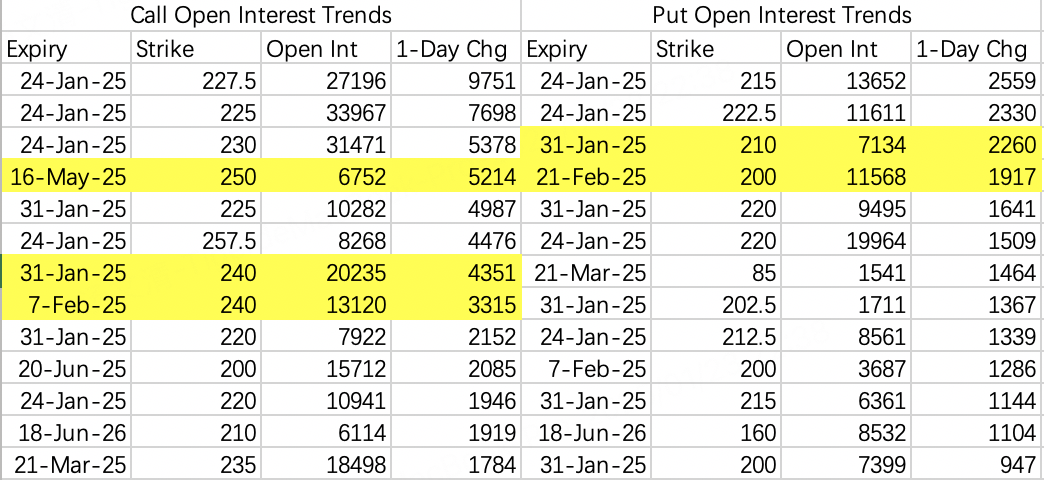

Apple shows the weakest rebound among tech stocks, mainly due to recent negative news, but the stock stabilized at 220 after the bad news, likely bottoming here.

Call positions exceed puts; I closed my 200 put position for a more aggressive at-the-money 225 put $AAPL 20250131 225.0 PUT$ .

Institutional Picks

Morgan Stanley and Goldman Sachs recently recommended their favorite earnings season stocks, with Morgan Stanley listing 10 and Goldman Sachs 20:

Morgan Stanley:

AXON, NET, MC, PB, SYF, VRTX, GWW, DIS, WDC, ZBRA

Goldman Sachs:

ARMK, DKNG, M, TGT, WING, FANG, HOOD, RJF, NTRA, GATX, TREX, MNST, CRM, DIS, NET, OS, SHOP, SPGI, TER, NEE

While pharmaceutical companies are less familiar, other tech companies are suitable for selling puts or other bullish strategies, following the pre-earnings bullish strategy mentioned earlier.

Chinese Stocks

Bullish large orders appear daily, signaling like high beams flashing before us.

The challenge with Chinese stocks is their complex trading patterns, making position holding difficult. Experienced traders stay calm through volatility, while others might exit despite thorough research.

With numerous investment options in the US market, many prefer more predictable choices like NVIDIA over constantly dangling opportunities. Strategy choice depends on individual circumstances.

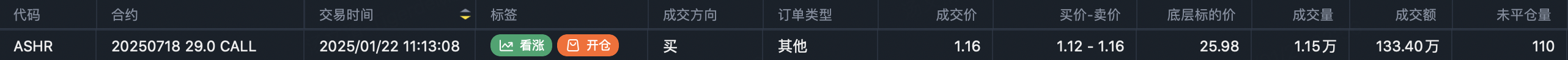

$X-trackers Harvest CSI 300 China A-Shares Fund(ASHR)$

Large order of 21,000 July 29 calls $ASHR 20250718 29.0 CALL$ , transaction value around $2.4 million.

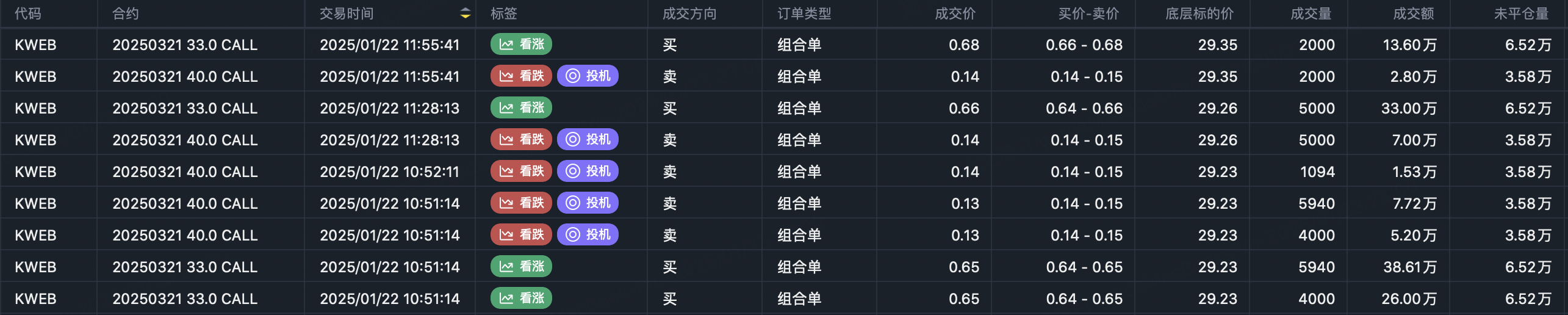

$KraneShares CSI China Internet ETF(KWEB)$

Large orders for March 33 calls and selling 40 calls:

Buy $KWEB 20250321 33.0 CALL$ - 32,000 contracts

Sell $KWEB 20250321 40.0 CALL$ - 28,900 contracts

Notably, another large order for $KWEB 20250321 33.0 CALL$ occurred on December 20th - 50,000 contracts, while selling 37 calls $KWEB 20250321 37.0 CALL$ . The 33 call transaction was $5.75 million. KWEB price moved from 29.5 on December 20th to 29.2 on January 23rd, with time decay causing roughly 50% loss, but institutions haven't closed positions.

Comments