- Recommends risk-on trade amid signs delta wave likely peaked

- His view contrasts with growing warnings about market turmoil

The growth scare that has prompted investors to seek safety in technology companies is overdone as the economic drag from the delta coronavirus variant is likely short-lived, according to JPMorgan Chase & Co. strategists led by Marko Kolanovic.

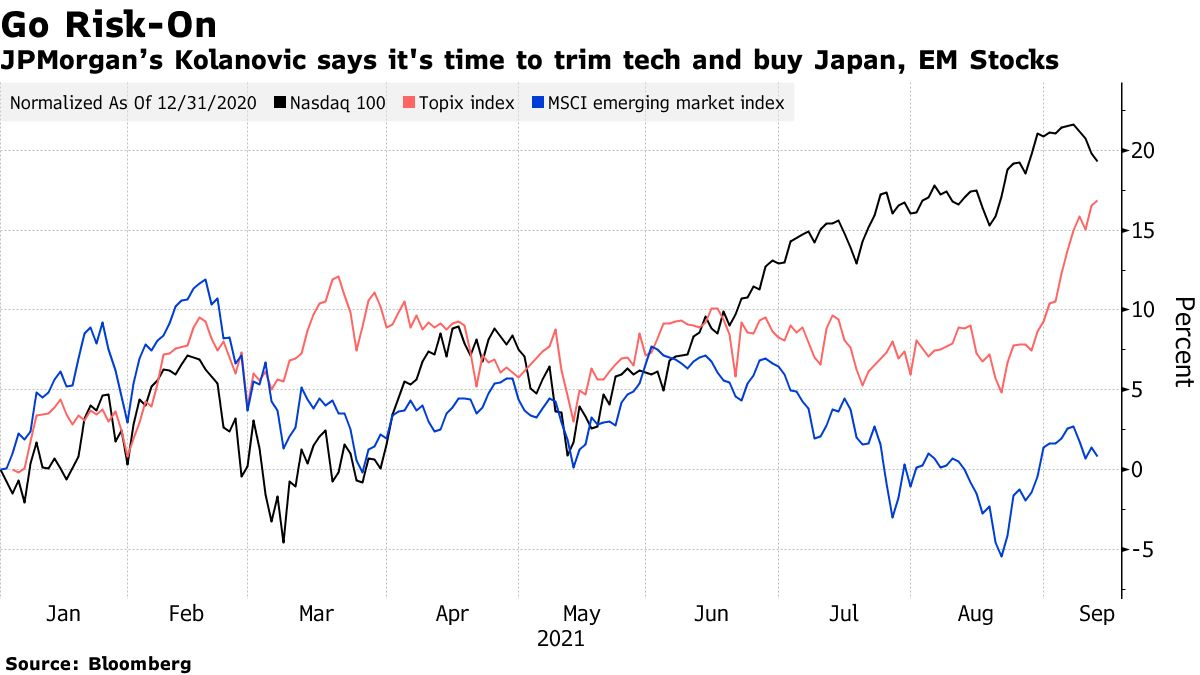

Investors should consider cutting exposure to tech shares, while raising stakes in economically sensitive companies like energy, the strategists recommended. Their upbeat view contrasts with a growing chorus of warnings that investors should brace for turmoil particularly in U.S. stocks amid a Covid-19 resurgence.

While JPMorgan strategists agree that the reopening of the global economy was delayed by the recent spike in coronavirus cases, their data show that the delta wave has likely peaked and is receding in the U.S. and globally.

“As delta subsides, and inflation persists due to supply frictions from reopening and accommodative monetary policy, we expect the reflation/reopening trade to resume its outperformance,” Kolanovic and his colleagues wrote in a client note. They reiterated a call that bond yields and cyclicals likely bottomed early last month.

The strategists also advised adding to stocks in Japan and emerging markets, assets that have lagged lately. The resignation of Japanese Prime Minister Yoshihide Suga paves the way for a stable Liberal Democratic Party, a scenario that the firm says has historically produced better equity returns.