Summary

- SE had an earnings beat but provided disappointing forward guidance.

- The company expects profitability in the next few years.

- Macro factors could soon change in a positive way.

- The time to rotate out of growth was 6 months ago. Now is the time to buy.

Thesis Summary

Sea Limited (SE) shares have been losing ground for the past 6 months, after being one of the best-performing stocks in 2020. This wasn't helped by SE's latest earnings report, which sent shares below $100.

While there are certainly some legitimate concerns, I believe the worst is already baked into SE's share price. Meanwhile, there's still a lot to be excited about in all three of its segments.

At today's price, SE is undervalued, and I expect the stock to come roaring back once market sentiment changes.

Earnings Results

SE reported results on March 1st, and investors were not pleased. While SE did beat on GAAP EPS and revenue, the forward guidance provided was lackluster especially when it comes down to Garena/Digital Entertainment.

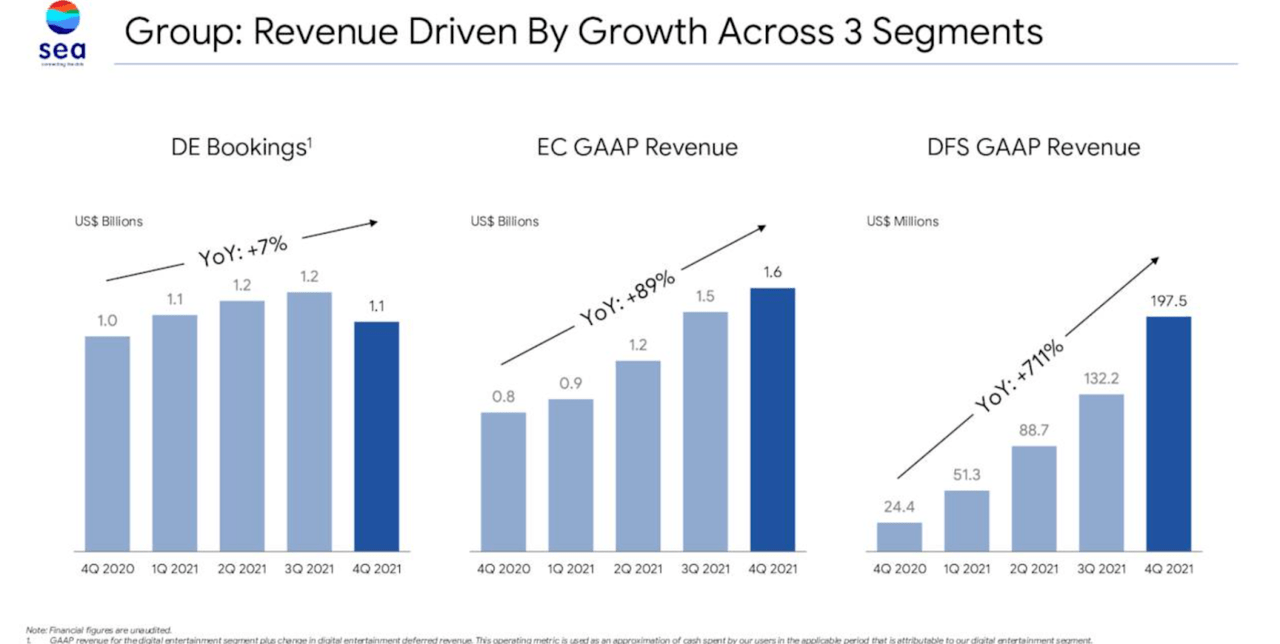

Revenue Growth (Investor Presentation)

First off, here is the breakdown of revenue growth across the three segments. EC (Shopee = and DFS (SeaMoney) continue to grow strongly, particularly the latter, with a staggering 711% YoY growth. However, DE bookings are down substantially for the quarter and almost flat for the year.

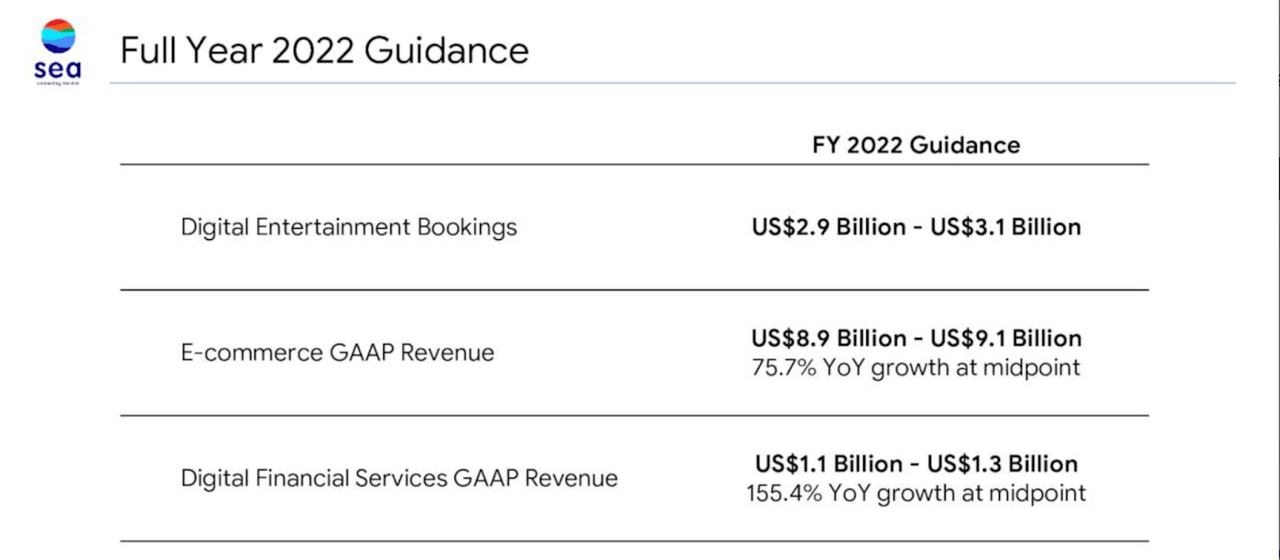

Forward Guidance (Investor Presentation )

Worst of all though, is the fact that SE has guided DE revenues to be around $3 billion in 2022. In 2021, DE bookings were $4.6 billion. It's no surprise the company decided to omit including the "growth rate" for DE bookings in the slide above…

And yet, I do feel like SE is offering us a good adding price here. Market sentiment for growth stocks is in the gutter, and SE is dealing with some headwinds, but this is still a company growing at triple digits with a very profitable segment and a clear path towards it for the two others.

A Path to Profitability

It's hard to understand why share prices have come down as far as they have. There are market forces beyond our control, but the core SE business remains attractive. In terms of growth, investors can hardly complain. Shopee grew GMV by 53%. The platform is a leader in SE Asia, and it has cemented a great position in Brazil, which ensures growth for years to come. In Q4, Shopee Brazil's orders grew close to 400%, and revenues grew 636%, according to the earnings call.

The concern investors could have with Shopee is profitability, but this is moving in the right direction. Adjusted EBITDA loss improved by 21% YoY. If management is to be believed, we should see both EC and DFS break even in a few short years:

We currently expect Shopee to achieve positive adjusted EBITDA before HQ cost allocation in Southeast Asia and Taiwan by this year. We also expect SeaMoney to achieve positive cash flow by next year. As a result, we currently expect that by 2025 cash generated by Shopee and SeaMoney proactively will enable these two businesses to substantially self-fund their long-term growth.

Source: Earnings Call

Sea Money is also on the right track, revenue for Sea Money for 20220 is expected to come in between $1.1 billion and $1.3 billion, which is roughly a 155% year-on-year growth. Financial services are easy to monetize, especially when you have a large user base like Shopee.

SE is a growing company in a growing economy, leveraging three segments that also have great growth prospects. Life is moving increasingly online, as we can see by the growing interest in the metaverse. Furthermore, banking and payments are being disrupted by new technologies, cryptocurrencies and blockchain. SE is in a perfect position to leverage these innovations and provide these developing, but fast-growing economies, with the tools they need to get to the next level.

Untapped Potential

I also feel like investors are expecting the worst from DE and Free Fire. Free Fire is currently banned in India, due to concerns about data being sent to China. However, Singapore is in talks with the Indian government, and this issue could be resolved.

Furthermore, while Free Fire's growth is slowing down, there is plenty more that the company can do to monetize and grow this segment. Gaming is a very fast-growing industry, which is also being boosted by a newfound interest in the metaverse and play-to-earn games. According to a report by Massoit, the number of active wallets connected to gaming smart contracts doubled in 2021.

SE's Free Fire has over 150 million active users and this is an asset in itself. I believe the company would do well to gain some exposure to blockchain and leverage related technology like NFTs.

This is a mixed bag. I'm sure some investors would disagree with this idea and, luckily for them, there wasn't any talk of blockchain or NFTs in the earnings call. However, if indeed this technology is here to stay and take gaming to the next level, it's yet another compelling argument in favor of SE.

Other Considerations

The biggest challenge SE has faced though has been on the macro level. Investors have rotated out of growth stocks in the last 6 months. While this has been painful for those invested in these stocks, as of right now, it creates a great opportunity to buy. Many stocks, including SE, are down over 60% since their ATHs, making valuations attractive. Furthermore, there are concrete reasons I believe a turnaround could happen soon.

The worst-case scenario has been baked in for the market, which is predicting high inflation, rate hikes and is concerned over war in Ukraine. But these expectations could soon change.

The first evidence we have of this is the latest jobs report. Employment numbers were strong, but what is most notable is that wages were almost unchanged for the month. This is a signal that inflation is slowing down. With slower inflation, a weak market, and war abroad, I wouldn't be surprised if the Fed delays hikes. On top of that, we could soon see energy prices reach a top, as the US and other countries tap into their oil reserves.

Takeaway

The time to rotate out of growth was 6 months ago. Now is the time to start getting back in. Inflation may have peaked, and with a slowing economy, and a flattening yield curve, nothing is stopping the Fed from continuing its easy money policy.

Regardless of that though SE continues to be a compelling investment. The company has growth and a clear path to profitability, and we should see a strong turnaround in the stock when market sentiment changes. It may still take a while, but remember, it is always darkest before dawn.