$GOOGL$

The broader market is likely to continue its rebound today, with SPY potentially reaching 688. However, not every stock will ride this wave—sector rotation is evident as year-end approaches.

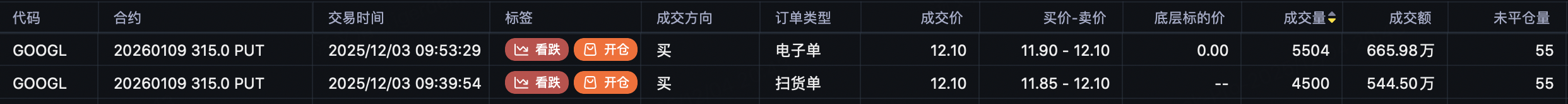

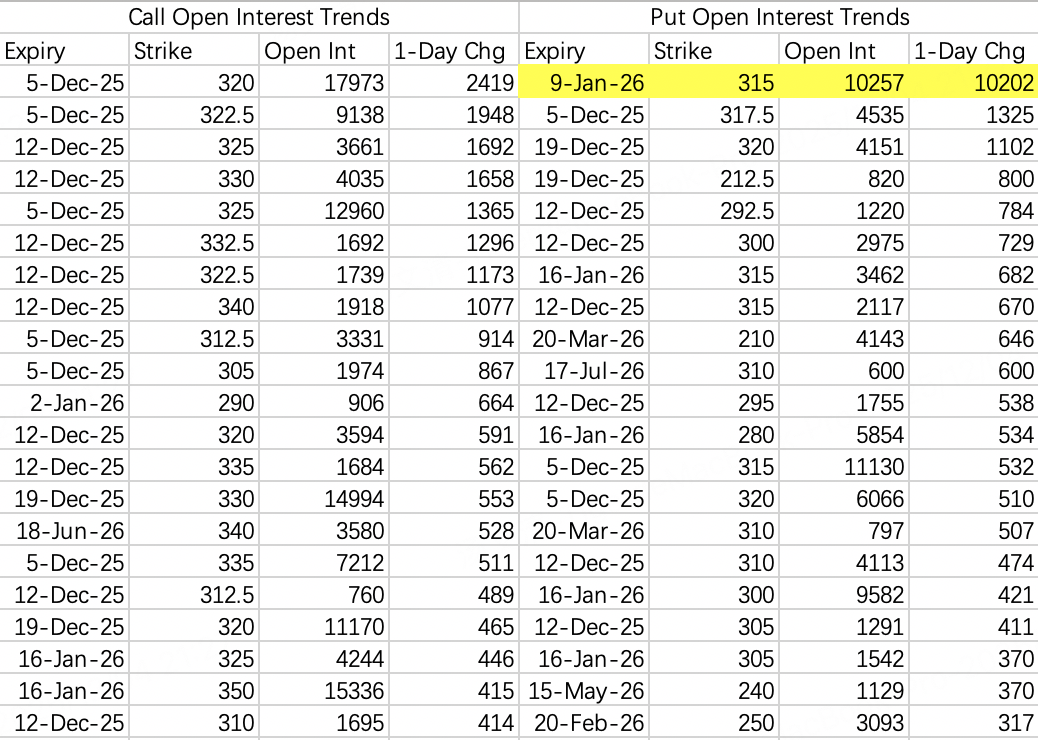

The rotation has turned against Google this time. Bears opened a position by buying 10,000 contracts of the Jan 9th 315 Put $GOOGL 20260109 315.0 PUT$ , with a total premium of approximately $12 million.

Overall, excluding this put activity, Google's options flow still appears strong, suggesting a likely trading range between $315–325. However, following this significant bearish bet, while the stock may hold above $315 this week, the outlook beyond next week becomes less certain.

$NVDA$

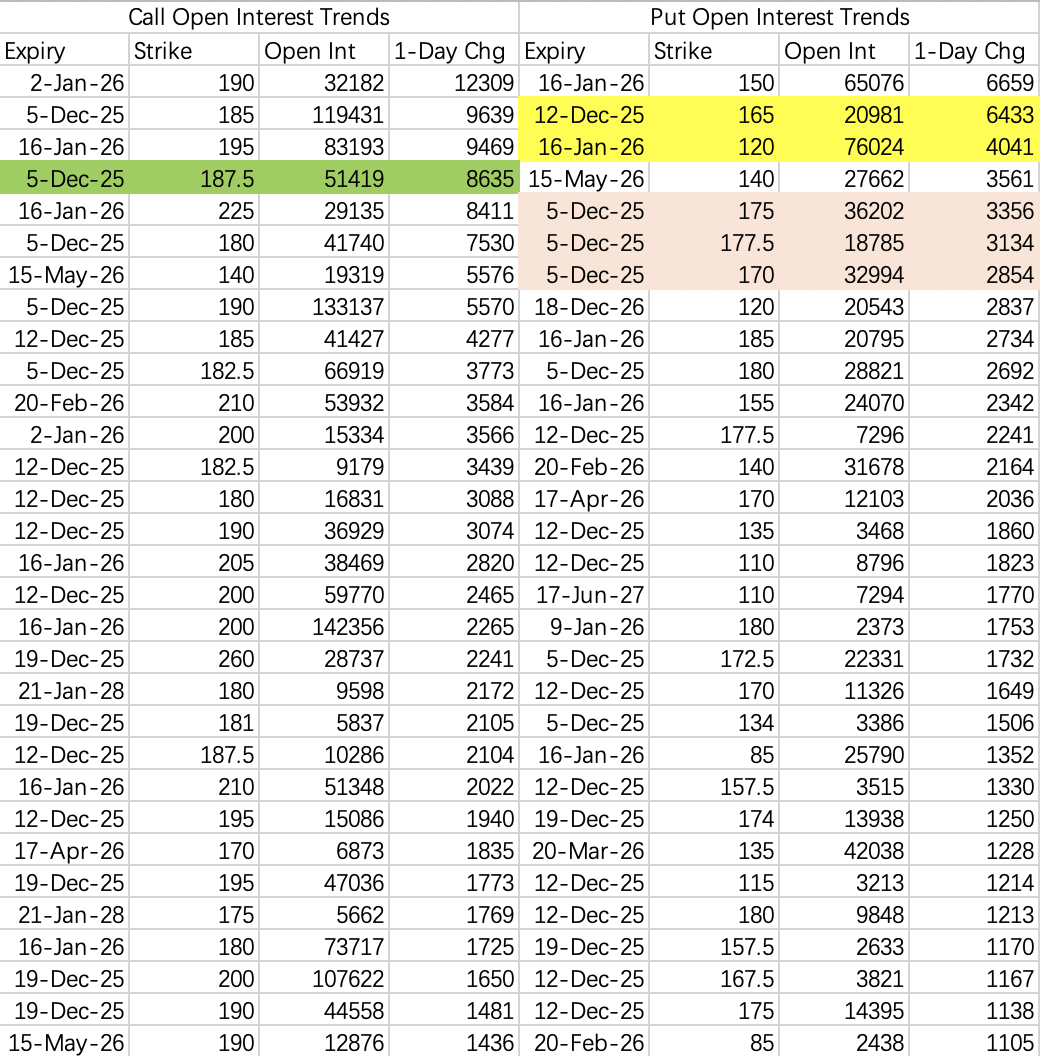

Maintaining the view of a $180–185 trading range. This week, consider selling the 175 Put $NVDA 20251205 175.0 PUT$ and the 185 Call $NVDA 20251205 185.0 CALL$ . Put buying for hedging purposes is expected to persist in the coming weeks.

$TSLA$

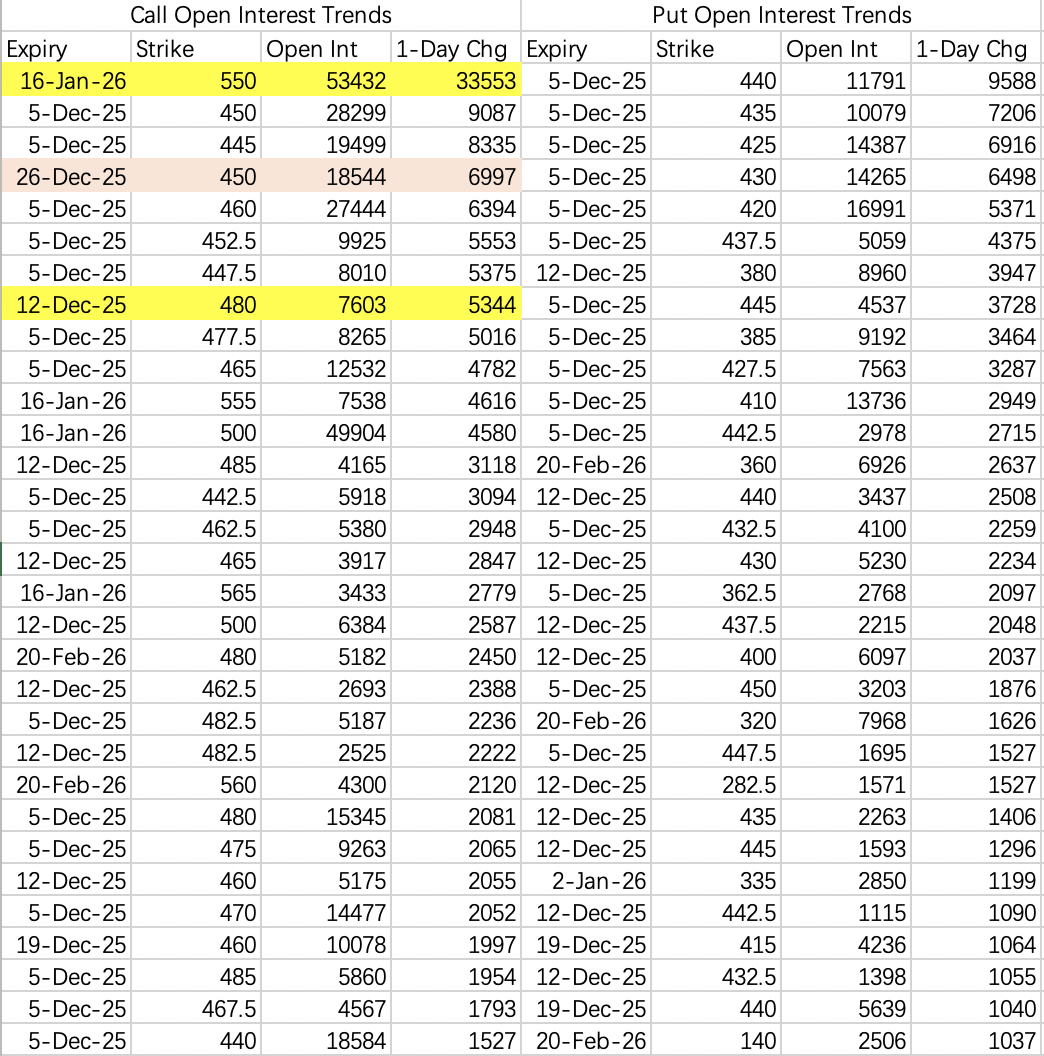

Initially considered selling calls on strength, but Wednesday's options flow was more bullish than anticipated. There was even opening buy flow in the 480 Call $TSLA 20251212 480.0 CALL$ .

Notably, the previous large 800 Call position was closed $TSLA 20260618 800.0 CALL$ , while the Jan 550 Call saw 33.5k contracts opened $TSLA 20260116 550.0 CALL$ . Although these are independent single-leg trades, it resembles a roll-down from the 800 to the 550 strike. It's difficult to judge at this point whether this signals insider information or retail speculation.

$INTC$

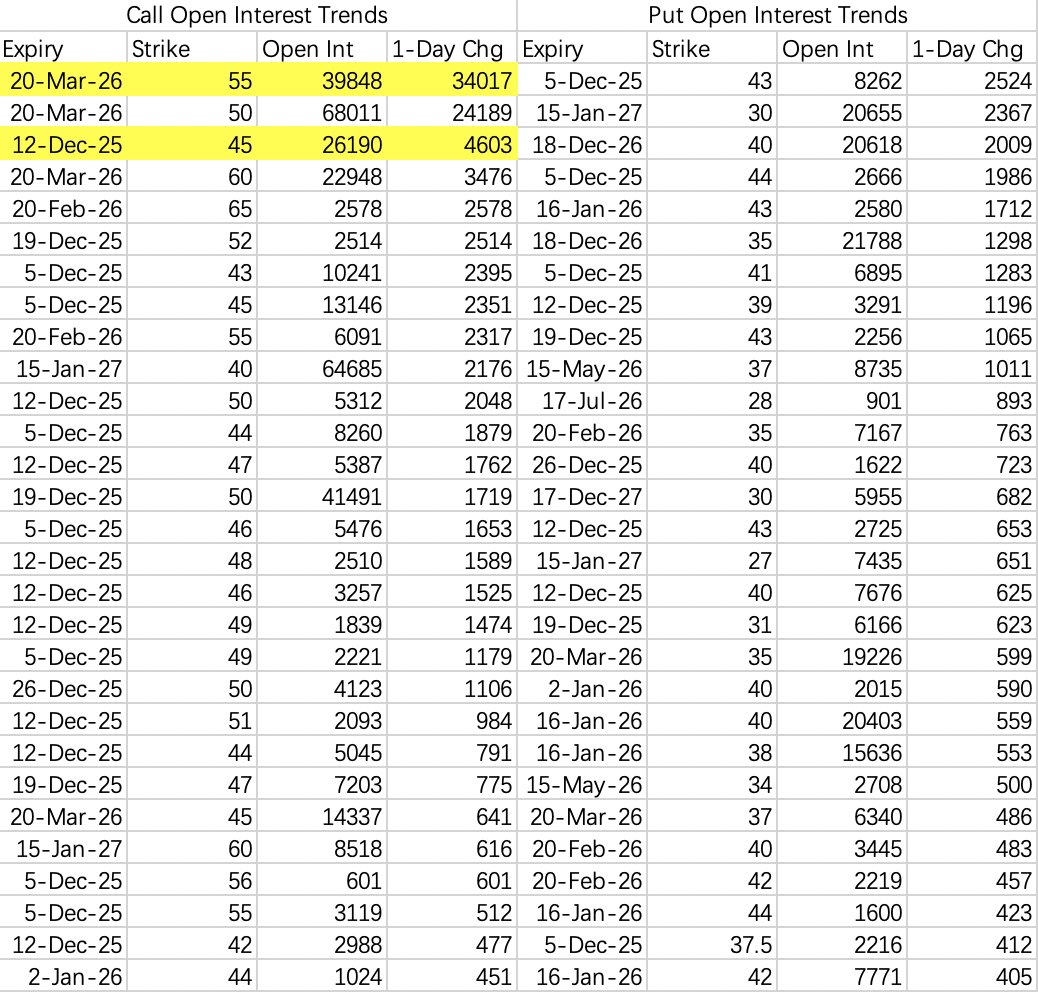

Institutions closed their long 48 Call $INTC 20260320 48.0 CALL$ and rolled to the same expiry 55 Call $INTC 20260320 55.0 CALL$ , indicating further upside targeting $50.

Intel's options flow also shows relative strength. For those looking to chase momentum, selling the 41 Put $INTC 20251212 41.0 PUT$ could be considered.

Comments