王华77

No personal profile

29Follow

0Followers

0Topic

0Badge

?

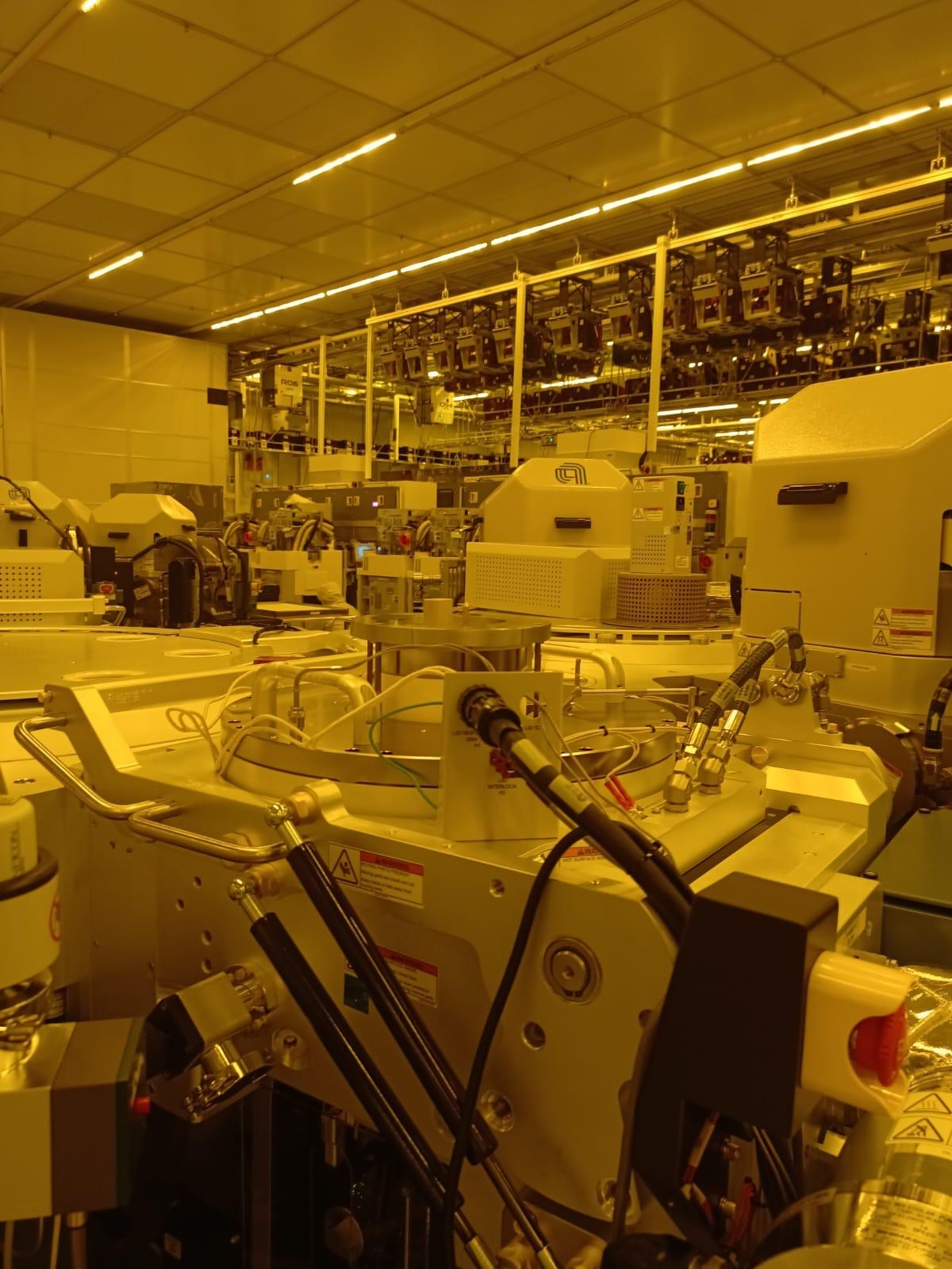

Intel in talks to acquire GlobalFoundries for roughly $30 billion

?

Sorry, the original content has been removed

?

The battle for ammunition, this game returns to Hong Kong, and XPeng wins!

??

Sorry, the original content has been removed

?

Didi submits listing application, management voting rights exceed 50%

?

"Cold thinking" under "hot inflation": Will the Fed policy make a sharp turn?

Go to Tiger App to see more news