This week Wall Street’s tech giants will take their turn to report March quarter earnings, and Apple (AAPL) will step up to the plate to deliver F2Q22’s results once the market closes on Thursday (April 28). This earnings season is playing out against a backdrop of worrying global developments. Hogging the headlines are inflationary pressures and Russia’s invasion of Ukraine and its impact on the global economy.

As such, heading into the print, Monness analyst Brian White thinks consumers will be “more selective” in their purchases and that could affect Apple.

Those aren’t the only headwinds the company currently has to contend with. Following the economy’s reopening, an uptick in spending on travel, restaurants, and “other” out-of-home entertainment could “curtail purchases of digital gadgets.” Furthermore, the prior work-from-home tailwind which was responsible for driving strong demand for PCs and tablets is now “waning and the extent of the unwind is unclear.” There are also supply chain snags to consider, and the impact of recent pandemic-driven lockdowns in China.

Nevertheless, White expects Apple will “meet” his FY2Q revenue estimate of $98.81 billion and EPS forecast of $1.54. Both are above Wall Street’s respective projections of $94.02 billion and $1.43.

White’s top-line expectation amounts to a sequential revenue drop of 20%, which is actually better than the four-year average of a 30% quarter-over-quarter decline in previous March quarters.

A quick glance at website traffic activity in the quarter bodes well, too. Unique Visitors (UVs) are up by 80% compared to the same period last year while also showing a sequential increase of 9%.

White also highlights Apple TV+’s recent Best Picture Oscar for CODA, which boosts the case for its streaming offering. Moreover, the 5-star analyst believes the recent launch of ‘Friday Night Baseball’ “foreshadows Apple’s larger ambitions in streaming live sports.”

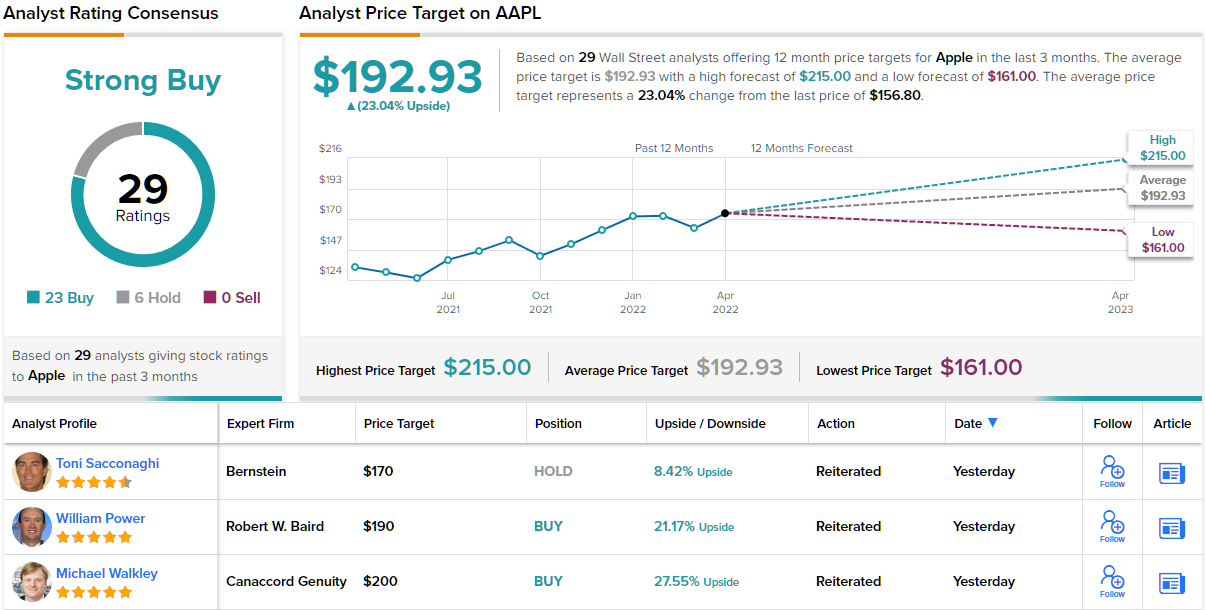

All in all, White rates Apple shares a Buy, while his $199 price target implies ~27% upside from current levels.

White’s objective sits marginally higher than the Street’s average target; at $192.93, the figure suggests one-year returns of 19%. Most analysts remain in Apple’s corner; based on 23 Buys vs. 6 Holds, the stock qualifies with a Strong Buy consensus rating.