$NVDA$

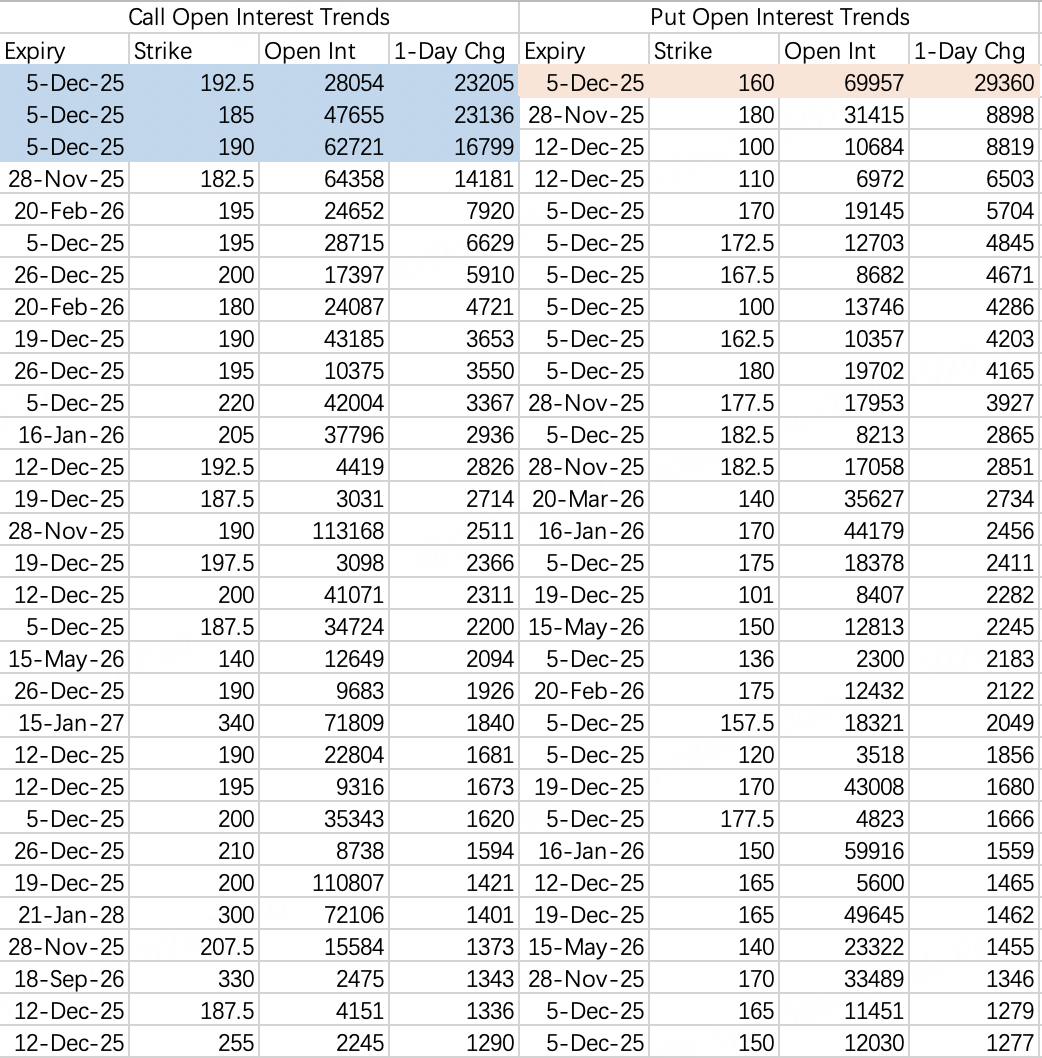

This week's closing range: $170–185. Expected range for next week is similar, oscillating between $160–190.

Institutions continue selling the 185 call $NVDA 20251205 190.0 CALL$ as a hedge, making a significant breakout above this level difficult.

The 160 put $NVDA 20251205 160.0 PUT$ saw 29k contracts opened with unclear direction, indicating support expectations are shifting lower. Additionally, heavy put opening for next week's expiry suggests strong pullback expectations, potentially creating a volatility selling opportunity. Consider short-dated sell puts if that materializes.

$SPY$

Closed above 680 on Friday. Likely tests 690 next week before pulling back into a consolidation phase. Put flow suggests positioning for a post-FOMC dip.

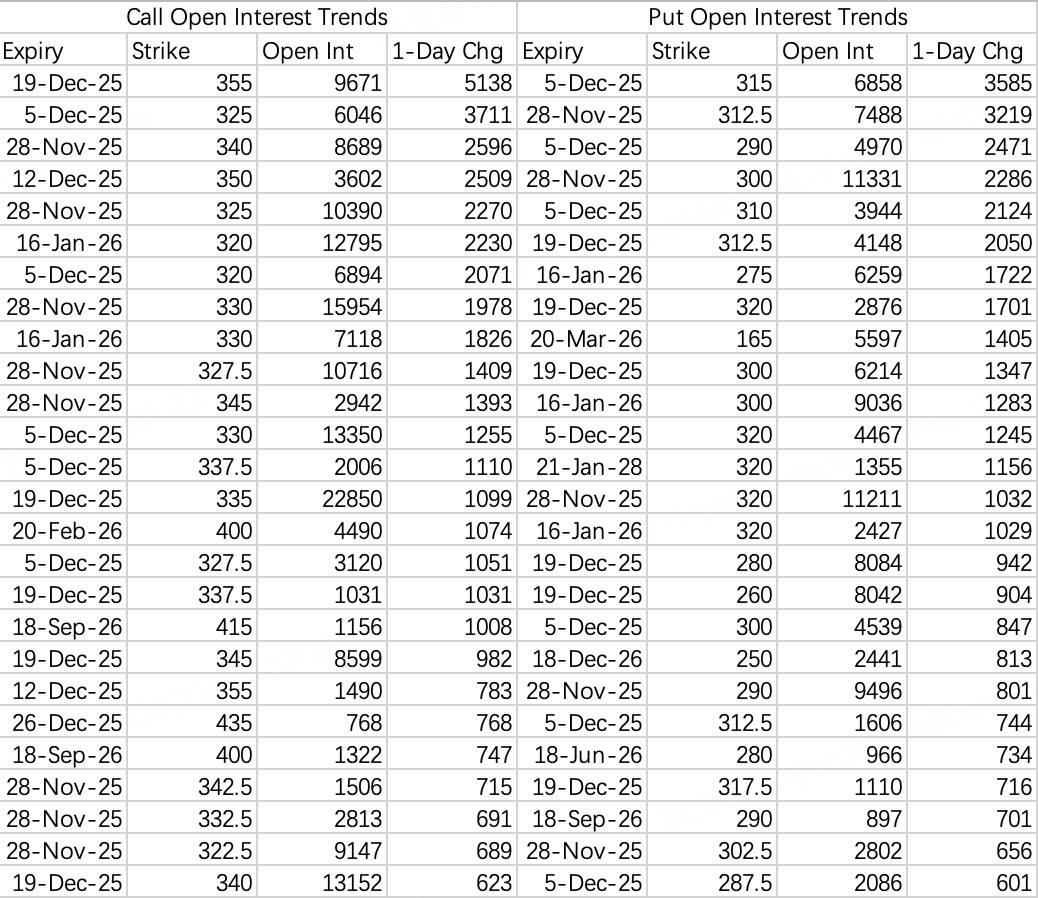

$GOOGL$

Call and put openings indicate near-term strength remains, but chasing the rally aggressively is not advised. Sell puts could be considered at the 300 strike $GOOGL 20251205 300.0 PUT$ .

Comments