Summary

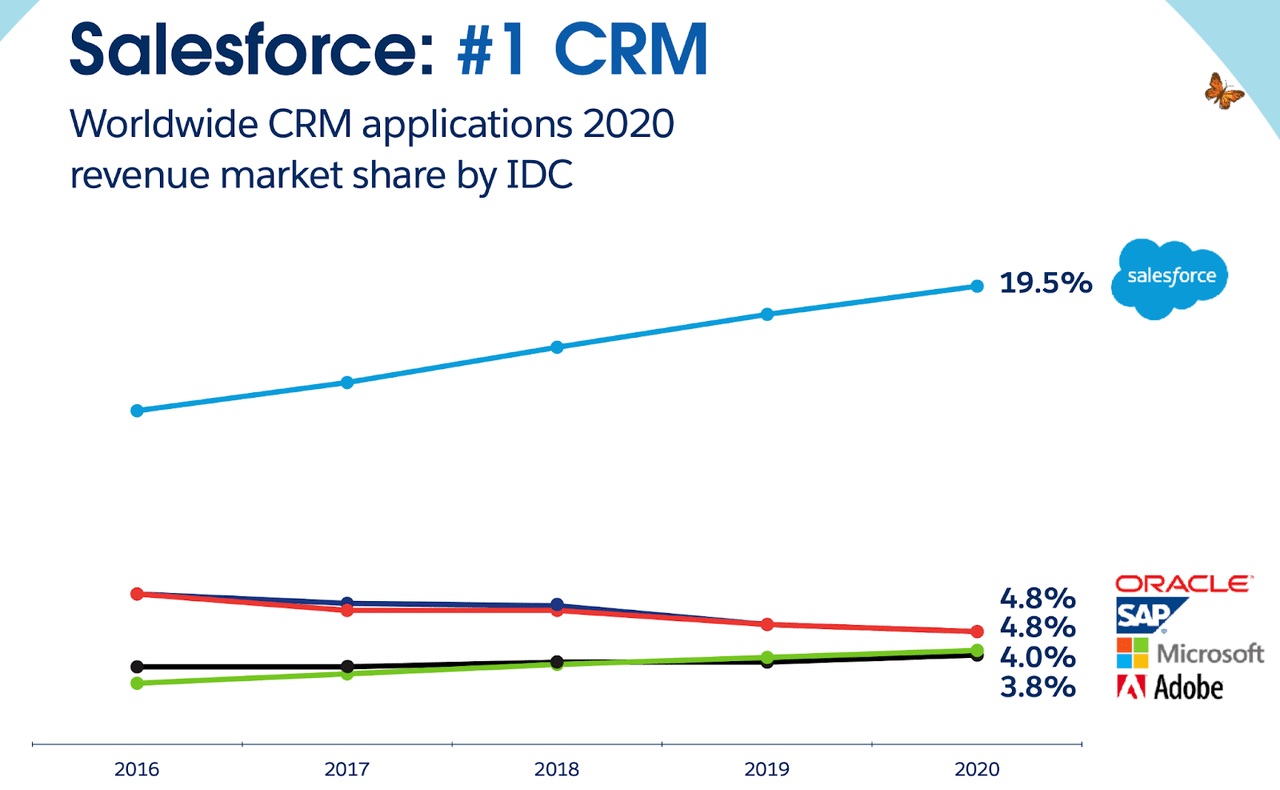

- Salesforce is the #1 CRM company by a wide mile.

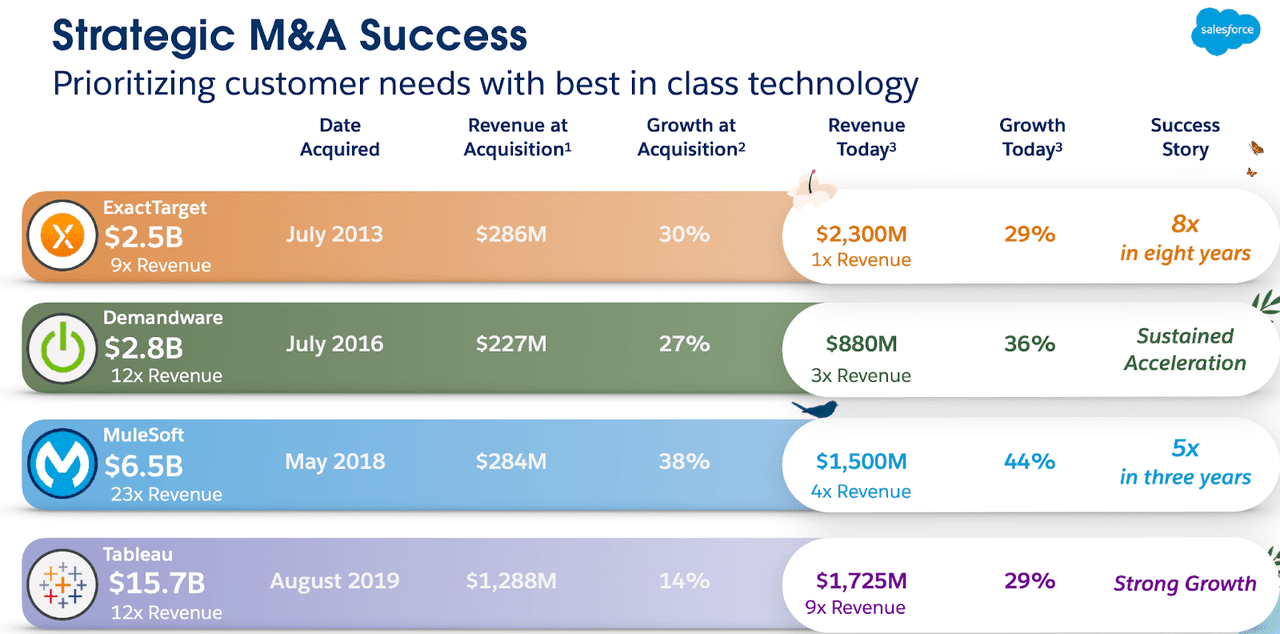

- The company has strengthened its portfolio through many tuck-in acquisitions that continue to pay off today.

- Salesforce has $9 billion of cash on its balance sheet and is generating ample free cash flow.

- As tech stocks fall, I evaluate if this is the time to buy Salesforce stock.

Salesforce (CRM) has apparently done everything right. The company has sustained elevated growth rates, is generating respectable cash flow, maintains a strong balance sheet, and has shown strong execution on its tuck-in acquisitions. The stock has not been spared by the ongoing tech selloff, and has been a disappointing performer over the past few years. CRM looks like a future mega-cap tech giant in the making, and I evaluate whether now is the time to pounce on the stock.

CRM Stock Price

Amidst the ongoing volatility in tech stocks, CRM finds itself trading below levels more than 1 year ago.

Now trading below $230 per share, the poor price performance may have created a buying opportunity in what should be considered one of the higher quality names in tech.

What is Salesforce

CRM is a leader in customer relationship management (hence the stock ticker), as it has built out a full portfolio of products to help its customers better serve, well, their customers.

Customer relationship management serves a mission-critical role because it helps to ensure that you can keep your existing client relationships. Due to its continued investment in innovation and cloud-first strategy, CRM has steadily increased its market share lead over legacy incumbents.

CRM accelerated its innovation through a strong willingness to conduct M&A when appropriate. While some investors are understandably cautious when it comes to roll-up strategies, CRM has shown an impressive ability to drive accelerating growth even many years after acquiring these assets.

On a side note, the above slide should provide material justification for why tech stocks have enjoyed premium multiples over the past many years, as they maintain excess value as takeout candidates which needs to be reflected in their stock prices. Over the years, CRM has constantly found ways to sustain its 20+% growth trajectory while also maintaining high levels of cash generation.

Like many tech companies, CRM aggressively invests in growth, which manifests itself in increasing R&D expenses and naturally holds back its operating margins. I view CRM’s aggressive acquisitive strategy as being indicative of what investors should expect in the tech sector moving forward, as larger companies like CRM have shown that tuck-in acquisitions can prove profitable even if they have to pay a premium sticker price.

Is CRM Stock A Buy, Sell, or Hold?

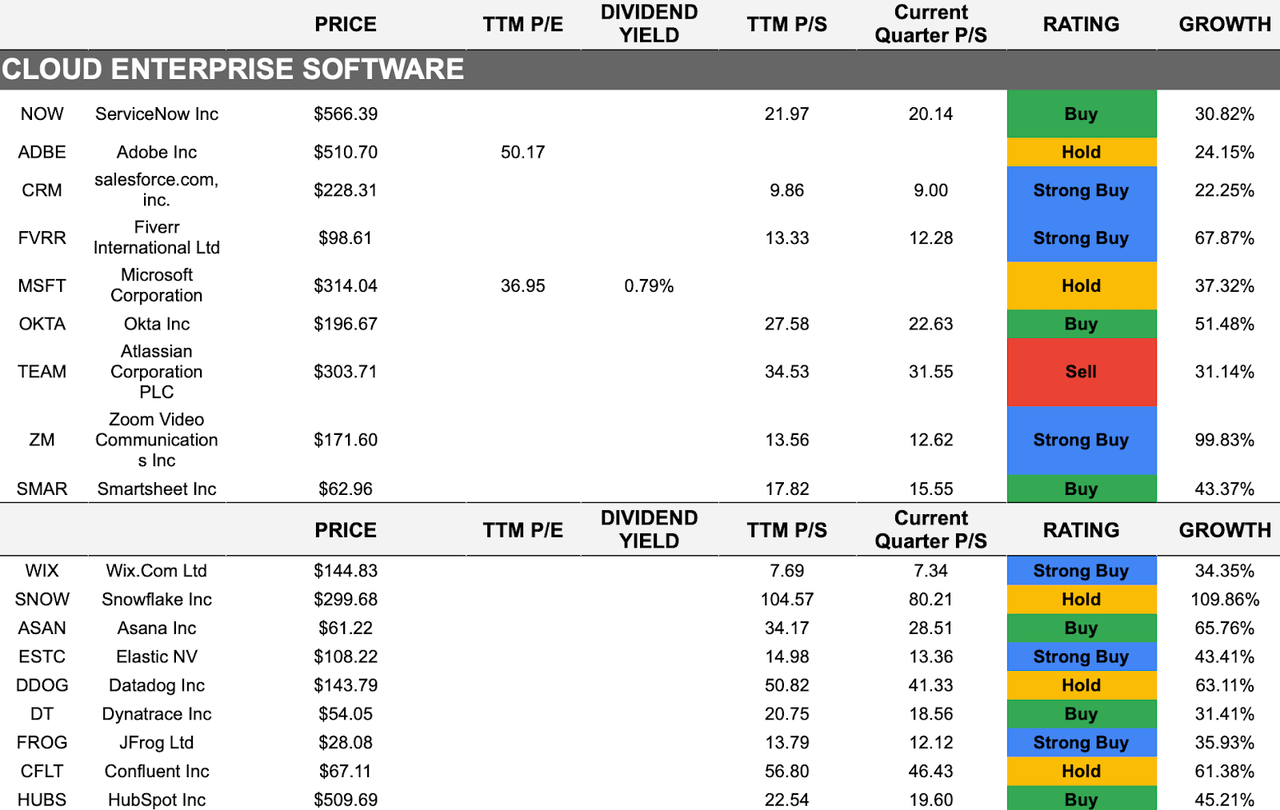

After the tech selloff, CRM is trading at less than 9x sales. Wall Street expects growth to slowly decelerate to the 15% range over the next 5 years.

CRM looks highly buyable here, but with almost all tech stocks having already fallen substantially, it is important to take into account whether CRM is the best buy among tech peers. We can see below that most tech stocks in my coverage universe are now flashing buy signals.

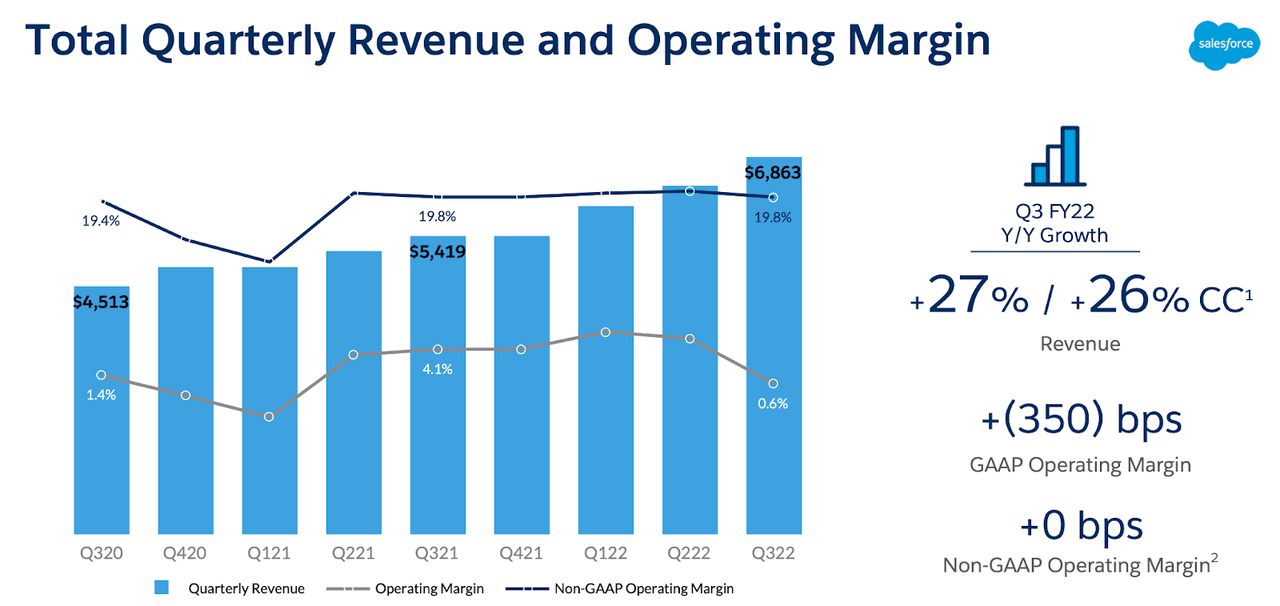

It is understandable why CRM has held up so well. The company has a diversified portfolio of tech assets, $9 billion of cash on its balance sheet, and a track record of strong execution. Throw in the fact that CRM is also generating a near 20% non-GAAP operating margin, and the stock checks off all of the criteria for retaining a premium multiple in spite of arguably average growth rates.

I expect CRM to earn long term net margins in the 40% range. Assuming a 1.5x price to earnings growth ratio (‘PEG’), I can see CRM trading at 7x sales in 2030, representing a stock price of $650, or annualized returns of 12.5%. The actual returns will vary based on actual growth rates, use of annual earnings, and the terminal earnings multiple. That 12.5% projected return should be enough to beat the market, and CRM has a lower risk profile to make the return look attractive. However, there are a slew of peers in the tech sector which are offering projected returns much higher than that, albeit at some higher risk. While I rate CRM a buy, I emphasize that there are more attractive buying opportunities elsewhere in the sector.