Technology stocks will be taking the earnings confessional by storm this week, with Microsoft Corporation (NASDAQ: MSFT) among them. Last seen down 0.5% to trade at $259.17 at last check, the company is set to report fiscal fourth-quarter earnings after the close, July 26. Already, the equity is attracting analyst attention, with Wells Fargo cutting its price target to $350 from $400 ahead of the event. The brokerage said inflation, rising rates, and a stronger U.S. dollar are likely to weigh on MSFT's quarterly outlook.

As usual, analysts are optimistic towards Microsoft stock, with 23 of the 24 in question calling it a "buy" or better rating, while the 12-month consensus target price of $343.99 is a 32.8% premium to current levels. Should more firms follow Wells Fargo's lead, the equity could drop even lower.

Its status as one of the world's most powerful tech companies hasn't spared Microsoft stock from recent headwinds. The security is down 22.9% year-to-date, with two of its most recent rallies rejected at the $270 mark. Plus, the 80-day moving average lingers overhead.

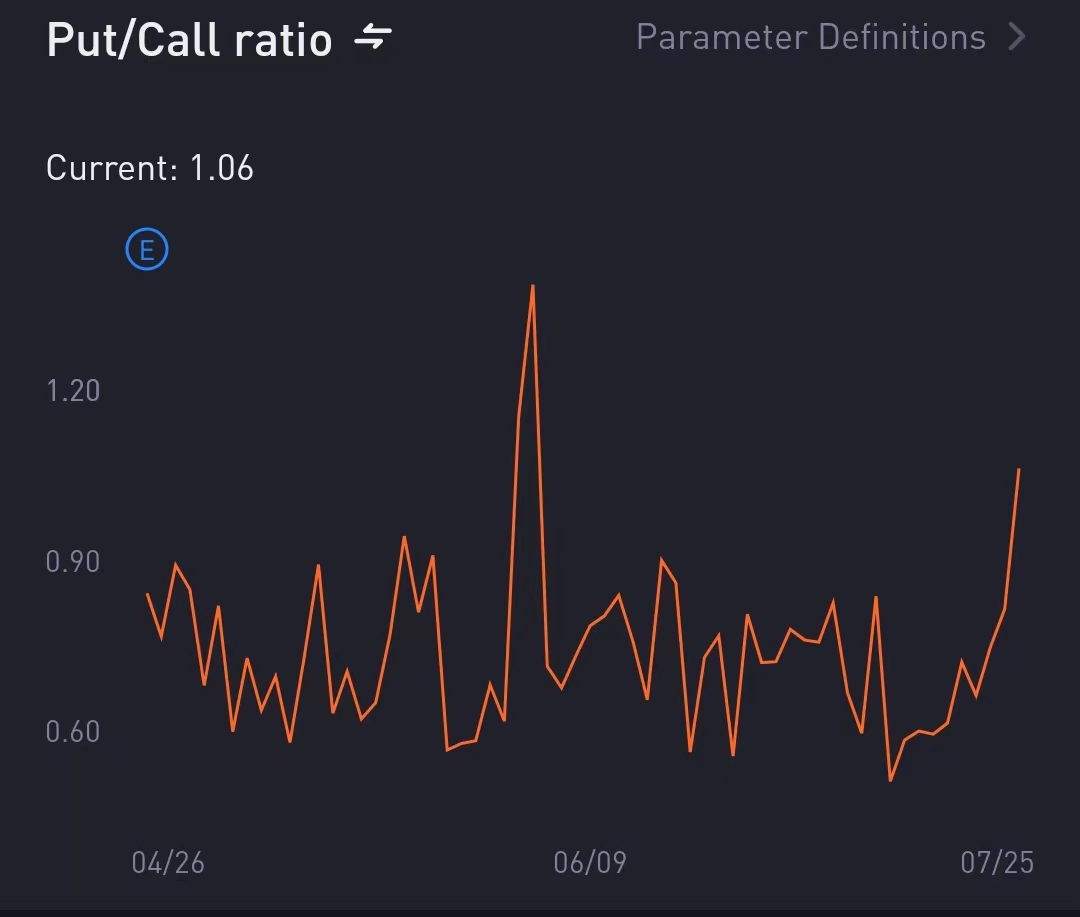

The Put/Call Ratio, which is calculated by dividing the number of traded put options by the number of traded call options, surged to 1.06, suggesting a rise in bearish sentiment.