With investments, popular is not better.

U.S. stock funds now are riding a river of new cash from investors — and that is not a bullish sign.

Many investors might see this differently — that a huge influx of cash is positive. In fact, fund flows are a contrarian indicator: the U.S. stock market in the past has performed better when there is a net outflow of cash.

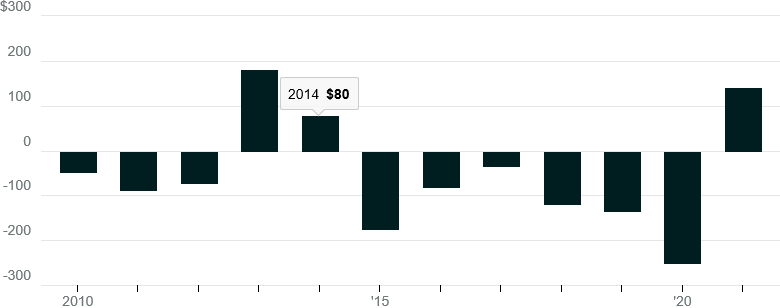

The evidence is summarized in the chart below, which plots net inflows of cash to U.S. stock funds (both open-end and exchange-traded funds) by year over the past decade. Notice that in all but two of the years since 2010 there have been net outflows.

Reversal

Net flows into U.S. equity (open-endded funds and ETF), in billions

This 2010-2020 period was extremely strong for U.S. stocks. Yet over this time U.S. stock funds experienced a net outflow of $741 billion. (Data are from TrimTabs, a part of EPFR, a division of Informa Financial Intelligence.)

This year so far is seeing a major reversal of this longer-term trend. For the first four months of this year, according to TrimTabs, U.S. equity funds have received net inflows of $142.3 billion. If this pace were to continue for the full year, there would be $427 billion of net inflows in 2021 — retracing more than half the total outflow from 2010 through 2020.

One study that puts this huge year-to-date inflow in a bearish light appeared last December in the Review of Finance. Entitled “ETF Arbitrage, Non-Fundamental Demand, and Return Predictability,” the study was conducted by David Brown of the University of Arizona, Shaun William Davies of the University of Colorado Boulder and Matthew Ringgenberg of the University of Utah. The researchers found that, on average, the ETFs with the biggest outflows outperformed the ETFs with the biggest inflows for up to a year after these extreme flows.

Another academic study that reached a similar conclusion has been circulating since January. Entitled “Competition for Attention in the ETF Space,” the study was conducted by Itzhak Ben-David and Byungwook Kim of Ohio State University, Francesco Franzoni of the University of Lugano in Switzerland and Rabih Moussawi of Villanova University. The researchers focused on the specialized ETFs that are created to capitalize on investor fads and market trends, and which typically receive a big influx of cash soon after launch. They found that these ETFs over their first five years after launch lag the market on a risk-adjusted basis by 5% per year on average.

The tenuous relationship between performance and fund flows is evident also in the accompanying tables. The first lists the 10 ETFs with the best year-to-date returns. The second table lists the 10 ETFs with the largest net inflows. (Return data are from FactSet; flow data are from CFRA Research).

Notice that none of the funds in the first table appears in the second.