According to the latest news from CNBC and other US media on the 12th, according to the latest guidelines of US Customs, smartphones and computers will not be affected by the Trump administration's "reciprocal tariff" policy.

The new tariff guidance also includes exemptions for other electronic devices and components, including semiconductors, solar cells, flat-screen TV monitors, flash drives, memory cards, and solid-state drives used to store data. It is reported that this tariff exemption applies to all countries affected by Trump's so-called "reciprocal tariffs".

Some analysts believe that one of the purposes of Trump's waving the "tariff stick" is to let the American manufacturing industry return. But Wall Street is not optimistic about this. The latest report released by Bank of America warned that if Apple transfers all iPhone production to the United States, the cost will soar by 90% and it will face logistics problems.

In addition, Dan Ives, a senior analyst at Wedbush Securities who has long been bullish on U.S. technology stocks, said in a podcast that these tariffs could set the U.S. technology industry back a decade. He also predicted that 15%-20% of capital expenditures in the U.S. technology industry have been automatically suspended.

It is generally believed that one of Trump's purposes of wielding the "tariff stick" is to let the American manufacturing industry return. For American tech giants, however, this is very difficult.

The latest report released by Bank of America warned that if Apple transfers all iPhone production to the United States, the cost will soar by 90% and it will face logistics problems.

The team led by Bank of America analyst Wamsi Mohan wrote in a note to clients: "The cost of the iPhone could increase by 25% just because of higher labor costs in the United States." While the tech giant can find labor in the United States to do assembly, a "significant portion" of the components used to make the iPhone will still be assembled in China and then imported to the United States. They estimate that assuming Apple has to pay "reciprocal tariffs" on these imported components, its total cost will rise by 90% or more.

To make it feasible for Apple to move the final assembly of the iPhone to the United States, Mohan wrote, tariff exemptions are needed for parts and semi-finished products made abroad.

Mohan maintained a "buy" rating on Apple stock, with a target stock price of $250, and the current Apple stock price is $199. He said: "Unless the continuity of the new tariff policy becomes clear, we don't expect Apple to take the step of shifting production to the United States."

Use the bullish spread strategy to buy the bottom of Apple,$Nvidia (NVDA) $

For the average investor, buying these stocks outright may be costly or risky. But byCall Spread Strategy, can participate in the potential upside of these stocks at a lower cost while controlling risk.

Call spreadThe operations include:

Buy a lower strike Call Option (Call Option), obtain the right to rise in the stock in the future;

Sell a call with a higher strike price, recycling some premium while limiting potential revenue.

For example: If you are optimistic about$Apple (AAPL) $The following strategies can be constructed for the future stock price:

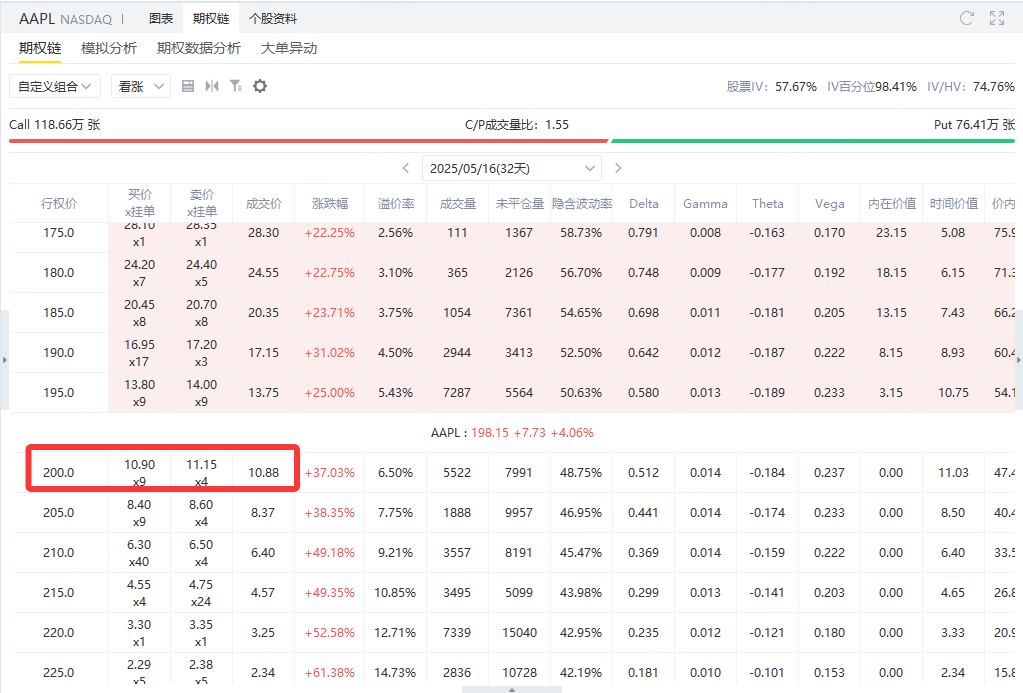

It costs premium $1,088 to buy a call option expiring May 16 with a strike price of $200.

Sell a call option expiring on May 16 with a strike price of $240 and get a premium of $80.

Premium Spend: $1,088 (Buy)

Premium Revenue: $80 (Sell)

Net Cost = $1,088-$80 = $1,008

This is also for investorsMaximum loss, that is, the result when the stock price falls below $200 at expiration.

The maximum gain occurs when the stock price matures ≥ $240:

Call 200 is exercised, earning $40/share × 100 = $4,000

Call 240 is exercised, with a loss of $0 (it is an obligation for investors and does not generate income)

Net income = $4,000-$1,008 =$2,992

The break-even point is:

$$200 + $$1,008/100) =$210.08

Advantages of Call Spread Strategies

In volatile markets, a call spread strategy has the following advantages:

Low capital requirements:Compared with buying stocks directly, it requires less funds;

The risks and benefits are clear:The maximum loss is the net premium paid, and the maximum gain is the difference between the two strike prices minus the net premium;

Volatility Impact Less:Since there are both call and put options in the strategy, it is less sensitive to changes in implied volatility.

Comments