Palantir Technologies Inc stock is staging a post-earnings slidey, down 14.24% at $9.82 on Monda, after its mixed second-quarter report. The software name posted a worse-than-expected loss of 1 cent per share, while revenue beat analyst estimates. What is mostly weighing on the shares today, however, is the company's lowered full-year and current-quarter revenue forecasts, after the timing of its government contracts became "uncertain."

Today's drop has PLTR on track to snap an eight-day win streak, after the security closed above the 150-day moving average for the first time since November over the last session. Now, the shares have pulled back to a trendline connecting higher lows since its May 12, record low of $6.44. Year-to-date, the equity is down 45%.

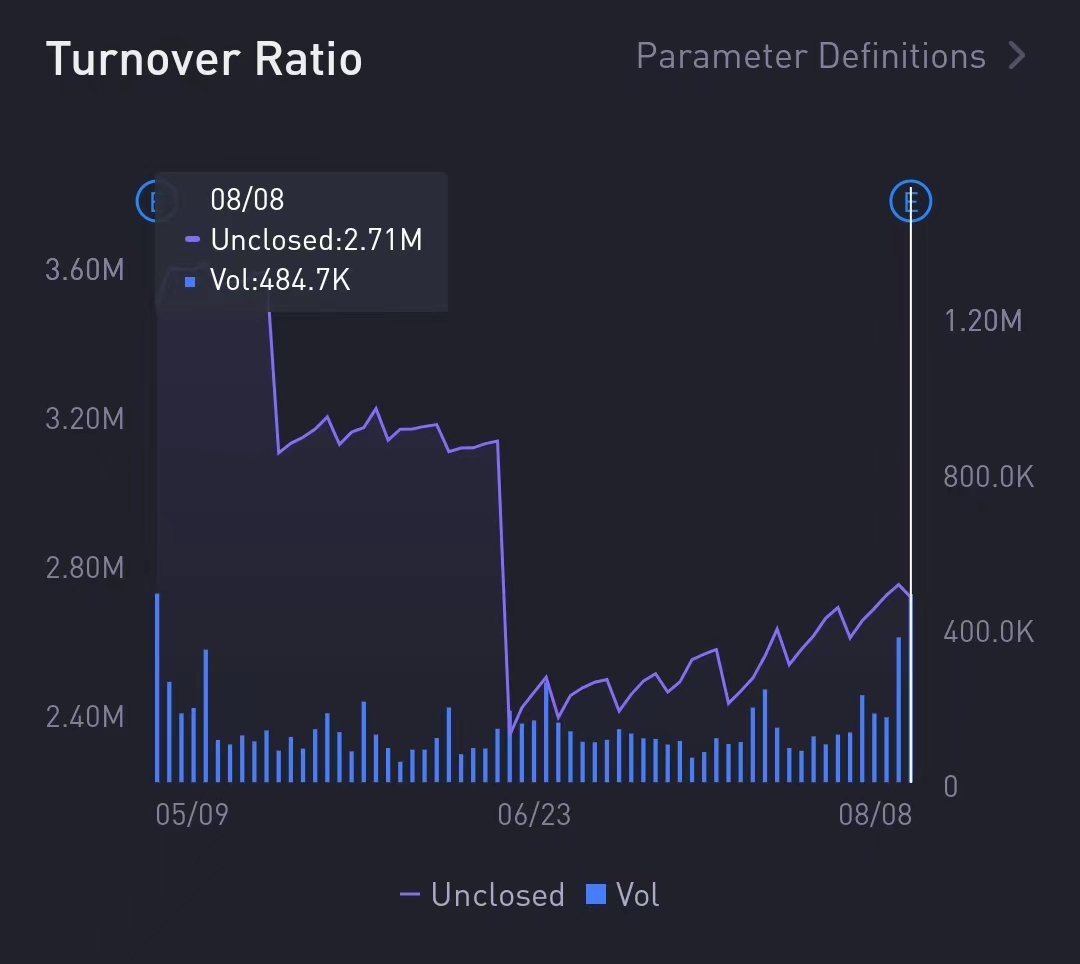

Analysts have yet to chime in after the event, though the majority lean bearish. Of the nine in coverage, six carry a tepid "hold" or worse rating. Meanwhile, short interest account for 6.3% of the stock's available float.

When we last checked in with PLTR, its options pits were showing a stronger-than-usual penchant for puts. On Monday, however, 345,097 calls and 139,786 puts have been exchanged, with overall options volume running at five times the intraday average. The 8/12 10-strike call is the most popular contract by far, with new positions being bought to open there.